What Suntory Beverage & Food (TSE:2587)'s Upgraded Earnings Forecast and IT Shift Mean for Shareholders

Reviewed by Sasha Jovanovic

- Suntory Beverage & Food Limited recently revised its consolidated earnings guidance for the fiscal year ending December 31, 2025, forecasting revenue of ¥1.72 trillion and profit for the year attributable to owners of the company at ¥84.5 billion.

- This announcement follows a significant IT transformation at Suntory Oceania, which is designed to support advanced, carbon-neutral manufacturing operations in Australia and New Zealand.

- We'll examine how Suntory's new earnings outlook and digital transformation investment influence the company's evolving investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Suntory Beverage & Food's Investment Narrative?

Suntory Beverage & Food’s revised earnings guidance signals a more cautious outlook for 2025, with lower expectations for both revenue and profit compared to earlier in the year. This update comes as the company doubles down on digital transformation, notably through a $30 million IT investment at its Oceania division aimed at boosting efficiency and sustainability at its new carbon-neutral facility. The longer-term belief underpinning Suntory’s story is the potential for digital and sustainable manufacturing to drive margin improvement and brand appeal. In the near term, however, a sharper focus is likely to fall on execution risk: whether these sizable investments will deliver the bottom-line results investors are hoping for, especially given the latest lowered profit forecast. As a result, the primary catalyst shifts toward observable operational gains rather than top-line expansion, while the biggest risk is underperformance against newly set expectations. Recent price moves appear muted, suggesting limited immediate impact, but sentiment could shift quickly if results disappoint against these recalibrated targets.

But with so much focus on execution, there’s a key operational risk you should not overlook. Despite retreating, Suntory Beverage & Food's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

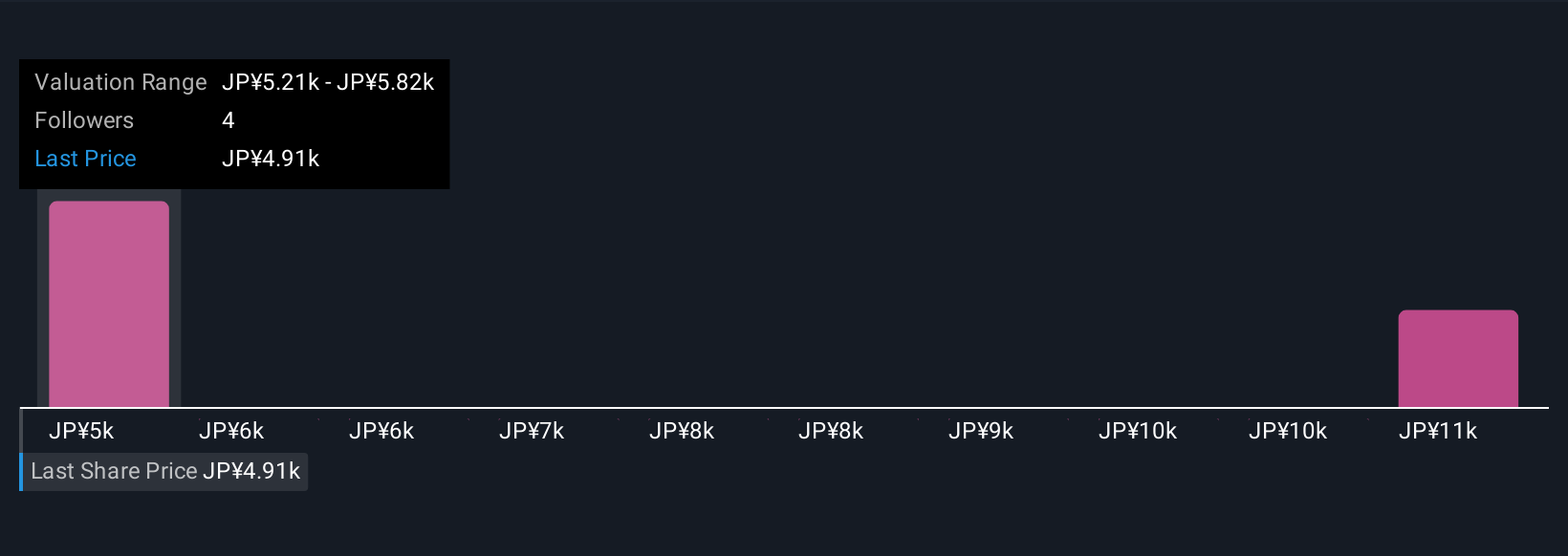

Explore 2 other fair value estimates on Suntory Beverage & Food - why the stock might be worth just ¥5208!

Build Your Own Suntory Beverage & Food Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suntory Beverage & Food research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Suntory Beverage & Food research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suntory Beverage & Food's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2587

Suntory Beverage & Food

Engages in manufacture and sale of alcoholic and non-alcoholic beverages, and foods in Japan, Asia-Pacific, Europe, and the Americas.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives