Should Maruha Nichiro's (TSE:1333) Stock Split and Rebranding to Umios Prompt Investor Action?

Reviewed by Sasha Jovanovic

- At its November 10, 2025 Board meeting, Maruha Nichiro Corporation approved a stock split, amendments to its Articles of Incorporation to increase authorized shares to 350,000,000, affirmed a JPY 50.00 per share dividend, revealed plans for a company name change to "Umios Corporation" in March 2026, and proposed introducing a commemorative shareholder benefits program.

- The coordinated actions around corporate structure, dividend policy, and rebranding indicate a broad transformation aimed at strengthening shareholder engagement during a period of transition.

- With the introduction of a shareholder benefits program marking its planned transformation to Umios Corporation, we explore how these changes influence Maruha Nichiro's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Maruha Nichiro's Investment Narrative?

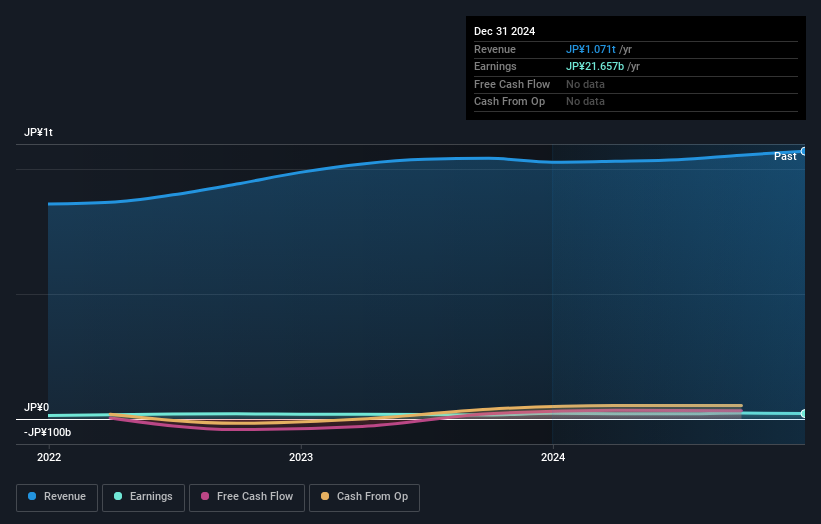

For shareholders of Maruha Nichiro, the investment narrative is evolving quickly. The company’s sweeping changes, including the stock split, planned rebrand to Umios Corporation, and shareholder benefit program, signal a push to refresh its identity and deepen engagement. These moves arrive as Maruha Nichiro’s board and management continue to see unusually high turnover, and while core financials, like modest profit margins and negative earnings growth last year, offer both value and uncertainty. The announced stock split and dividend should improve liquidity and signal management’s confidence, but they do not seem to address the underlying risks identified earlier, such as the inexperienced board and management or ongoing profitability pressures. The catalyst for the stock now shifts from short-term yield to how these governance and structural changes might affect profitability in the coming quarters, while the main risk remains execution through a significant leadership transition.

But, with such a new board, execution risk shouldn’t be underestimated by anyone considering Maruha Nichiro. Maruha Nichiro's share price has been on the slide but might be up to 13% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Maruha Nichiro - why the stock might be worth 11% less than the current price!

Build Your Own Maruha Nichiro Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maruha Nichiro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Maruha Nichiro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maruha Nichiro's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1333

Maruha Nichiro

Engages in the fishing, fish farming, food processing, trading, meat products, and distribution businesses in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives