How Kikkoman’s Upgraded 2026 Profit Outlook and Currency Gains Will Impact Investors (TSE:2801)

Reviewed by Sasha Jovanovic

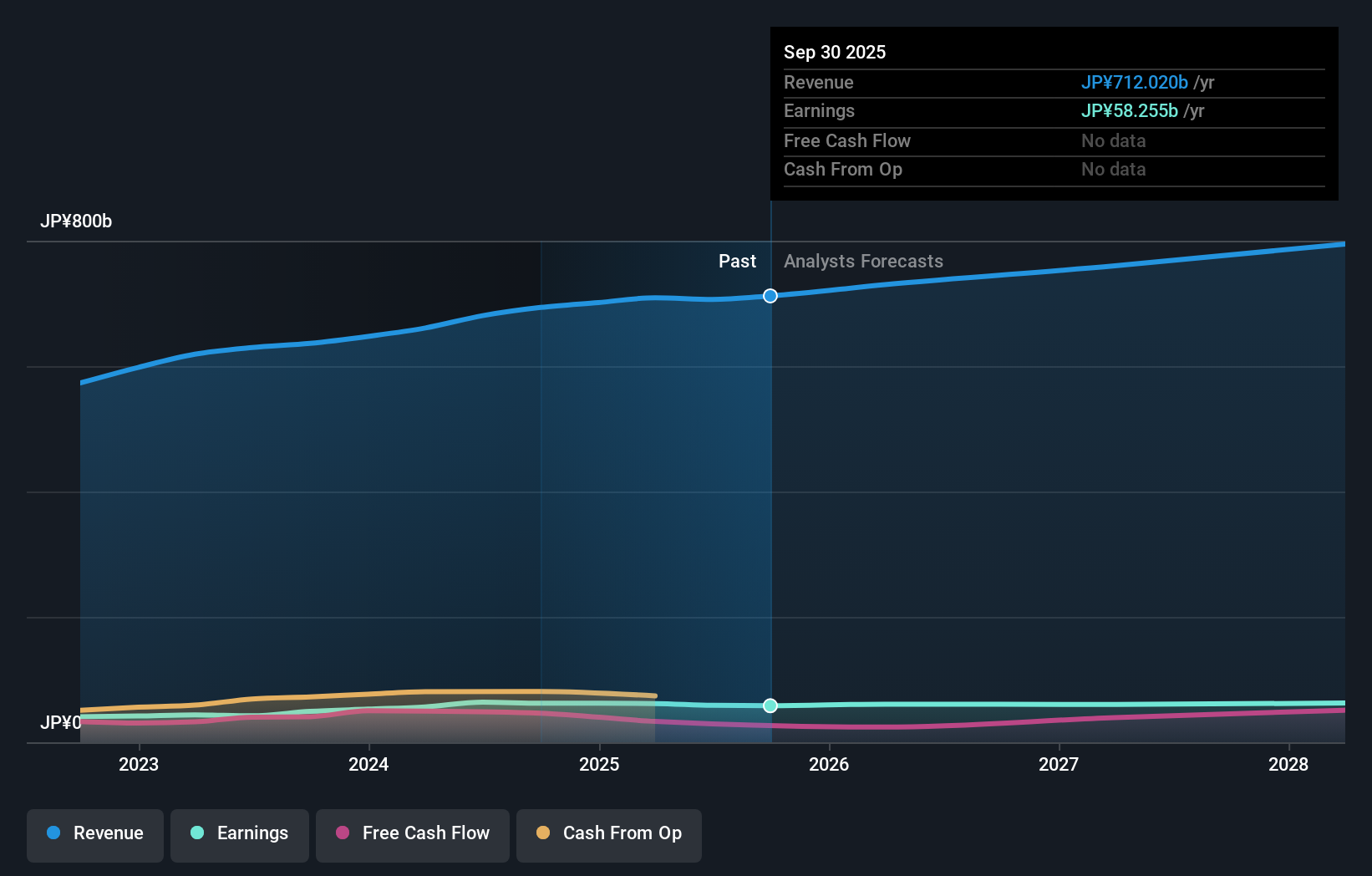

- Kikkoman Corporation recently revised its consolidated earnings guidance for the fiscal year ending March 31, 2026, updating its forecast to revenue of ¥731 billion and profit attributable to owners at ¥60 billion, citing a stronger-than-expected first half and exchange rate impacts.

- This revision reflects how fluctuations in foreign currency, specifically a more favorable yen-dollar rate compared to initial expectations, contribute significantly to the company’s financial outlook.

- We'll examine how Kikkoman’s increased profit guidance, driven by currency gains and first-half strength, shapes its investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Kikkoman's Investment Narrative?

Kikkoman’s recent earnings guidance revision centers the spotlight on foreign exchange gains and solid first-half business momentum, but the bigger story for shareholders is unchanged: this is a company focused on steady, incremental growth, investor returns through dividends and buybacks, and experienced governance. In the short term, the upgrade in profit projections may strengthen investor confidence ahead of upcoming results, suggesting that currency tailwinds are currently a key catalyst, while the trimmed revenue forecast could temper optimism. However, the slower-than-market growth outlook, persistent premium valuation, and recent share price underperformance continue to be significant risks. The raised guidance does incrementally improve the near-term narrative, but investors still need to weigh muted long-term growth prospects against current valuation and recent returns. In a sense, the latest update reinforces themes that have already been shaping Kikkoman’s investment case.

On the other hand, concerns linger over growth consistently lagging the broader market and sector. Kikkoman's shares have been on the rise but are still potentially undervalued by 5%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Kikkoman - why the stock might be worth just ¥1468!

Build Your Own Kikkoman Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kikkoman research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kikkoman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kikkoman's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kikkoman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2801

Kikkoman

Through its subsidiaries, engages in the manufacture and sale of food products in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives