How Suntory Beverage & Food’s New CEO and Global Rebranding Could Shape Investor Perspectives (TSE:2587)

Reviewed by Sasha Jovanovic

- Suntory Beverage & Food recently announced that Josuke Kimura will become the new representative director, president, and CEO, succeeding Makiko Ono, alongside proposed changes to its trade name and amendments to the Articles of Incorporation to be voted on at the 2026 shareholders meeting.

- This leadership transition, set amid moves to unify global branding and strengthen governance, comes following executive departures connected to external investigations at the parent company.

- We’ll explore how the appointment of a new CEO and the global rebranding initiative shape Suntory Beverage & Food’s investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Suntory Beverage & Food's Investment Narrative?

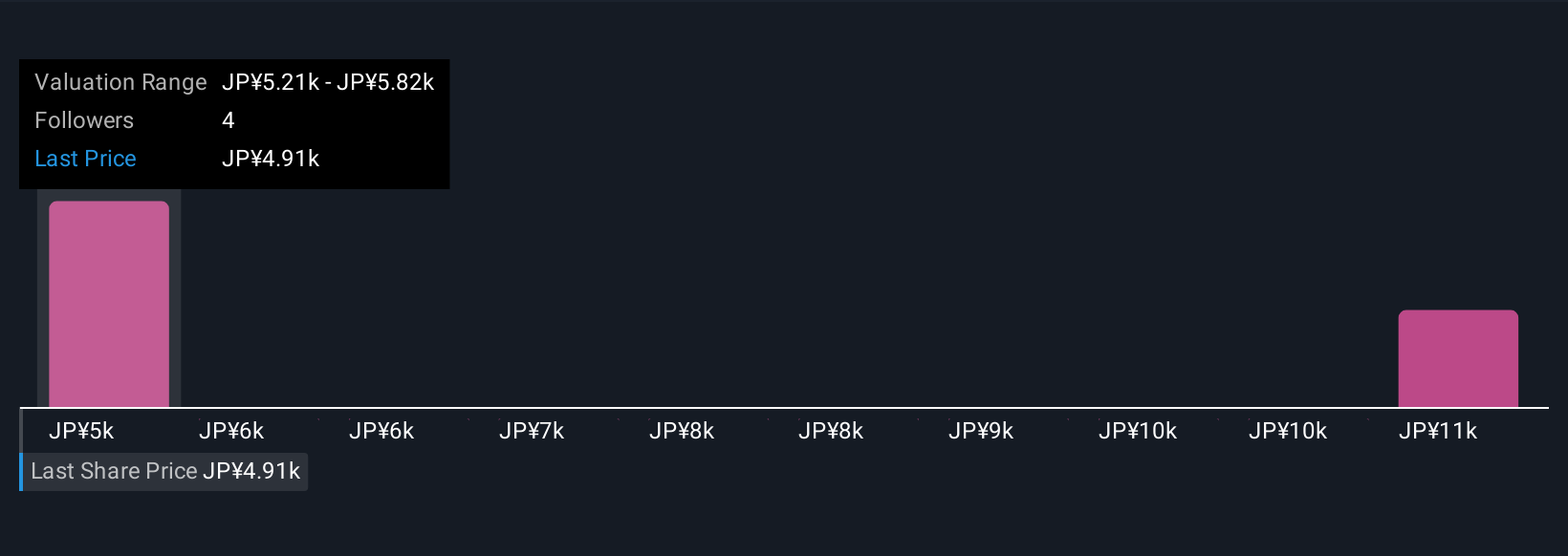

The case for holding Suntory Beverage & Food revolves around its established market position, reliable dividend, and reasonable valuation compared to industry peers, as highlighted before the company’s recent leadership transition. With the new CEO appointment and a global rebranding push, the focus now turns to whether management can maintain operational momentum while navigating past governance issues. Short-term catalysts such as earnings growth and new international partnerships could be overshadowed if uncertainty around executive turnover and board changes persists, especially given the company’s history of rapid board refreshes and ongoing investigations at the parent level. That said, recent share price stability and a muted reaction suggest investors may see these leadership changes as constructive rather than disruptive. As always, governance and execution are in sharp focus. But investors should keep in mind the risk of further board instability affecting future strategy.

Despite retreating, Suntory Beverage & Food's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Suntory Beverage & Food - why the stock might be worth over 2x more than the current price!

Build Your Own Suntory Beverage & Food Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suntory Beverage & Food research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Suntory Beverage & Food research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suntory Beverage & Food's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2587

Suntory Beverage & Food

Engages in manufacture and sale of alcoholic and non-alcoholic beverages, and foods in Japan, Asia-Pacific, Europe, and the Americas.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026