- Japan

- /

- Oil and Gas

- /

- TSE:1662

A Look at Japan Petroleum Exploration’s (TSE:1662) Valuation Following Upgraded Earnings Guidance and Stronger Energy Prices

Reviewed by Simply Wall St

Japan Petroleum Exploration (TSE:1662) caught the market’s attention by raising its earnings guidance for the fiscal year ending March 2026, attributing the upgrade to stronger crude oil and natural gas sales prices.

See our latest analysis for Japan Petroleum Exploration.

After announcing its upgraded earnings outlook, Japan Petroleum Exploration has seen positive momentum, with a 1-day share price return of 1.31% and a notable 16.26% gain over the past 90 days. Looking longer term, shareholders have enjoyed a 33.96% total return over the past year, and the five-year total return is an impressive 400.03%. This reflects sustained value creation amid periodic shifts in energy market sentiment.

If this strong run has you curious about what else could be on the move, now’s an ideal time to discover fast growing stocks with high insider ownership

But with shares rallying and the company setting a higher bar for future results, investors may be wondering if Japan Petroleum Exploration is still undervalued or if the market is already factoring in all expected growth.

Price-to-Earnings of 4.1: Is it justified?

Japan Petroleum Exploration’s shares trade at a price-to-earnings (P/E) ratio of just 4.1, notably below both its industry peers and the current market price, signaling that the company may be undervalued.

The price-to-earnings ratio, or P/E, compares a company's stock price to its earnings per share. For an energy business like this, the P/E reveals how the market values current profits relative to other players.

With a P/E of 4.1, the market is pricing Japan Petroleum Exploration well below the Asian Oil and Gas industry average of 13.2 as well as the company’s closest peers at 10.2. This sharp discount is also apparent when compared to its estimated fair ratio of 8.2, which could indicate the market may reassess its stance if earnings resilience continues.

Explore the SWS fair ratio for Japan Petroleum Exploration

Result: Price-to-Earnings of 4.1 (UNDERVALUED)

However, slowing annual revenue and net income growth could challenge the company’s undervaluation story if market conditions or energy prices soften further.

Find out about the key risks to this Japan Petroleum Exploration narrative.

Another View: Discounted Cash Flow Perspective

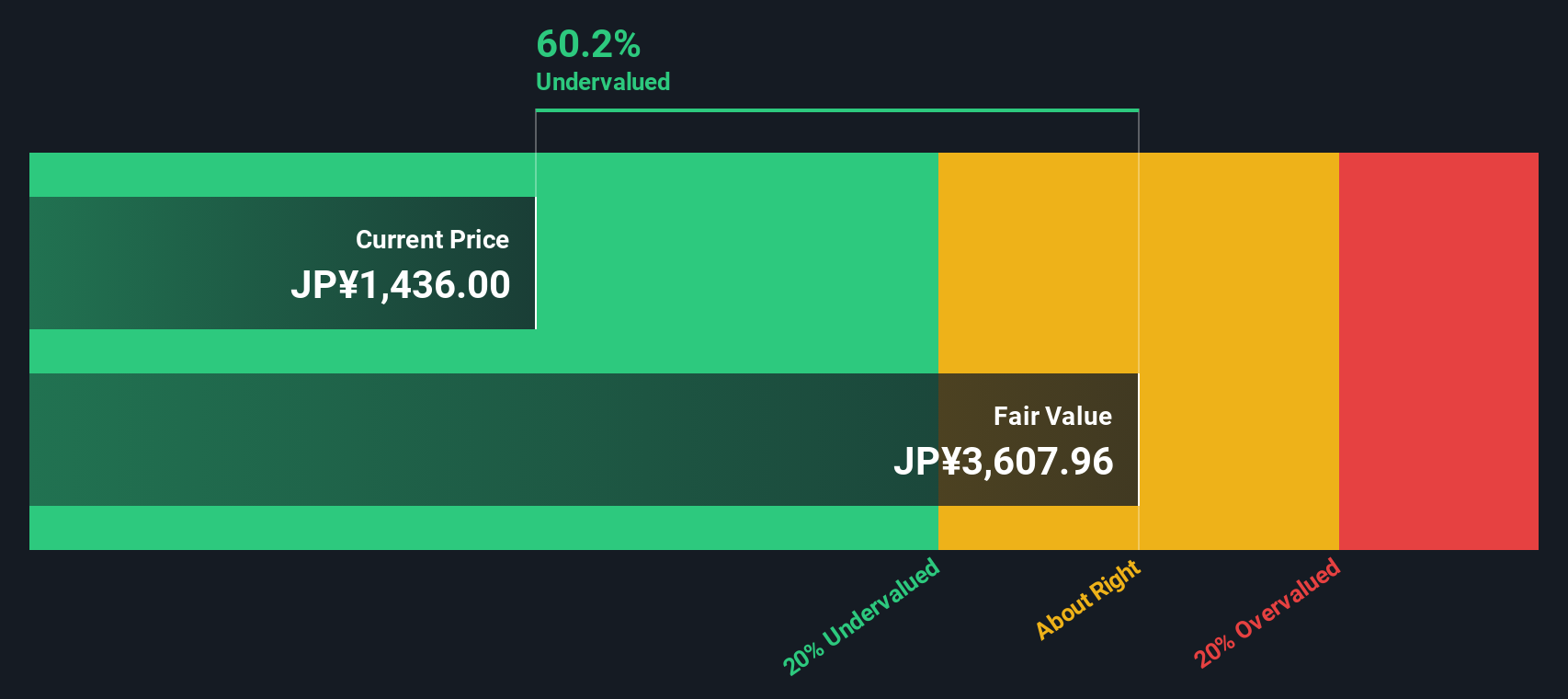

While the low price-to-earnings ratio hints the shares are undervalued, our SWS DCF model offers an even more pronounced outlook. It estimates Japan Petroleum Exploration is trading at a steep 61.4% discount to its fair value, suggesting there could be far greater upside than the market currently reflects. Could this be a signal that sentiment is leaving money on the table?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Petroleum Exploration for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Petroleum Exploration Narrative

Keep in mind, if you have a different perspective or want to see the numbers for yourself, it’s easy to create your own view of the story in just a few minutes, so why not Do it your way

A great starting point for your Japan Petroleum Exploration research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunity is always knocking in the markets, but finding the best stock ideas takes the right tools. Set yourself up to make smarter moves with strategies and filters designed for active investors on Simply Wall St.

- Unearth powerhouses transforming healthcare by checking out these 30 healthcare AI stocks, where you can find high-potential AI-driven medical companies at the forefront of the industry.

- Capture strong yields that can help boost your portfolio by evaluating these 14 dividend stocks with yields > 3%, featuring top-paying stocks with steady dividend histories.

- Capitalize on undervalued market opportunities now by reviewing these 924 undervalued stocks based on cash flows, which uses cash flow insights to highlight stocks that may be poised for future gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1662

Japan Petroleum Exploration

Explores, develops, produces, and sells oil, natural gas, and other energy resources in Japan, Europe, North America, and the Middle East.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success