- Japan

- /

- Oil and Gas

- /

- TSE:8133

Evaluating Itochu Enex (TSE:8133) Valuation Following Its Latest Dividend Increase

Reviewed by Simply Wall St

Itochu Enex Ltd (TSE:8133) just revealed a boost to its second quarter-end dividend, increasing it to JPY 31 per share compared with JPY 28 a year ago. The change takes effect with payments set for December 5, 2025.

See our latest analysis for Itochu EnexLtd.

That dividend hike comes after a strong run for Itochu EnexLtd. Despite some recent volatility, including a challenging last quarter, the stock’s total shareholder return stands at 15.2% over the past year and a remarkable 130.6% over five years. This suggests positive long-term momentum may be building as confidence grows around its strategy.

If news of Itochu EnexLtd’s progress has you scanning for more opportunities, why not see what else is out there and discover fast growing stocks with high insider ownership

With such a strong track record and a higher payout, investors may wonder: Is Itochu EnexLtd still trading below its intrinsic value, presenting a compelling entry point? Or is the market already anticipating further gains ahead?

Price-to-Earnings of 12.7x: Is it justified?

At a price-to-earnings ratio of 12.7x, Itochu EnexLtd’s shares are trading at a notable discount compared to both peer and industry averages. This suggests the market may be overlooking its earnings strength.

The price-to-earnings (P/E) ratio helps investors measure how much they are paying for each yen of current earnings. It is a common benchmark for evaluating profitability, especially in established industries like oil and gas.

This level indicates the stock could be undervalued relative to expected profits since the current multiple is well below the average for similar companies. The implication is that the market’s expectations may be more pessimistic than recent performance suggests.

Looking at peers, Itochu EnexLtd’s P/E of 12.7x is lower than the average peer multiple of 17x and below the Asian Oil and Gas sector mean of 13.4x. This strengthens the case for value. If the market adjusts its view on earnings quality or growth outlook, there is potential for the multiple to move closer to these benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.7x (UNDERVALUED)

However, any weakening in Oil and Gas sector demand or a downturn in Itochu EnexLtd’s earnings could quickly change the value story.

Find out about the key risks to this Itochu EnexLtd narrative.

Another Perspective: The SWS DCF Model

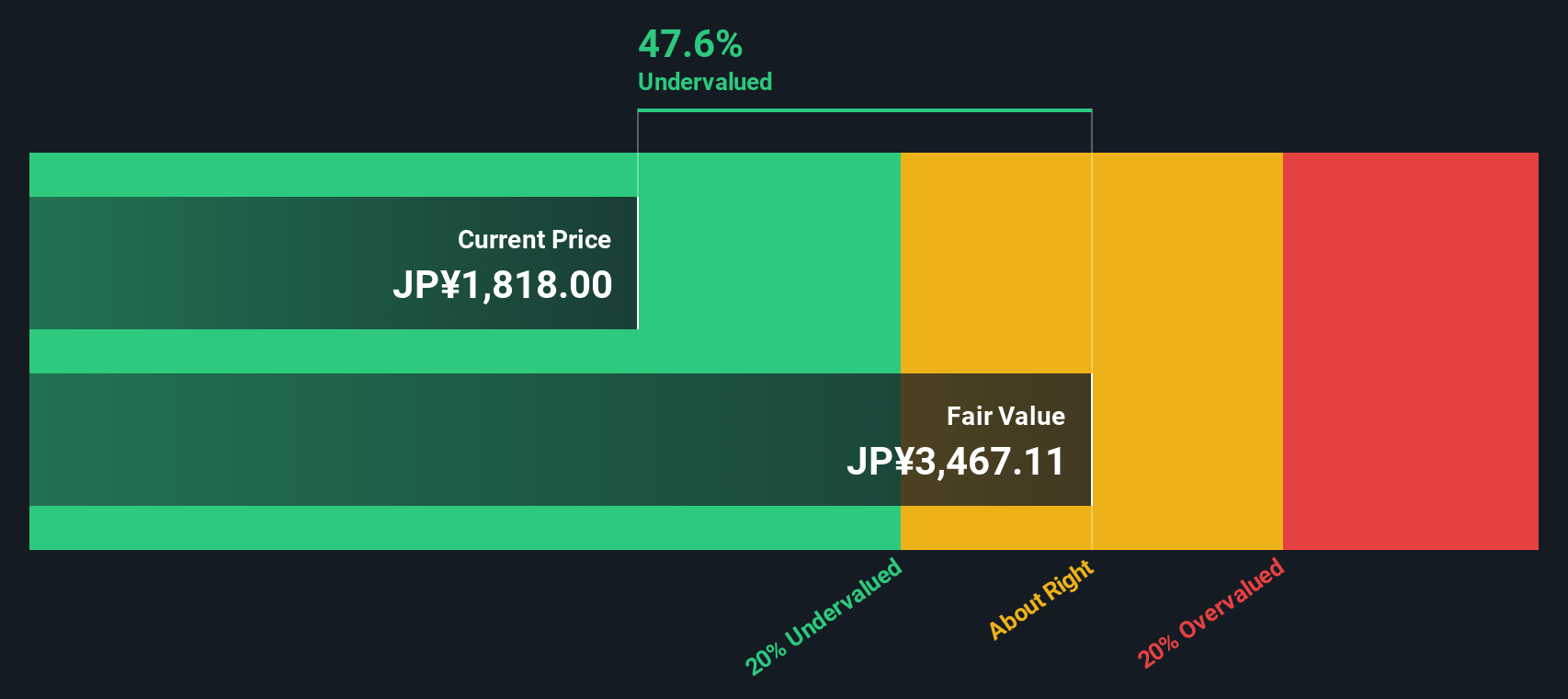

While the current price-to-earnings ratio points to undervaluation, the SWS DCF model offers another lens. Our DCF estimate places Itochu EnexLtd’s fair value at ¥3,467.11, nearly double the current share price of ¥1,818. This suggests the stock could be even more undervalued than multiples alone imply. However, do DCF assumptions truly capture future potential, or does the market know something that models cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Itochu EnexLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Itochu EnexLtd Narrative

If you want to dig deeper or chart a different course, you can examine the numbers yourself and shape your personal view in just a few minutes, then Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Itochu EnexLtd.

Looking for More Ways to Grow Your Portfolio?

The market does not wait for anyone, so now is the perfect time to catch the next opportunity. Make your money work harder with smarter, more targeted investments using these ideas:

- Capture high yields and stable returns with these 16 dividend stocks with yields > 3%, which offers superior income potential and above-average payout ratios.

- Unlock tomorrow’s potential by checking out these 24 AI penny stocks, positioned at the forefront of artificial intelligence and automation breakthroughs.

- Safeguard your capital and find true bargains through these 870 undervalued stocks based on cash flows, which highlights companies trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8133

Itochu EnexLtd

Engages in the sale of petroleum products and liquefied petroleum gas (LPG), electricity, heat supply, vehicle sales in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives