How NH Foods’ Five-Year High Amid a Nikkei Slump (TSE:2282) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- During a recent trading session, NH Foods stood out by achieving a five-year high on its share price while the Nikkei 225 index declined sharply, reflecting widespread weakness across Paper & Pulp, Transport, and Communication sectors.

- The company’s positive performance, despite broad market declines, highlights a possible sense of resilience or strong investor sentiment specific to NH Foods amid subdued sector trends.

- We'll explore how NH Foods' relative strength during a challenging session influences its broader investment narrative and perceived sector resilience.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is NH Foods' Investment Narrative?

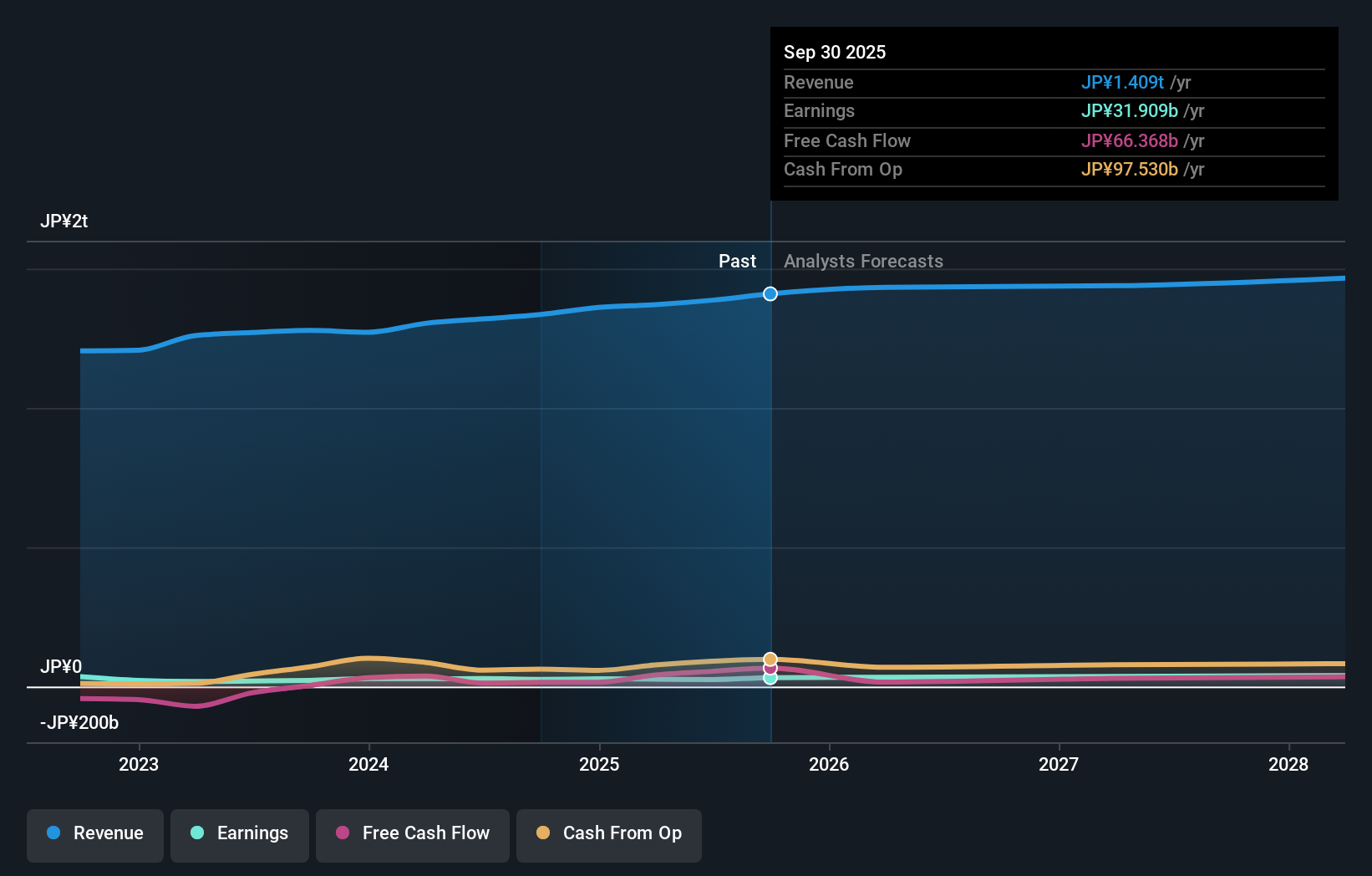

For anyone considering NH Foods as a long-term holding, the big picture centers on a mix of steady, if unspectacular, growth in a mature sector, consistent dividends, and a willingness to adjust both strategy and capital structure. The recent surge to a five-year high in share price, especially while the broader Nikkei 225 slumped, may reflect investor recognition of management’s efforts, ranging from a raised earnings outlook and higher dividends, to a sizable buyback and a new international partnership with CPF. However, this positive trading session alone does not dramatically reshape NH Foods’ main short-term risks or catalysts. Growth remains modest, and the management team is still in its early days. The company’s relative strength during market volatility adds to the narrative of sector resilience and could help sentiment, but unless these gains are supported by sustained earnings momentum or transformative results from the venture with CPF, the fundamental outlook is largely unchanged.

In contrast, the company’s low return on equity remains a key issue that investors should consider.

NH Foods' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on NH Foods - why the stock might be worth just ¥15375!

Build Your Own NH Foods Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NH Foods research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free NH Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NH Foods' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2282

NH Foods

Engages in manufacturing and selling ham, sausage, processed food, meat, and dairy product in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives