Coca-Cola Bottlers Japan (TSE:2579): Forecast 90% Annual Earnings Growth Sets Up Profit Turnaround Narrative

Reviewed by Simply Wall St

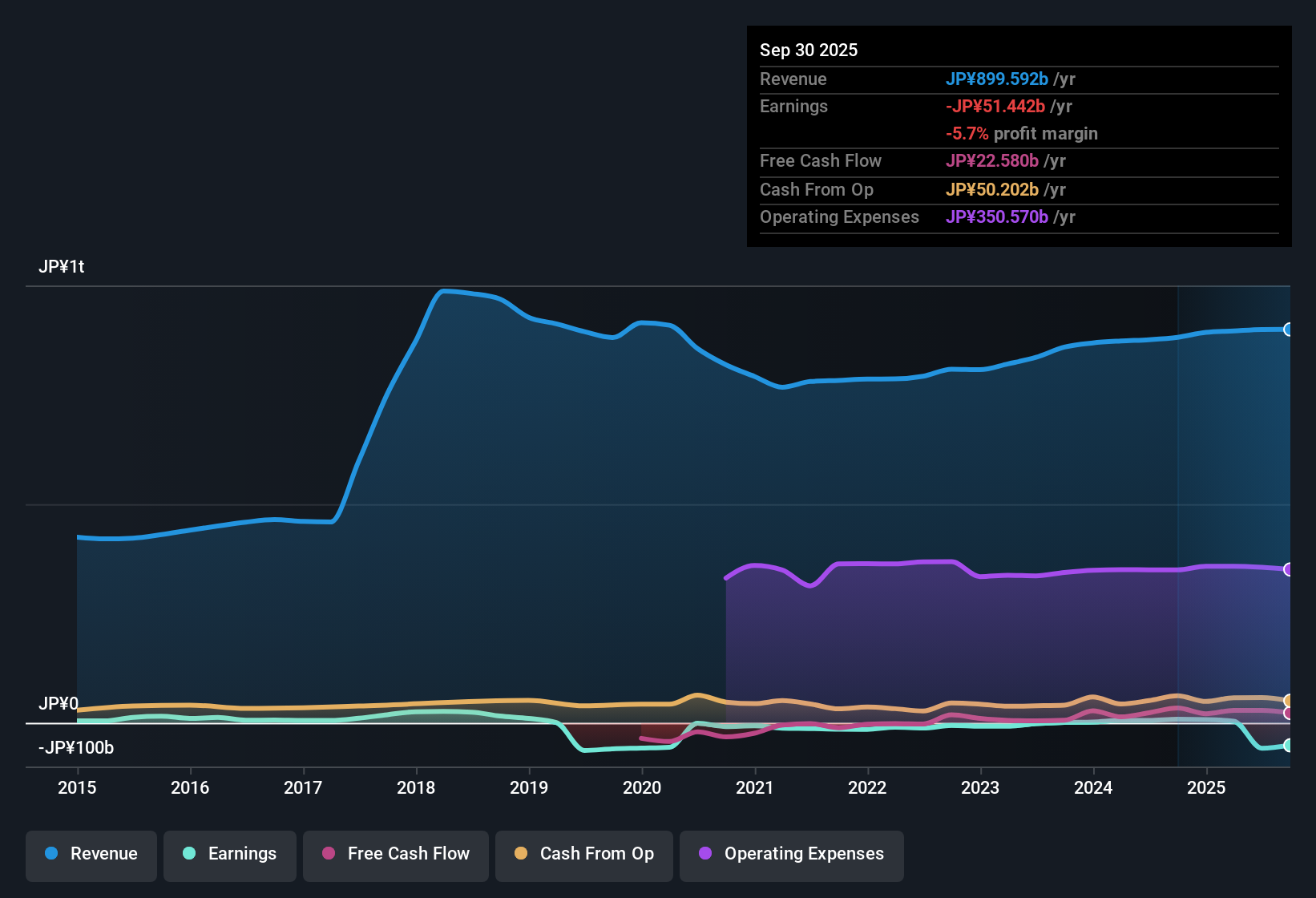

Coca-Cola Bottlers Japan Holdings (TSE:2579) remains in the red, with losses deepening by an average of 10.5% per year over the past five years. That said, the company’s earnings are forecast to surge 90.05% annually, which could put it on track to return to profitability within three years. Investors are weighing this sharp expected recovery and current undervaluation against slow revenue growth of just 0.6% per year and persistent concerns about dividend sustainability.

See our full analysis for Coca-Cola Bottlers Japan Holdings.The next section puts these results side by side with the dominant market narratives, highlighting where the numbers confirm or challenge popular investor viewpoints.

See what the community is saying about Coca-Cola Bottlers Japan Holdings

Profit Margins Expected to Turn Positive

- Analysts expect Coca-Cola Bottlers Japan Holdings' profit margin to swing from -6.5% now to 2.2% within three years, highlighting a turnaround from losses to profitability.

- Analysts' consensus view heavily supports the transformation thesis, with margin recovery underpinned by:

- Targeted cost savings of ¥30 to 35 billion through supply chain automation and digitalization by 2030, which is expected to drive a significant improvement in profitability.

- Expansion into health-focused product lines and premium beverage segments, catering to changing consumer preferences and supporting higher sales value per unit.

- Analysts are watching for confirmation that cost savings and new product mixes will materialize soon enough to reverse losses, putting the margin recovery hypothesis to the test.

📊 Read the full Coca-Cola Bottlers Japan Holdings Consensus Narrative.

Dividend Growth Ambitions Face Headwinds

- Management is targeting a progressive dividend of ¥140 to 150 per share by 2030 and expects to support aggressive buybacks totaling ¥150 billion, despite ongoing operating losses and concerns about dividend sustainability.

- Consensus narrative notes tension between management's shareholder return ambitions and the company’s fundamental challenges:

- Persistently slow revenue growth of 0.6% per year, well below the Japanese beverage industry's expected 4.5%, raises doubts about the capacity to fund these dividends over time.

- Falling core vending volumes, which are down 5% year-on-year, and a shrinking addressable market due to demographic shifts highlight structural risks to dividend durability.

Valuation Discount Versus DCF Fair Value

- Coca-Cola Bottlers Japan Holdings trades at ¥2,463.5, which is below its DCF fair value estimate of ¥2,537.38, and sports a price-to-sales ratio of 0.5x, more attractive than peers and the broader industry.

- According to the consensus narrative, the current discount bolsters the case for value-oriented investors, but comes with caveats:

- The analyst consensus price target is ¥2,932.22, meaning the current share price is about 16% below this level, suggesting potential upside if expected profit growth materializes.

- However, the low revenue growth and elevated uncertainty over margin normalization muddy the reliability of these upside scenarios.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Coca-Cola Bottlers Japan Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data another way? Share your viewpoint and build your personal narrative in under three minutes with Do it your way.

A great starting point for your Coca-Cola Bottlers Japan Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Slow revenue growth, unresolved operating losses, and persistent questions about dividend sustainability set Coca-Cola Bottlers Japan Holdings apart from its industry’s consistent performers.

Prefer consistency and reliability? Use stable growth stocks screener (2087 results) to focus on companies achieving steady growth and robust results, regardless of changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2579

Coca-Cola Bottlers Japan Holdings

Engages in the purchases, sales, bottling, packaging, distribution and marketing of carbonated beverages, coffee beverages, tea-based beverages, mineral water, and other soft drinks in Japan.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives