Kyokuyo (TSE:1301) Margin Decline Undercuts Consensus on Stable Earnings Quality

Reviewed by Simply Wall St

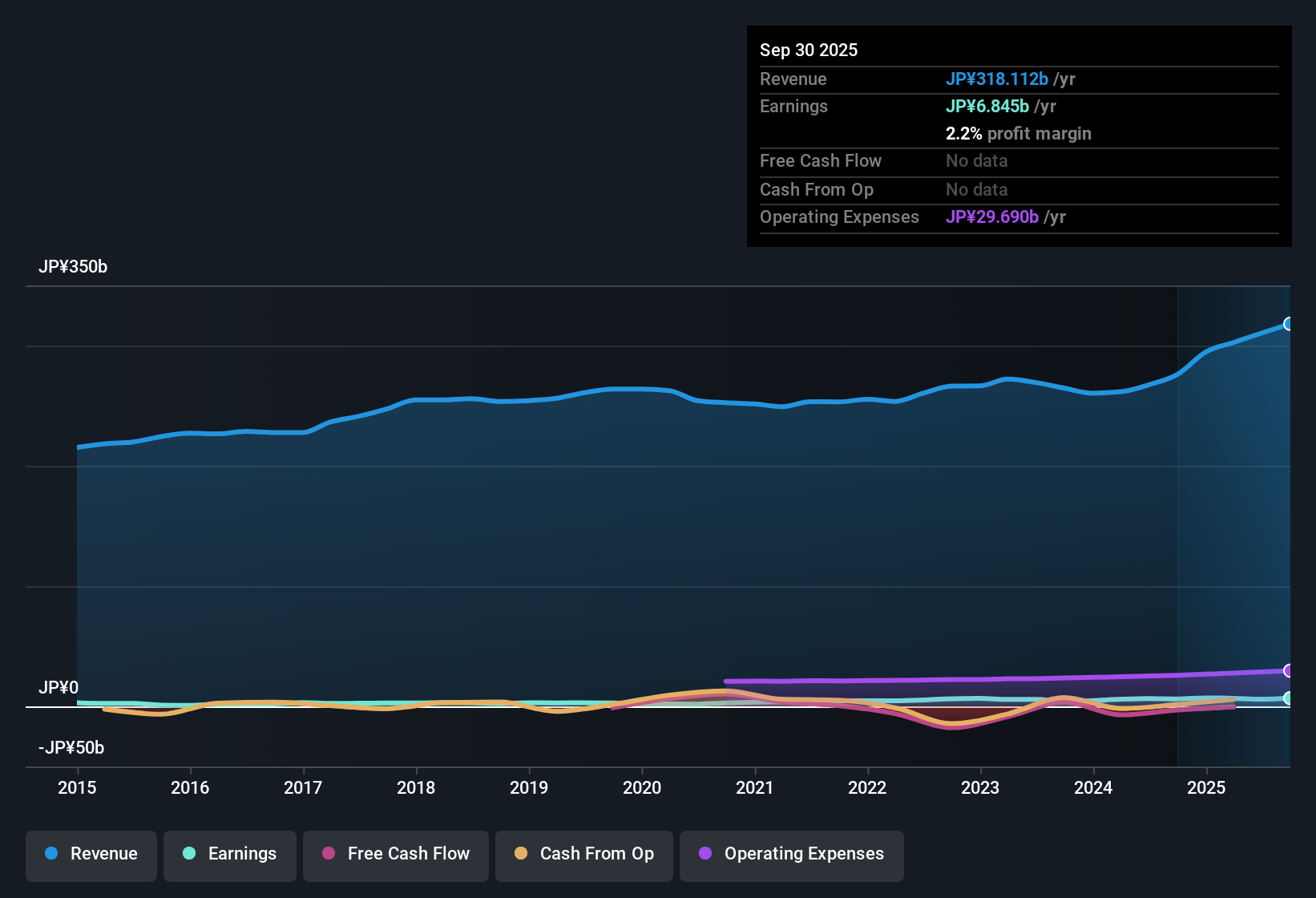

Kyokuyo (TSE:1301) posted net profit margins of 1.9% for the latest period, down from 2.4% last year, highlighting a year-over-year margin contraction. Over the past five years, average annual earnings growth stood at 11.9%. However, the most recent year saw a negative trend in earnings, breaking from that positive run. While the shares currently trade at a relatively low Price-To-Earnings Ratio of 8.9x compared to an industry average of over 15x, the market remains wary with the share price positioned well above the estimated fair value.

See our full analysis for Kyokuyo.Next, we will put these headline results side by side with the broader market narratives to see which assumptions about Kyokuyo hold up and which may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Pressure Follows Years of Strong Growth

- While the five-year average annual earnings growth was 11.9%, the most recent period flipped to negative earnings growth, breaking the company’s consistent upward trend from previous years.

- Many highlight that this setback creates a test of durability. What stands out is that even with high-quality past earnings, the sudden downshift challenges assumptions that Kyokuyo can always deliver stable profit expansion.

- The consensus narrative points out the company is seen as resilient, but the loss of momentum means cautious market participants may choose to wait for clearer signs of a turnaround.

- This reversal underlines a neutral to slightly positive market mood. The absence of aggressive growth drivers is counterbalanced by the company’s reputation for consistency.

Attractive P/E Hides Fair Value Gap

- Shares trade at a Price-To-Earnings Ratio of 8.9x versus an industry average above 15x. However, the current share price of ¥4,515 levels out at over 2.6x the DCF fair value of ¥1,713.49, revealing a significant disconnect for value-focused investors.

- The broader analysis suggests good value on a relative basis but little genuine bargain when measured against intrinsic worth. Investors appreciate the low P/E but remain cautious given the sizable premium above DCF fair value.

- Such tension results in the notion that although the stock looks cheap by peer standards, market participants may hesitate since upside could be limited unless new catalysts justify the valuation gap.

- This aligns with the prevailing market view that stability is rewarded, but true re-rating may not occur absent fresh strategic developments.

Profitability Questions Raise Caution on Financial Position

- Net profit margin slipped from 2.4% last year to 1.9% now, signaling that recent profitability is under more pressure than before.

- In prevailing market discussions, critics highlight how thinner margins paired with flagged financial position and dividend sustainability risks feed investor caution. It has become clear that even defensive stocks like Kyokuyo are not immune to deeper financial scrutiny.

- The focus is not just on operational resilience but also on whether the balance sheet can support ongoing payouts.

- This caution echoes across sector trends, especially for companies in stable industries that nonetheless must manage margin headwinds.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kyokuyo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kyokuyo faces valuation concerns, with shares trading well above fair value. Recent profitability pressure also raises questions about sustainable long-term returns.

If you want to uncover companies trading at more attractive prices relative to their fundamentals, compare opportunities with these 841 undervalued stocks based on cash flows that better align with value-driven investors’ goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyokuyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1301

Kyokuyo

Engages in the marine products, fresh foods, processed food, and logistics businesses in Japan and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives