Prima Meat Packers (TSE:2281) Net Margin Decline Reinforces Dividend Sustainability Concerns

Reviewed by Simply Wall St

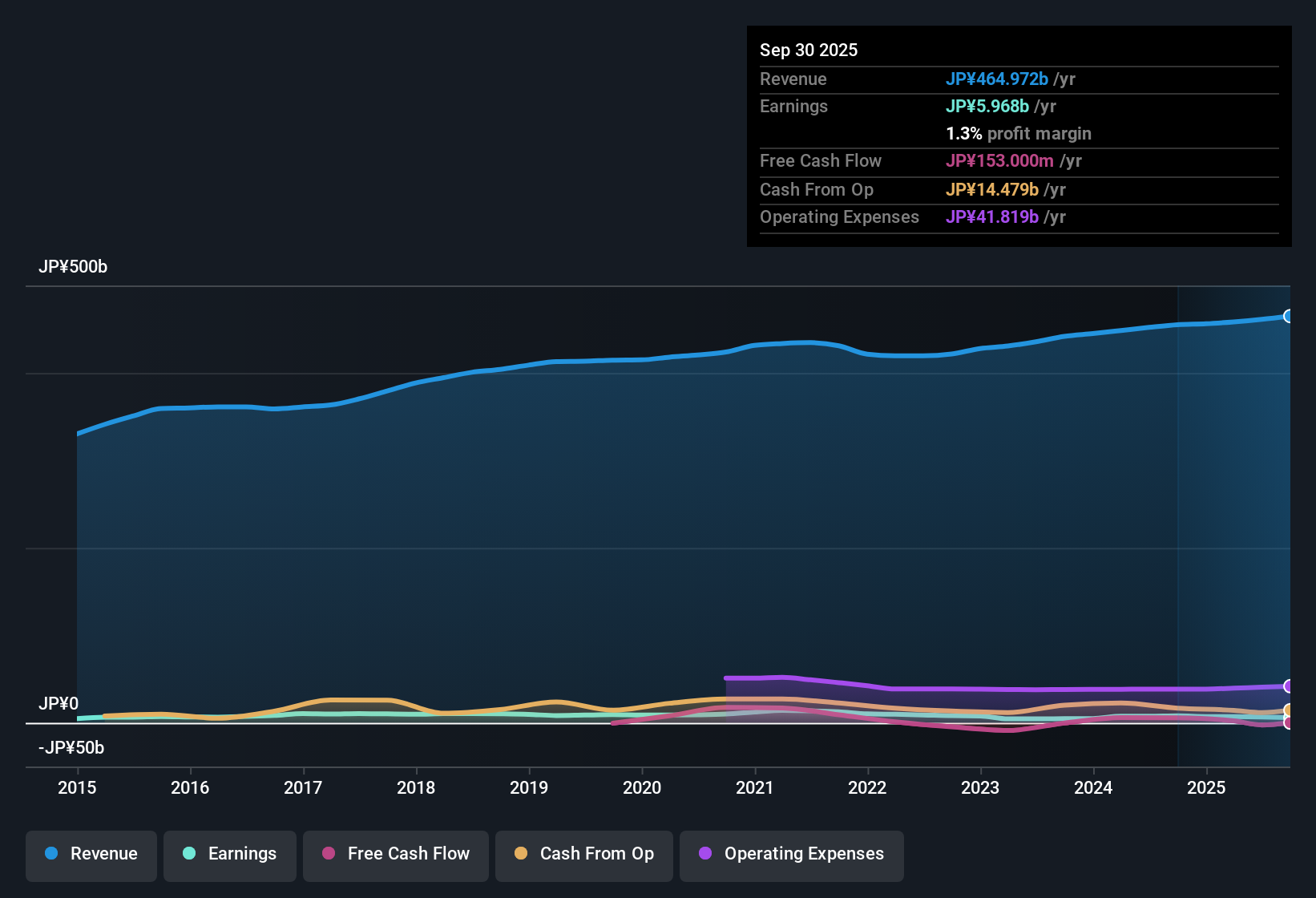

Prima Meat Packers (TSE:2281) posted a net profit margin of 1.3%, down from 1.7% the previous year, as annual earnings have declined by 16.5% on average over the last five years and earnings growth turned negative over the past year. Despite these compressed margins, analysts are looking ahead to an expected rebound with forecast earnings growth of 11.1% per year, which would beat the broader JP market’s projected 7.8% profit growth.

See our full analysis for Prima Meat Packers.Next, we’ll see how Prima’s numbers stack up against the dominant narratives in the community, highlighting where the consensus gets it right and where these results might spark new debates.

Curious how numbers become stories that shape markets? Explore Community Narratives

Valuation Gap Versus Peers Widens

- Prima Meat Packers' Price-to-Earnings ratio of 20.8x is more than double the peer average of 9.9x, and sits above the Japanese food industry average of 16.3x. This signals that the stock trades at a steeper premium than most direct competitors.

- Despite this valuation premium, prevailing market analysis points out that the current share price of ¥2475 is well below the DCF fair value of ¥6236.55. This suggests the market sees challenges ahead that could be overshadowing the company’s intrinsic value.

- The disconnect between the relatively high trading multiple and ongoing earnings declines highlights sector pressures. The fair value gap keeps the door open for upside if margin recovery materializes.

- Investors have to weigh the potential for a rebound, backed by a forecast profit growth of 11.1% per year, against persistent historical declines and premium entry levels relative to both peers and industry benchmarks.

Forecast Profit Growth Edges Past Industry

- Analysts expect Prima’s profit growth to average 11.1% annually, comfortably ahead of the broader JP market’s projected 7.8% profit growth rate, even as revenue growth forecasts for the company (1.4% per year) lag the sector average of 4.5%.

- Prevailing market assessment emphasizes that this upbeat growth forecast offers cautious optimism, while also flagging that topline momentum remains modest in comparison to sector peers.

- Where profit is expected to rebound robustly, muted revenue improvement highlights how improved cost control or margin restoration, rather than surging sales, drives the bullish narrative for the stock.

- Market watchers note that outpacing the industry on profit growth can attract attention, but slow revenue growth may limit how much excitement translates into sustained share price gains.

Dividend Sustainability Sits in the Crosshairs

- Dividend sustainability arises as a material risk, with filings specifically calling out its durability as an investor concern, despite the company's high earnings quality designation.

- While recent operational efficiency and product innovation headline the positive narrative, scrutiny intensifies on whether declining earnings over five years, down an average of 16.5% annually, could undermine future dividend commitments.

- Bulls highlight Prima’s high quality earnings, but critics argue that profit declines may constrain management’s ability to maintain or grow dividends.

- The attention on dividend risks gives added weight to each earnings cycle, as any further profit pressure could directly affect returns for income-focused shareholders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Prima Meat Packers's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Prima Meat Packers’ shrinking margins, profit declines, and uncertain dividend outlook may leave income-focused investors seeking more reliable long-term returns.

If you want consistent yield and confidence in payouts, check out these 2000 dividend stocks with yields > 3% to spot stocks with stronger, more dependable dividends than Prima.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2281

Prima Meat Packers

Produces and markets hams and sausages, meats, processed foods, and other products in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives