The Bull Case For Takara Holdings (TSE:2531) Could Change Following Management's 2026 Earnings Guidance Release

Reviewed by Sasha Jovanovic

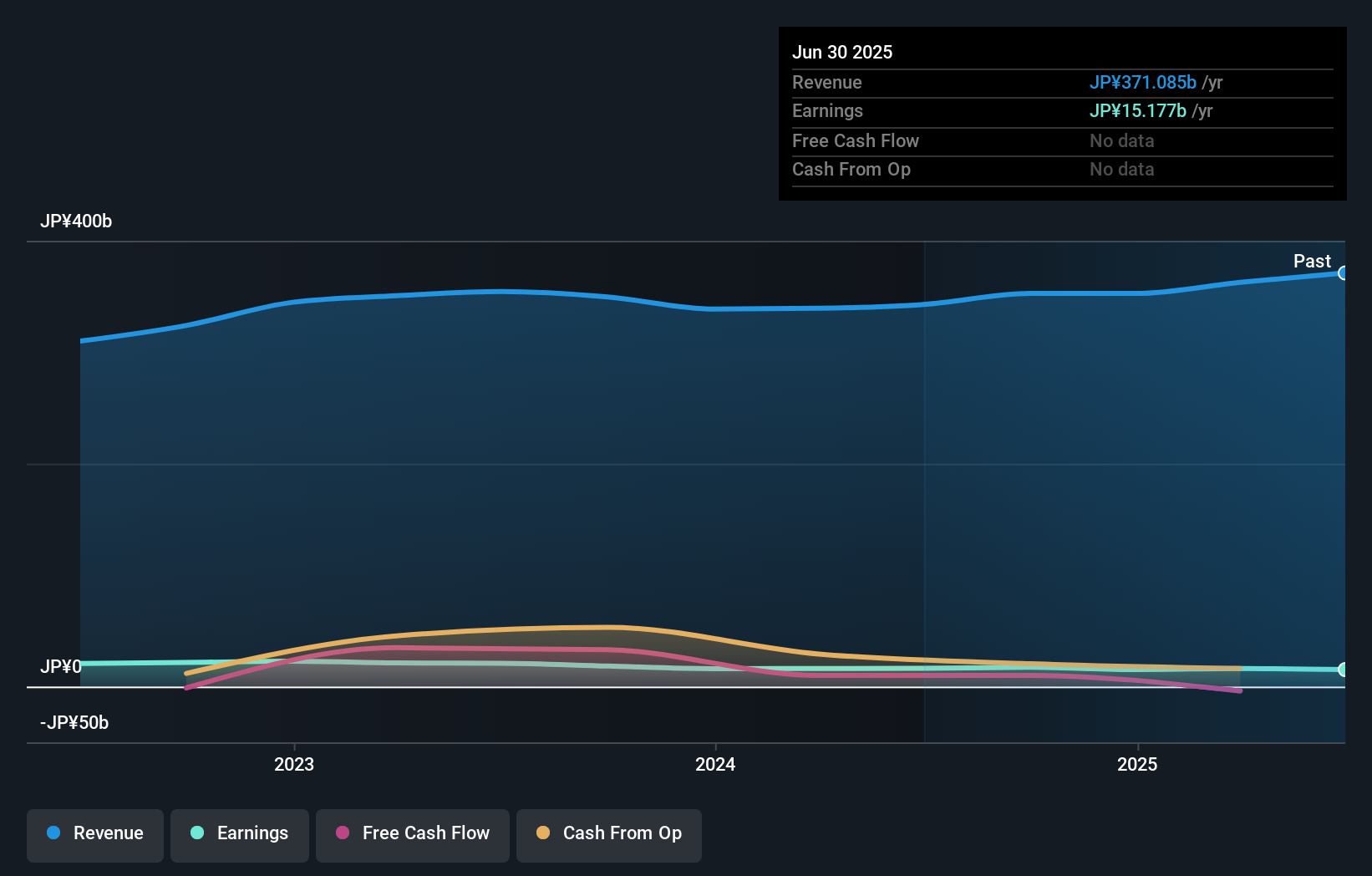

- On November 11, 2025, Takara Holdings Inc. released its consolidated earnings guidance for the fiscal year ending March 31, 2026, forecasting net sales of ¥392 billion, operating income of ¥16.2 billion, and net income attributable to owners of the parent at ¥11.1 billion, or ¥57.43 per share.

- This guidance gives investors an updated view into management’s expectations for the company’s performance over the upcoming fiscal year.

- With management’s earnings outlook now public, we'll explore how these updated forecasts influence Takara Holdings’ investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Takara Holdings' Investment Narrative?

To be a shareholder in Takara Holdings, it’s important to believe in the company’s ability to steady its earnings and adapt to a changing industry outlook. The announcement on November 11, 2025, delivered sharply lower earnings guidance versus the prior forecast, with net sales and profits now expected to be well below what management outlined in August. This revised outlook does refocus short-term attention on how Takara navigates consumer trends, input cost pressures, and the effectiveness of recent share buybacks. Risks now feel more immediate, specifically around whether Takara can maintain margin stability and protect its dividend, given recent cuts and a payout not fully covered by free cash flow. For now, the fresh guidance appears to confirm concerns flagged by the stock’s steep 30-day price drop, making near-term recovery and the board’s relatively new composition key catalysts to watch.

In contrast, the board’s short tenure could play a bigger role than you might expect.

Exploring Other Perspectives

Explore another fair value estimate on Takara Holdings - why the stock might be worth as much as ¥690!

Build Your Own Takara Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Takara Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Takara Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Takara Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2531

Takara Holdings

Manufactures and sells alcoholic beverages and seasonings in Japan, the United States, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth