Evaluating Megmilk Snow Brand (TSE:2270) Valuation Ahead of Board Meeting and Asset Transfer Decision

Reviewed by Simply Wall St

MEGMILK SNOW BRANDLtd (TSE:2270) is drawing attention as investors look ahead to the board meeting scheduled for November 14. The meeting will address a possible asset transfer and coincide with the company’s latest earnings call.

See our latest analysis for MEGMILK SNOW BRANDLtd.

Shares of MEGMILK SNOW BRANDLtd have seen notable momentum this year, up 12.3% year-to-date. The latest 1-day share price return of 2.7% is likely fueled by anticipation around the board’s upcoming asset transfer discussion and the earnings call. Long-term momentum is even more impressive, with a 16.2% total shareholder return over the past year and a standout 83.1% total return across three years. This suggests the company is staying on investors’ radar for both near-term catalysts and sustained performance.

If today's moves have you scanning for more opportunities, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares running higher ahead of key events, the real question is whether MEGMILK SNOW BRANDLtd's current price reflects all of its future prospects, or if investors still have a genuine buying opportunity on their hands.

Price-to-Earnings of 11.7x: Is it justified?

MEGMILK SNOW BRANDLtd trades at a price-to-earnings (P/E) ratio of 11.7x, with shares closing recently at ¥3,035. While this figure stands below the overall market’s average, it is notably higher than several direct peer group averages, indicating some market optimism in the stock’s pricing.

The price-to-earnings ratio compares the company's share price to its per-share earnings. This key multiple helps investors assess whether the market is overpaying or underpaying for company profits, making it especially important for established consumer goods businesses such as MEGMILK SNOW BRANDLtd.

In recent years, the company has delivered profitable growth, but its earnings are facing new headwinds. The current P/E is above the average of close competitors (10.4x), and even surpasses the estimated fair P/E ratio of 10.6x. This sends a signal that optimism or expectation is already built into the share price, rather than a discounted entry point for value-seekers.

Compared to the broader Japanese food industry, MEGMILK SNOW BRANDLtd appears relatively well-priced, with the industry averaging a P/E of 16x. However, against its peer group and the company’s own fair value calculation, the stock looks slightly on the expensive side.

Explore the SWS fair ratio for MEGMILK SNOW BRANDLtd

Result: Price-to-Earnings of 11.7x (OVERVALUED)

However, slowing annual net income growth and a share price already close to analyst targets could limit further upside for MEGMILK SNOW BRAND Ltd.

Find out about the key risks to this MEGMILK SNOW BRANDLtd narrative.

Another View: Discounted Cash Flow Model

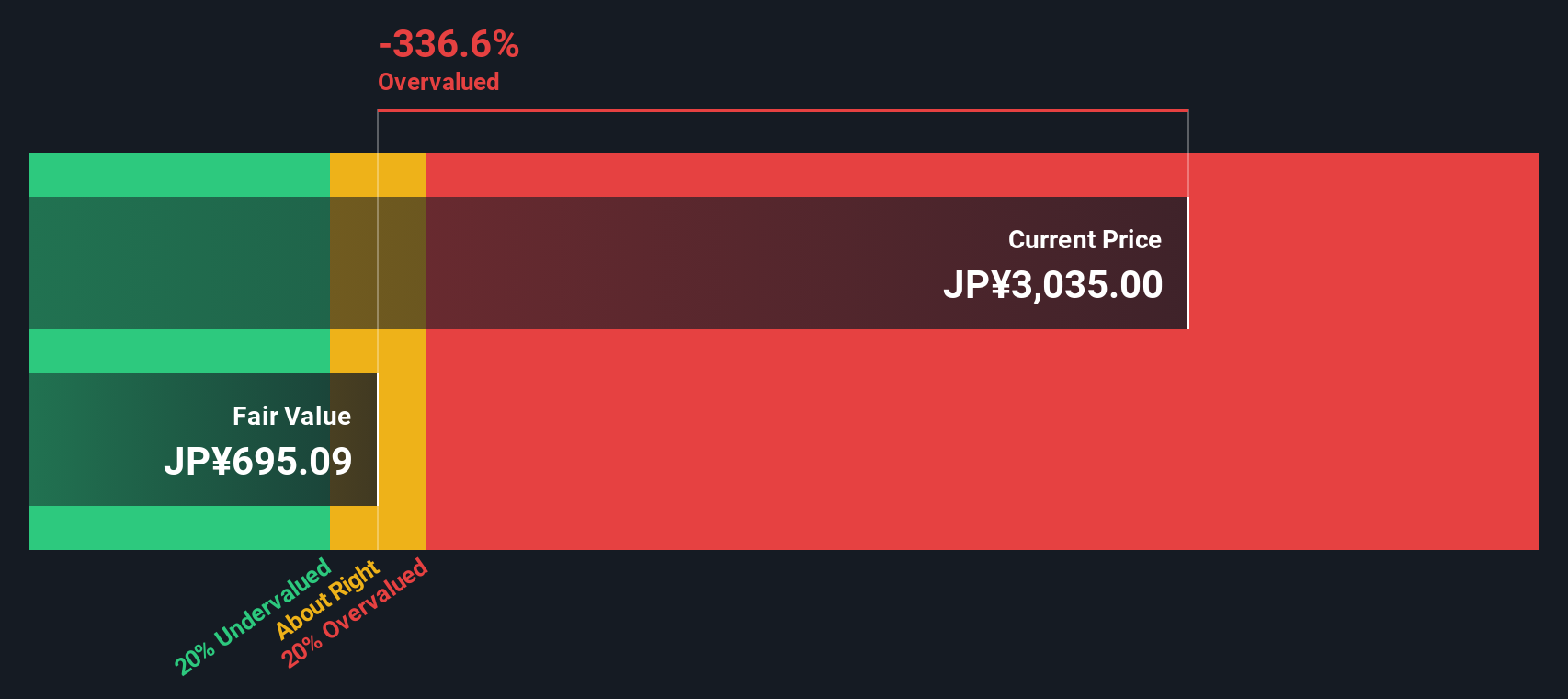

Looking from another angle, our SWS DCF model values MEGMILK SNOW BRANDLtd at ¥695.09 per share. This places the current price far above fair value. This method presents a much less optimistic picture compared with earnings multiples. Could markets be overestimating the company’s future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MEGMILK SNOW BRANDLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MEGMILK SNOW BRANDLtd Narrative

If you see the data differently or want to dig into the details yourself, it’s easy to build your own take in just minutes. Do it your way

A great starting point for your MEGMILK SNOW BRANDLtd research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Finding your next standout investment is easier than ever with the right tools. Don't leave great opportunities on the table; let the Simply Wall St Screener point you toward stocks with real upside potential.

- Grab the potential for powerful returns by scanning these 3603 penny stocks with strong financials packed with strong fundamentals and untapped growth stories.

- Capitalize on digital transformation and data-driven breakthroughs by reviewing these 25 AI penny stocks which are reshaping entire sectors through artificial intelligence advancements.

- Boost your income stream with these 17 dividend stocks with yields > 3% that offers yields over 3 percent and robust payout records even in challenging markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2270

MEGMILK SNOW BRANDLtd

Manufactures and sells milk, milk products, and other food products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives