NH Foods (TSE:2282) Margin Miss Challenges Defensive Reputation Despite Premium Valuation

Reviewed by Simply Wall St

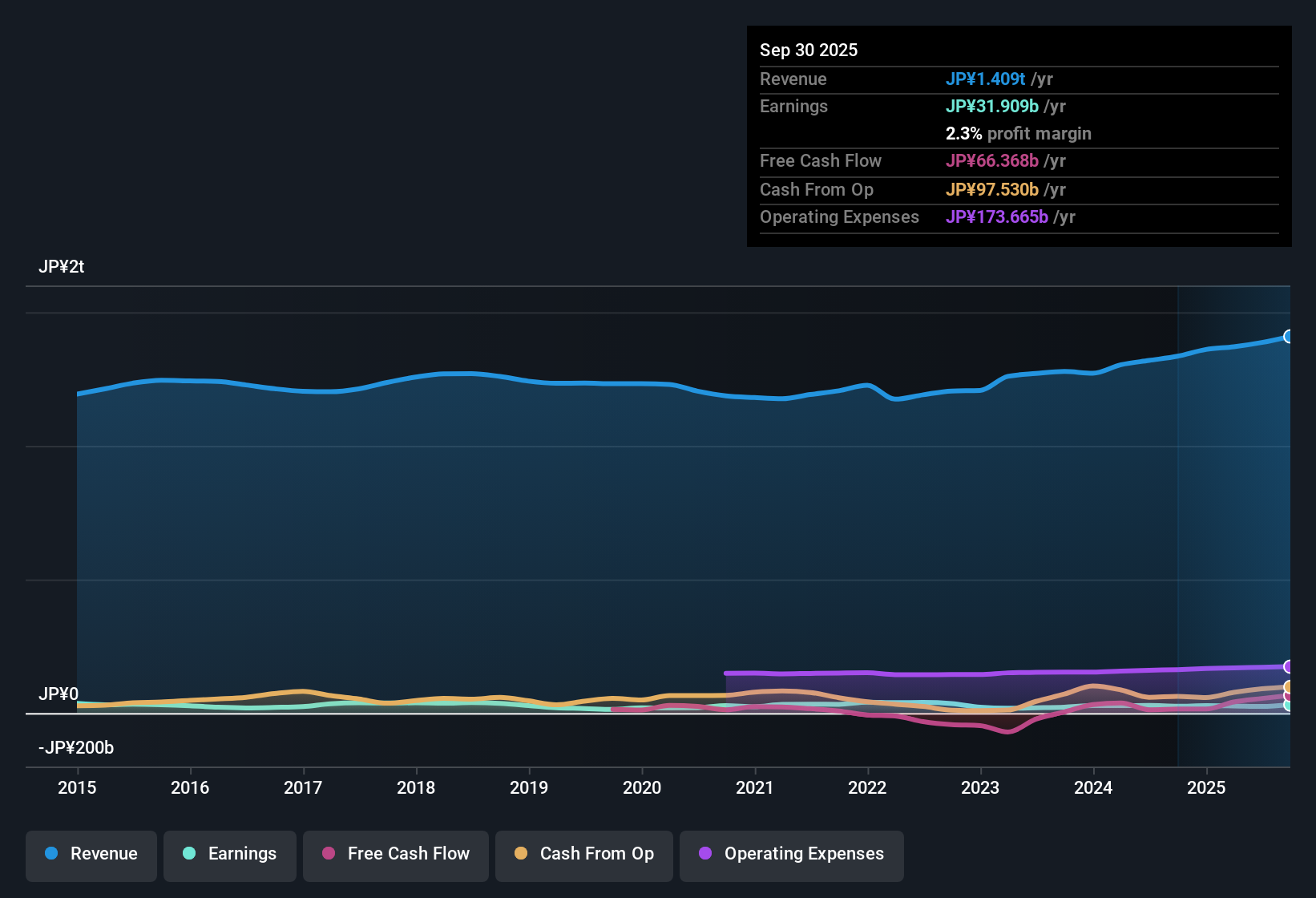

NH Foods (TSE:2282) reported a net profit margin of 1.8%, down from 2.2% the year before, with earnings declining by an average of 5.8% per year over the last five years. Despite forecasts signaling revenue growth of just 1% per year and earnings growth of 6.7% per year, both falling short of the broader JP market averages, the company continues to trade at a price-to-earnings ratio of 25.1x, outpacing peers and the industry overall. Investor focus has shifted to NH Foods’ high quality earnings, attractive dividend, and discounted cash flow valuation amid narrowing profitability.

See our full analysis for NH Foods.With the headline numbers in place, it’s time to see how these results compare to the most widely followed narratives in the market, and which assumptions might get upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Compressed as Profit Growth Lags

- Net profit margin has narrowed from 2.2% last year to 1.8%, underscoring that profitability is getting squeezed even as the bottom line remains positive.

- The prevailing market view notes that NH Foods is seen as a defensive choice, thanks to its history of stable operations and focus on food staples. However, the shrinking margin challenges the confidence in ongoing stability.

- Although the margin dip could flag cost pressures common in the sector, the lack of negative news may help keep investor nerves steady.

- Management’s steady hand is cited by the market as a means of navigating supply chain challenges, but flat or lower margins make it tougher to outpace competitor performance.

Growth Forecasts Underwhelm Versus Market

- NH Foods projects revenue growth of 1% per year and earnings growth of 6.7% per year, both trailing the broader Japanese market’s averages of 4.5% and 7.8% respectively.

- According to the prevailing market view, investors are keeping expectations modest, recognizing NH Foods’ resilience amid sector headwinds but also doubting that the company can deliver breakout growth.

- Stable revenue outlook supports its reputation as a reliable, low-volatility pick. However, slower forecasted growth chips away at excitement for long-term upside.

- Sentiment holds steady mostly due to food sector defensiveness, rather than forecasts for aggressive expansion or market share gains.

Premium Valuation Despite Discounted Cash Flow Upside

- Shares trade at a price-to-earnings ratio of 25.1x, far above the industry average of 15.9x and peer average of 19.2x. The current share price of 6,437.00 yen sits well below the DCF fair value estimate of 15,323.13 yen.

- This alignment pushes the discussion towards conflicting valuation signals, as the prevailing market view balances concerns about a premium earnings multiple with optimism from DCF analysis and an attractive dividend.

- DCF valuation suggests substantial upside relative to the current price, which supports reward-seeking investors even as headline multiples appear expensive.

- The company’s reputation for high-quality earnings and appealing dividend may help justify the premium multiple in the eyes of long-term holders.

See our latest analysis for NH Foods.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NH Foods's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NH Foods’ premium valuation stands out as a concern, particularly since its profit margins are narrowing and growth forecasts remain underwhelming compared to the market.

If you want to sidestep companies that look expensive on traditional metrics, consider discovering undervalued opportunities with stronger growth outlooks by using these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2282

NH Foods

Engages in manufacturing and selling ham, sausage, processed food, meat, and dairy product in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives