Meiji Holdings (TSE:2269) Valuation in Focus After Major KM Biologics Restructuring Announcement

Reviewed by Simply Wall St

Meiji Holdings (TSE:2269) has just unveiled a strategic plan to transfer ownership of KM Biologics to Meiji Seika Pharma through an absorption-type company split. This board-approved restructuring is intended to better integrate pharmaceutical operations and support global growth.

See our latest analysis for Meiji Holdings.

Meiji Holdings recently caught investor attention with its board-level restructuring announcement, but that is not the only development making headlines. The company also revised its earnings guidance for the year and announced a slightly higher interim dividend, reflecting shifting fortunes across its food and pharmaceutical businesses. Despite these moves, momentum has been mixed. The 1-month share price return of 6% suggests short-term optimism, yet the 1-year total shareholder return remains slightly negative, hinting that confidence in the longer-term outlook is still rebuilding.

If you’re interested in what else is driving the market right now, consider broadening your search and discover fast growing stocks with high insider ownership

With shares currently trading below analysts’ price targets, but recent guidance remaining subdued, investors must ask whether Meiji Holdings is a hidden value play or if the market has already factored in realistic growth prospects.

Most Popular Narrative: 4.5% Undervalued

With Meiji Holdings closing at ¥3,180, the most popular narrative sees fair value at ¥3,328.57. This places the stock just under analyst consensus, hinting at a modest discount and room for upside if assumptions hold true.

Expansion in B2B and international markets, coupled with production optimization, is likely to drive revenue growth and profitability. Investments in production optimization, including new plants in Hokkaido and Kanagawa, are expected to reduce costs and improve margins by optimizing capacity and reducing fixed costs.

Curious about what’s behind the confidence in that price target? The story hinges on robust international momentum and profit margin gains from new production investments. See what other key forecasts support this bullish stance. Read the complete narrative to discover the quantitative levers behind the fair value.

Result: Fair Value of ¥3,328.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained increases in raw material costs or further declines in overseas earnings could quickly challenge these positive valuation assumptions for Meiji Holdings.

Find out about the key risks to this Meiji Holdings narrative.

Another View: What Do Multiples Say?

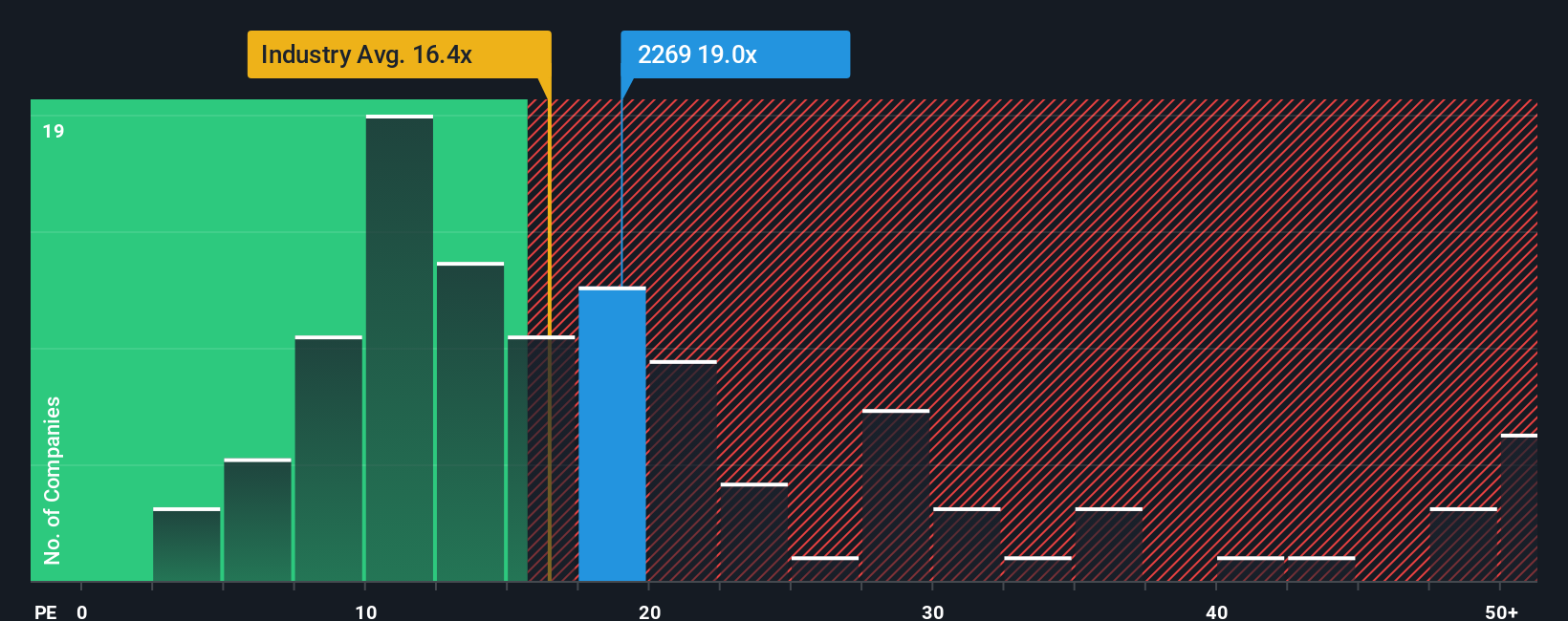

Looking from a different angle, the current valuation based on the price-to-earnings ratio paints a less optimistic picture. Meiji Holdings trades at 19x earnings, making it pricier than both the peer average (18.1x) and the broader industry (16.4x). Although the fair ratio is estimated at 20.5x, the premium right now suggests investors could be exposed to valuation risk if the market corrects.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meiji Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can put together your own perspective in under three minutes, and Do it your way

A great starting point for your Meiji Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Step out ahead of the crowd and get inspired by stocks that are making waves in new sectors and delivering compelling opportunities. Tap into unique ideas now. Don’t miss your chance to spot winners before everyone else.

- Capture steady income potential by scanning for these 15 dividend stocks with yields > 3% with robust yields above 3% and dependable track records.

- Power up your portfolio with the fast-paced innovations driving these 26 AI penny stocks as artificial intelligence reshapes entire industries.

- Unlock hidden gems trading lower than their estimated intrinsic worth by seeking out these 927 undervalued stocks based on cash flows that could offer a strong upside from today’s prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2269

Meiji Holdings

Through its subsidiaries, engages in the manufacture and sale of dairy products, confectionery food products and pharmaceuticals in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives