Takara Holdings (TSE:2531): Reviewing Valuation After New FY2026 Earnings Guidance Announcement

Reviewed by Simply Wall St

Takara Holdings (TSE:2531) drew investor focus after releasing new consolidated earnings guidance for the fiscal year ending March 2026. This update comes just ahead of its upcoming Q2 2026 earnings call. The company’s outlook covers net sales, operating income, and net income projections.

See our latest analysis for Takara Holdings.

Investors seem to be weighing Takara Holdings’ fresh outlook against its recent price swings; the shares have given back ground this month but are still up 7.4% year-to-date, with a standout 22.1% total shareholder return over the past year. Momentum may look choppy in the near term, yet the longer-term total returns suggest investors have benefited from sticking with the stock through recent volatility.

If this kind of momentum shift has you thinking more broadly, now is a great time to check out fast growing stocks with high insider ownership

With new earnings guidance on the table and shares still well ahead over the past year, the real question is whether Takara Holdings is undervalued at current levels, or if the market has already priced in all the future growth.

Price-to-Earnings of 21.8x: Is it justified?

Takara Holdings is currently trading at a price-to-earnings (P/E) ratio of 21.8x, measured against its latest closing price of ¥1,445. This multiple offers a lens into how much investors are paying for each yen of company earnings. When compared to other players in the sector, it helps gauge whether the market believes future earnings growth is likely.

The P/E ratio captures the relationship between a company's market price and its annual earnings per share. For consumer goods and beverage companies like Takara Holdings, investors rely on this ratio to judge where the stock is positioned versus competitors and whether expected profit growth justifies a higher or lower valuation multiple.

Right now, Takara Holdings looks expensive compared to the Asian Beverage industry average of 19.2x and sits only slightly below the overall Beverage industry average of 22.4x. However, it still represents better value compared to its peer group, where the average is a lofty 51.6x. This suggests that while the market is willing to pay a premium for Takara Holdings' relatively stable earnings, there may be caution over its recent negative earnings growth. If a fair P/E ratio could be established based on future prospects, it could indicate where market expectations may shift next.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 21.8x (ABOUT RIGHT)

However, sluggish recent earnings growth and ongoing share price volatility could both undermine confidence in Takara Holdings’ current valuation premiums.

Find out about the key risks to this Takara Holdings narrative.

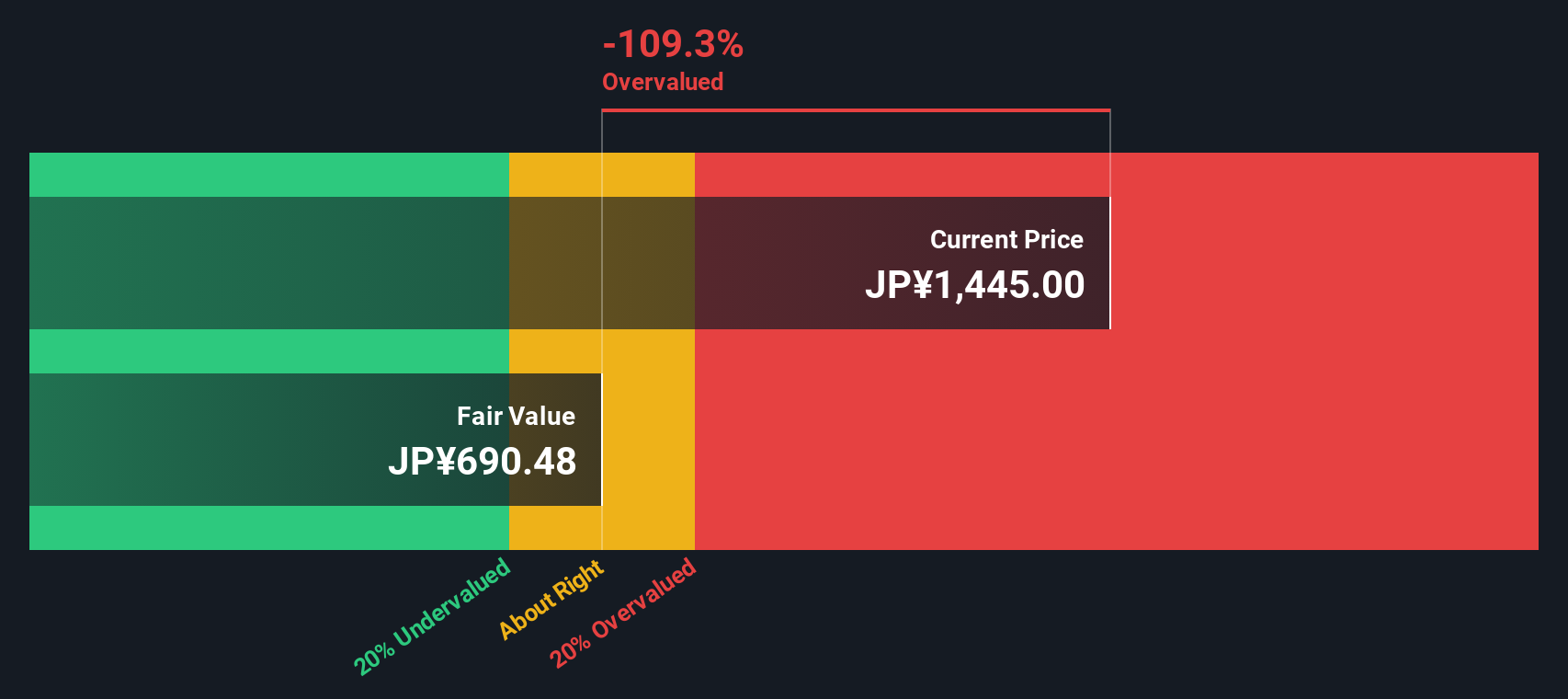

Another View: Discounted Cash Flow Says Overvalued

Taking a different approach, our DCF model values Takara Holdings at about ¥690 per share, which is well below its actual market price of ¥1,445. While the earlier price-to-earnings analysis suggests the valuation is roughly fair, the DCF view raises the possibility that the shares are trading above their fundamental worth. Which method reflects reality, and what might prompt the market to reprice?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Takara Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Takara Holdings Narrative

If you would rather dig into the numbers yourself, you can shape your own perspective and craft a narrative in just a few minutes. Do it your way

A great starting point for your Takara Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t leave profit on the table. Leverage the power of Simply Wall Street’s Stock Screener to pinpoint sector leaders and opportunities you never considered.

- Unlock the potential of tomorrow’s digital currencies by checking out these 81 cryptocurrency and blockchain stocks and see which innovators are changing the way the world transacts.

- Take hold of steady income with these 16 dividend stocks with yields > 3% to identify companies offering strong yields and financial resilience for your portfolio.

- Get ahead of the curve in artificial intelligence by following these 25 AI penny stocks and spot the businesses building next-generation algorithms right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2531

Takara Holdings

Manufactures and sells alcoholic beverages and seasonings in Japan, the United States, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives