- Japan

- /

- Personal Products

- /

- TSE:4911

3 Japanese Exchange Stocks Estimated To Be Up To 48.8% Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets have shown robust performance recently, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, partly driven by a weaker yen following the U.S. Federal Reserve’s significant rate cut. This favorable market environment presents opportunities for discerning investors to identify undervalued stocks that could offer substantial upside potential. In the current market conditions, a good stock is typically characterized by strong fundamentals and trading below its intrinsic value, providing an attractive entry point for long-term growth amidst economic stability and positive investor sentiment.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1491.00 | ¥2933.97 | 49.2% |

| Densan System Holdings (TSE:4072) | ¥2664.00 | ¥5317.14 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥511.00 | ¥1012.08 | 49.5% |

| Stella Chemifa (TSE:4109) | ¥4175.00 | ¥8099.33 | 48.5% |

| Pilot (TSE:7846) | ¥4498.00 | ¥8861.25 | 49.2% |

| Taiyo Yuden (TSE:6976) | ¥3106.00 | ¥6061.05 | 48.8% |

| Hibino (TSE:2469) | ¥3515.00 | ¥6957.23 | 49.5% |

| Appier Group (TSE:4180) | ¥1813.00 | ¥3497.25 | 48.2% |

| Visional (TSE:4194) | ¥8690.00 | ¥16943.24 | 48.7% |

| SBI ARUHI (TSE:7198) | ¥845.00 | ¥1687.52 | 49.9% |

Let's uncover some gems from our specialized screener.

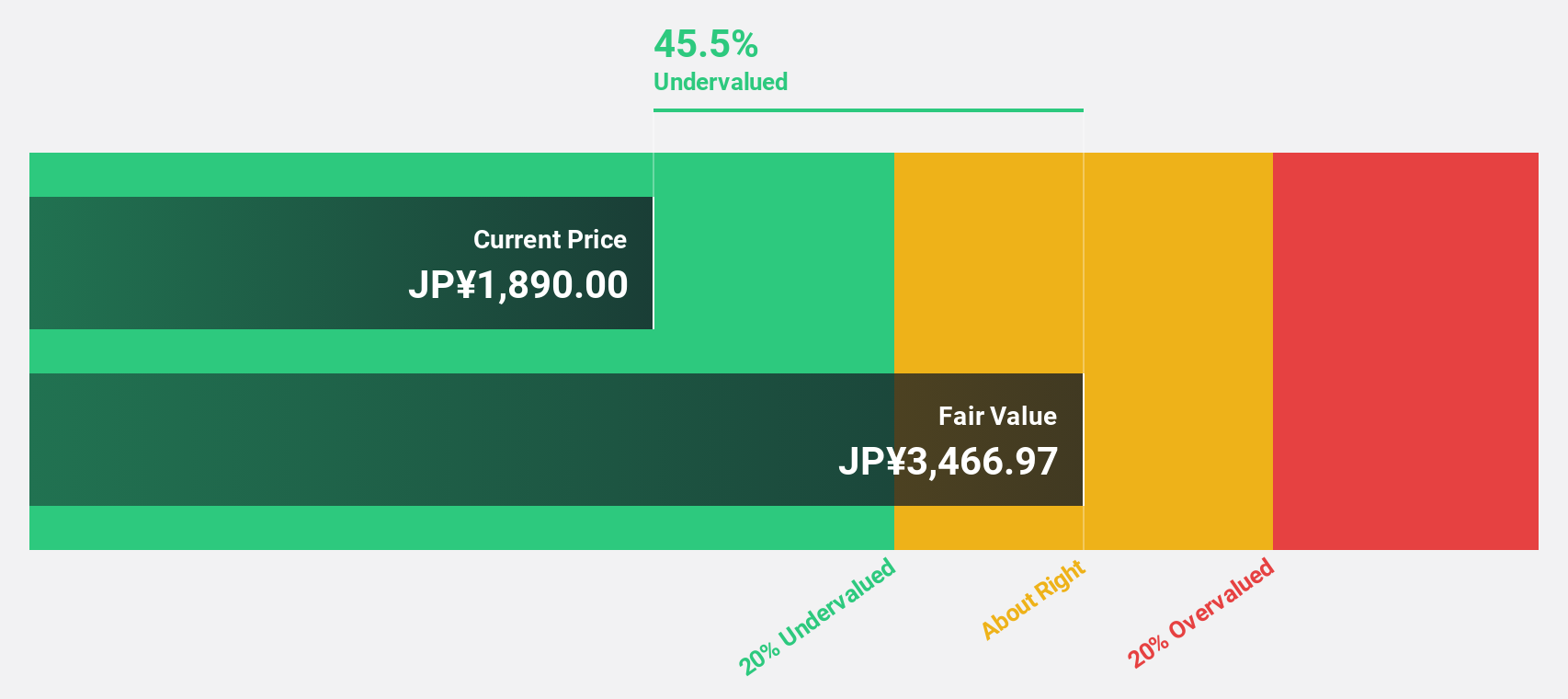

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. produces and sells sweets in Japan with a market cap of ¥278.76 billion.

Operations: Kotobuki Spirits Co., Ltd.'s revenue segments include Shukrei (¥27.03 billion), Casey Shii (¥18.88 billion), Kotobuki Confectionery/Tajima Kotobuki (¥13.19 billion), Sales Subsidiaries (¥7.06 billion), and Kujukushima (¥6.56 billion).

Estimated Discount To Fair Value: 47.9%

Kotobuki Spirits is trading at ¥1791, significantly below its estimated fair value of ¥3434.73, indicating it may be undervalued based on cash flows. The stock is also 47.9% below analyst price targets with consensus expecting a 37% rise in stock price. Revenue and earnings are forecast to grow faster than the Japanese market at 10.9% and 12.8% per year respectively, supported by strong recent performance with earnings growing by 33.7%.

- Our growth report here indicates Kotobuki Spirits may be poised for an improving outlook.

- Dive into the specifics of Kotobuki Spirits here with our thorough financial health report.

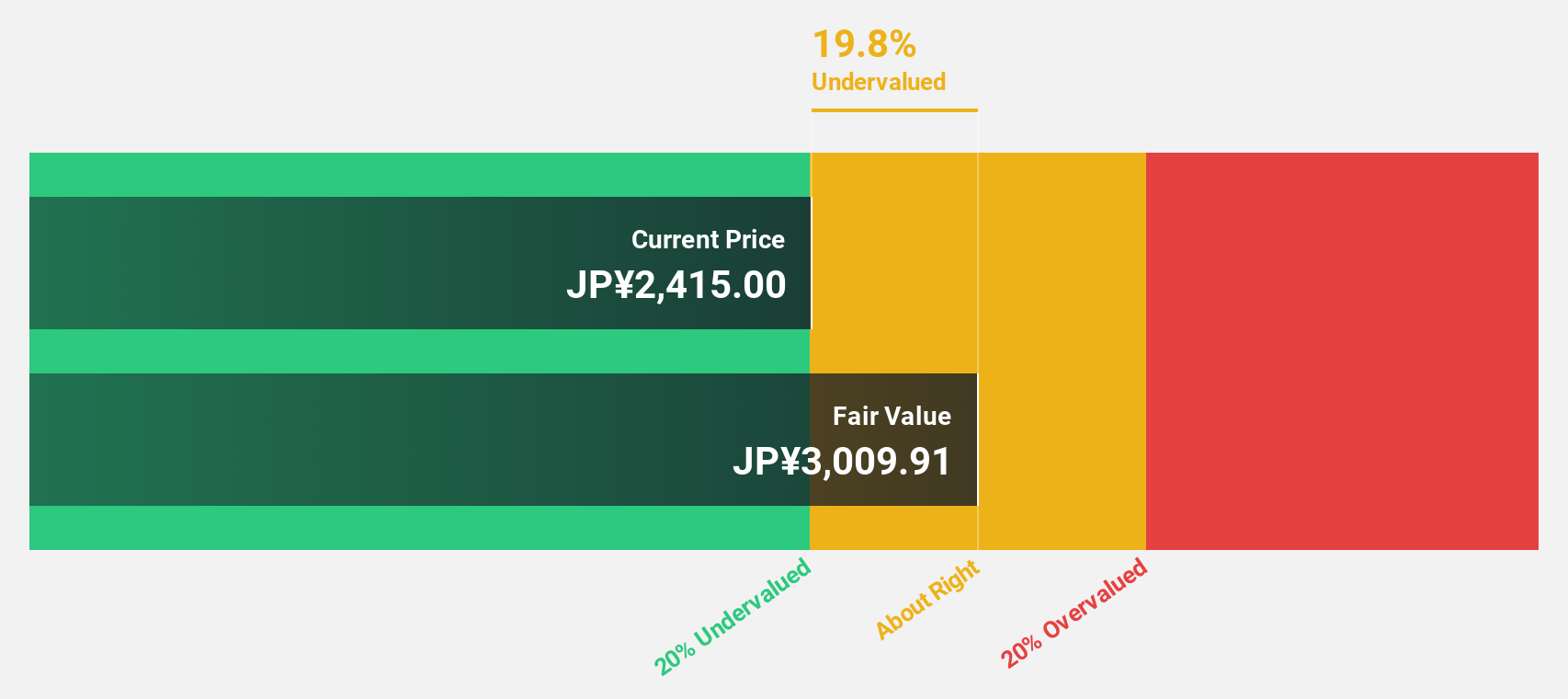

Shiseido Company (TSE:4911)

Overview: Shiseido Company, Limited engages in the production and sale of cosmetics in Japan and internationally, with a market cap of ¥1.51 trillion.

Operations: The company's revenue segments are as follows: EMEA Business: ¥134.42 billion, China Business: ¥253.08 billion, Japan Business: ¥279.41 billion, Americas Business: ¥120.34 billion, Asia-Pacific Business: ¥76.29 billion, and Travel Retail Business: ¥122.20 billion.

Estimated Discount To Fair Value: 10.2%

Shiseido Company is trading at ¥3785, about 10% below its estimated fair value of ¥4212.79, suggesting it might be undervalued based on cash flows. Despite a low profit margin of 1%, earnings are forecast to grow significantly at 35.83% per year, outpacing the Japanese market's growth rate. Recent executive changes and a completed share buyback program worth ¥1.04 billion could influence future performance positively.

- Our expertly prepared growth report on Shiseido Company implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Shiseido Company's balance sheet by reading our health report here.

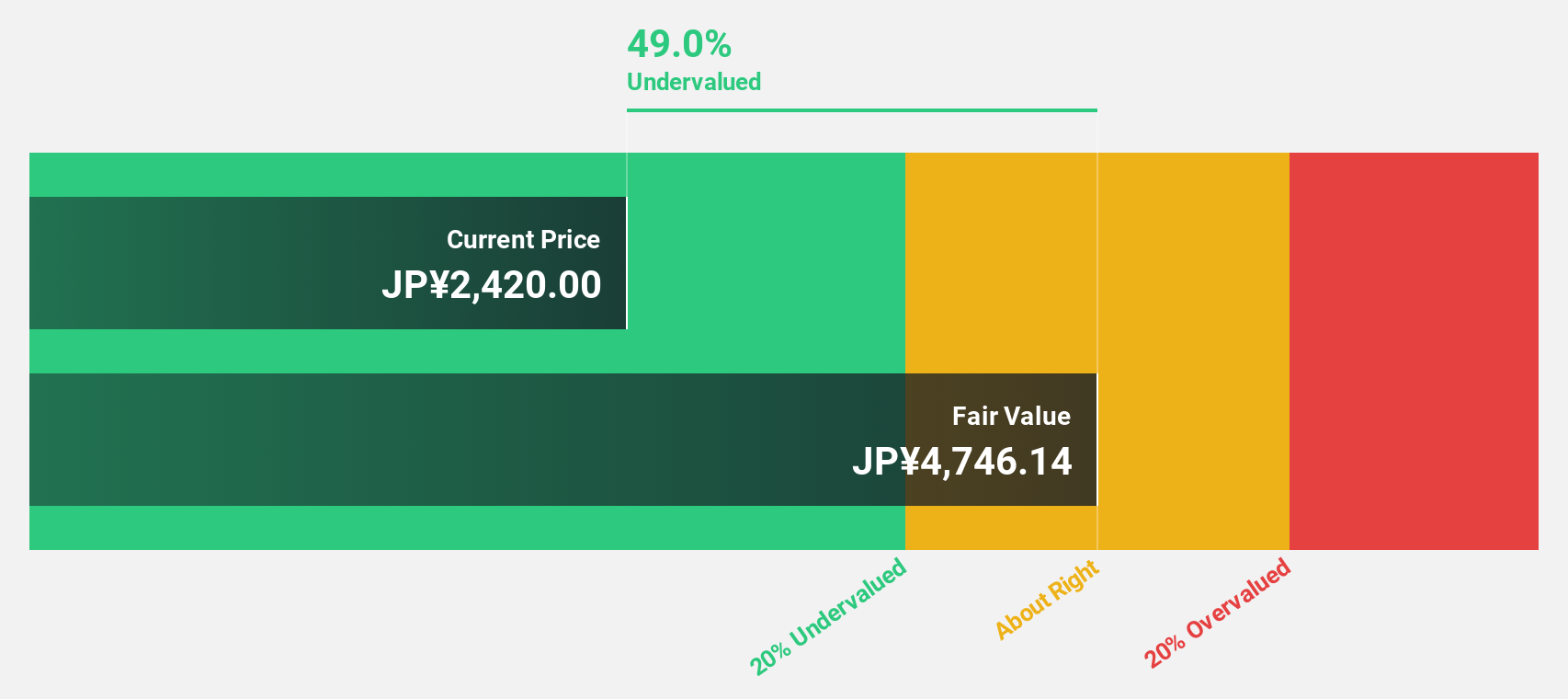

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally with a market cap of ¥387.09 billion.

Operations: The company generates revenue of ¥331.17 billion from its Electronic Components Business segment.

Estimated Discount To Fair Value: 48.8%

Taiyo Yuden, trading at ¥3106, is significantly undervalued with an estimated fair value of ¥6061.05. The company's earnings are forecast to grow 26.24% annually, outpacing the Japanese market's 8.6%. However, its revenue growth is slower at 6.9% per year and the Return on Equity is projected to be low at 9.6%. Recent board decisions on treasury stock disposal could impact future cash flows and shareholder returns.

- The analysis detailed in our Taiyo Yuden growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Taiyo Yuden stock in this financial health report.

Taking Advantage

- Click here to access our complete index of 82 Undervalued Japanese Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4911

Shiseido Company

Engages in the production and sale of cosmetics in Japan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives