A Fresh Take on Ajinomoto (TSE:2802) Valuation After Its Sustainable GRe:en Drop Coffee Launch

Reviewed by Simply Wall St

Ajinomoto (TSE:2802) has introduced GRe:en Drop Coffee, a limited edition dairy-free ice latte under its Atlr.72® brand. The product features beanless coffee and Solein, a protein with a low environmental footprint. This launch reflects a push toward sustainability and innovation within its portfolio.

See our latest analysis for Ajinomoto.

Ajinomoto’s share price has climbed an impressive 37.4% year-to-date, and momentum appears to be building with launches like GRe:en Drop Coffee and the company’s broader sustainability initiatives. Over the past year, its total shareholder return stands at a striking 53.3%, with longer-term holders seeing even more remarkable gains.

If Ajinomoto’s innovation streak has you looking for what’s next, now is the perfect time to discover fast growing stocks with high insider ownership

With such impressive returns and sustainability-driven innovation, the key question now is whether Ajinomoto’s shares still offer room to run or if the current price already reflects all the expected growth ahead.

Most Popular Narrative: Fairly Valued

Ajinomoto's previous close of ¥4,373 sits almost exactly at the narrative's estimated fair value, signaling expectations of limited further upside from here. This sets the stage for a closer look into the underlying drivers of the company's current valuation.

Ongoing investment in R&D and human capital, particularly in Functional Materials and Bio-Pharma Services, is expected to yield differentiated, higher-value products (e.g., specialty amino acids, AI/PC/server-related materials). This is seen as strengthening competitive moat and gradually improving net margins over the long term.

Want to know what powers this close call between price and fair value? The narrative banks on ambitious margin expansion and a bold sector transformation forecast. Curious about what optimistic assumptions bring this stock within striking distance of its target? Peek beneath the surface to discover the numbers shaping this valuation debate.

Result: Fair Value of ¥4,450 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent input cost inflation and continued weakness in key overseas markets could still challenge Ajinomoto's ability to meet optimistic forecasts.

Find out about the key risks to this Ajinomoto narrative.

Another View: The Market Multiple Perspective

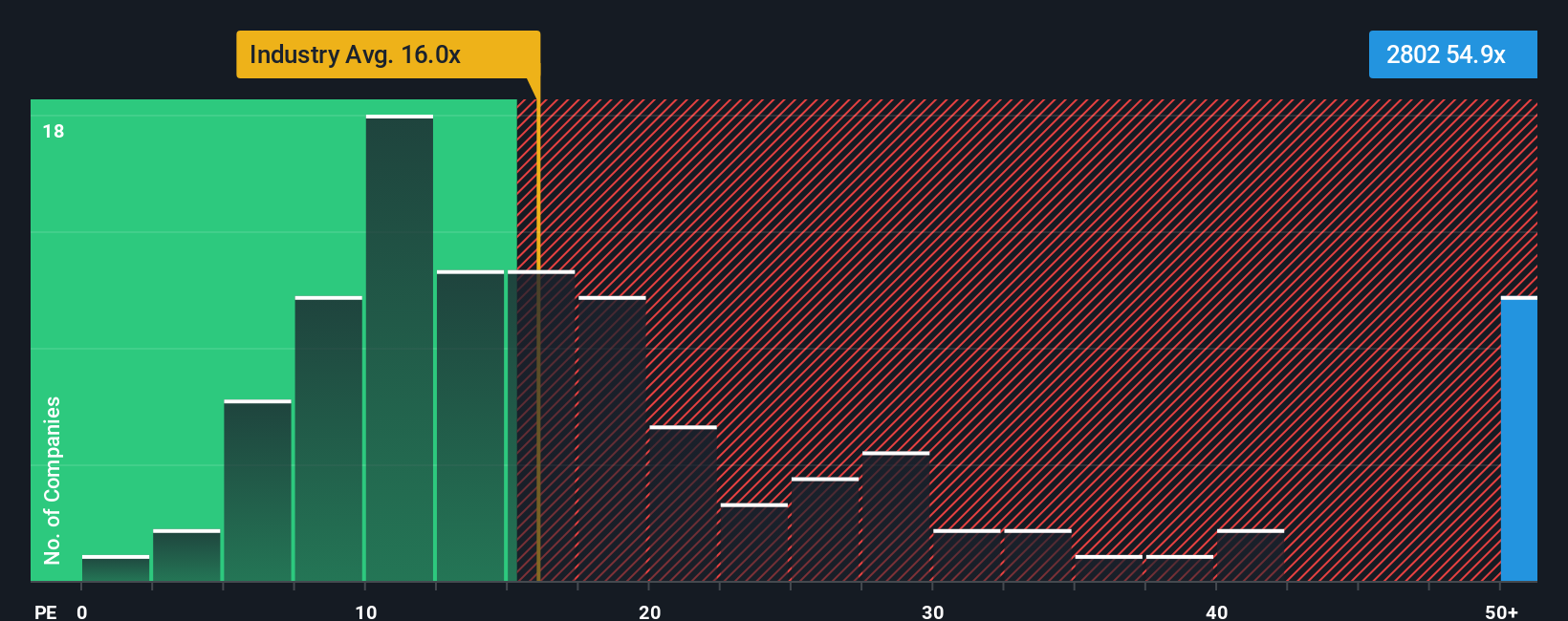

While fair value estimates suggest Ajinomoto’s current price is about right, a look at its price-to-earnings ratio tells a different story. Shares trade at 54.1 times earnings, far above the JP Food industry average of 16.3 and the peer group average of 17.4. Even the fair ratio is lower, at 32.2.

This wide gap means the stock is priced much higher relative to both industry norms and what the market could eventually move towards, which raises questions about potential valuation risk if growth expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ajinomoto Narrative

If you think there’s more to Ajinomoto’s story or you’d like to dig into the numbers and create your own perspective, it’s fast and easy to build your own view in just a few minutes. Do it your way

A great starting point for your Ajinomoto research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your investing game and uncover fresh stock opportunities that could give your portfolio the edge it needs this year. Simply Wall Street’s top screeners spotlight unique trends and market outliers, so you can stay updated on what smart investors are watching next.

- Boost your passive income by checking out these 20 dividend stocks with yields > 3% with reliable yields and a track record of rewarding shareholders.

- Get ahead of the trend and browse these 27 AI penny stocks where artificial intelligence is reshaping industries and driving outsized growth.

- Take advantage of market mispricing when you assess value bargains using these 843 undervalued stocks based on cash flows built on real cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2802

Ajinomoto

Engages in the seasonings and foods, frozen foods, and healthcare and other businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives