Did Yamazaki Baking's (TSE:2212) Upgraded Profit Guidance Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

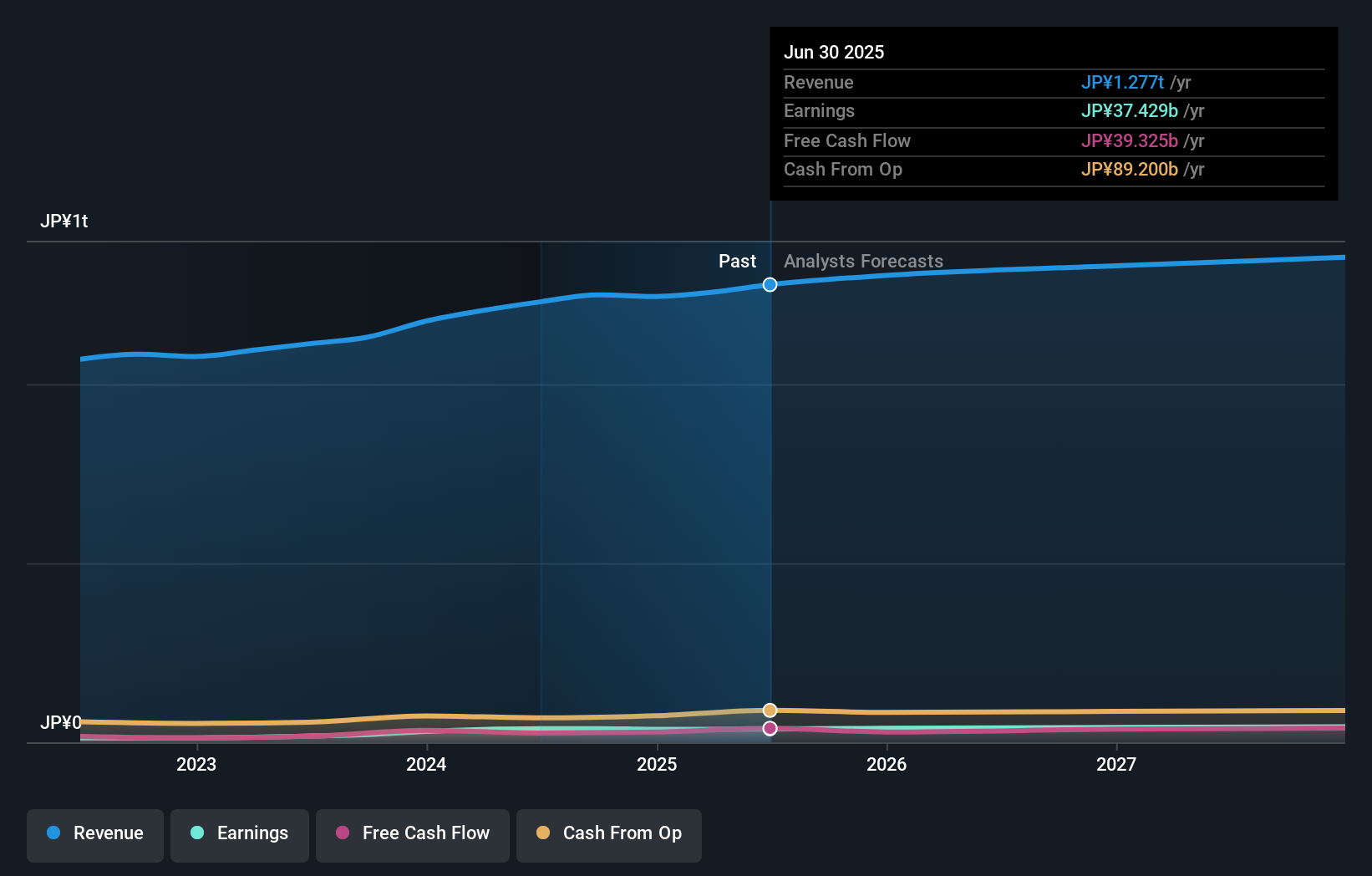

- Yamazaki Baking Co., Ltd. recently revised its full-year 2025 consolidated earnings guidance, now expecting ¥1.30 trillion in net sales and ¥59 billion in operating profit, citing stronger-than-expected results for the first nine months of the year.

- This upward revision reflects substantial growth in operating profits and signals management's confidence in the company's operational trajectory and future performance.

- We'll explore how Yamazaki Baking's upgraded profit outlook strengthens its investment narrative and underscores improving operational momentum.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Yamazaki Baking's Investment Narrative?

For anyone considering Yamazaki Baking, the story has just become more interesting. The company's upgraded full-year guidance, backed by stronger-than-expected nine-month results, points to real momentum on both sales and profit fronts. This signals management’s optimism and suggests that near-term catalysts, like ongoing margin improvement and increased dividend payouts, may play a bigger role than markets had assumed before. Historically, shares have traded at a discount to both analyst and retail fair value estimates, helped by a consistent approach to share buybacks and modest but steady profit growth. Yet, with return on equity remaining below higher benchmarks and profit margins inching only slightly higher, there’s still some risk that gains from these robust interim results may not fully address underlying profitability concerns. The latest news does move the needle, especially on sentiment and short-term outlook, but whether that leads to a sustainable change in long-term prospects remains uncertain.

On the other hand, Yamazaki’s modest profit margins should still be on every investor’s radar. Yamazaki Baking's shares have been on the rise but are still potentially undervalued by 36%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Yamazaki Baking - why the stock might be worth just ¥3638!

Build Your Own Yamazaki Baking Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamazaki Baking research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Yamazaki Baking research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamazaki Baking's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2212

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives