- Japan

- /

- Diversified Financial

- /

- TSE:8793

NEC Capital Solutions (TSE:8793) Margin Squeeze Challenges Defensive Profit Growth Narrative

Reviewed by Simply Wall St

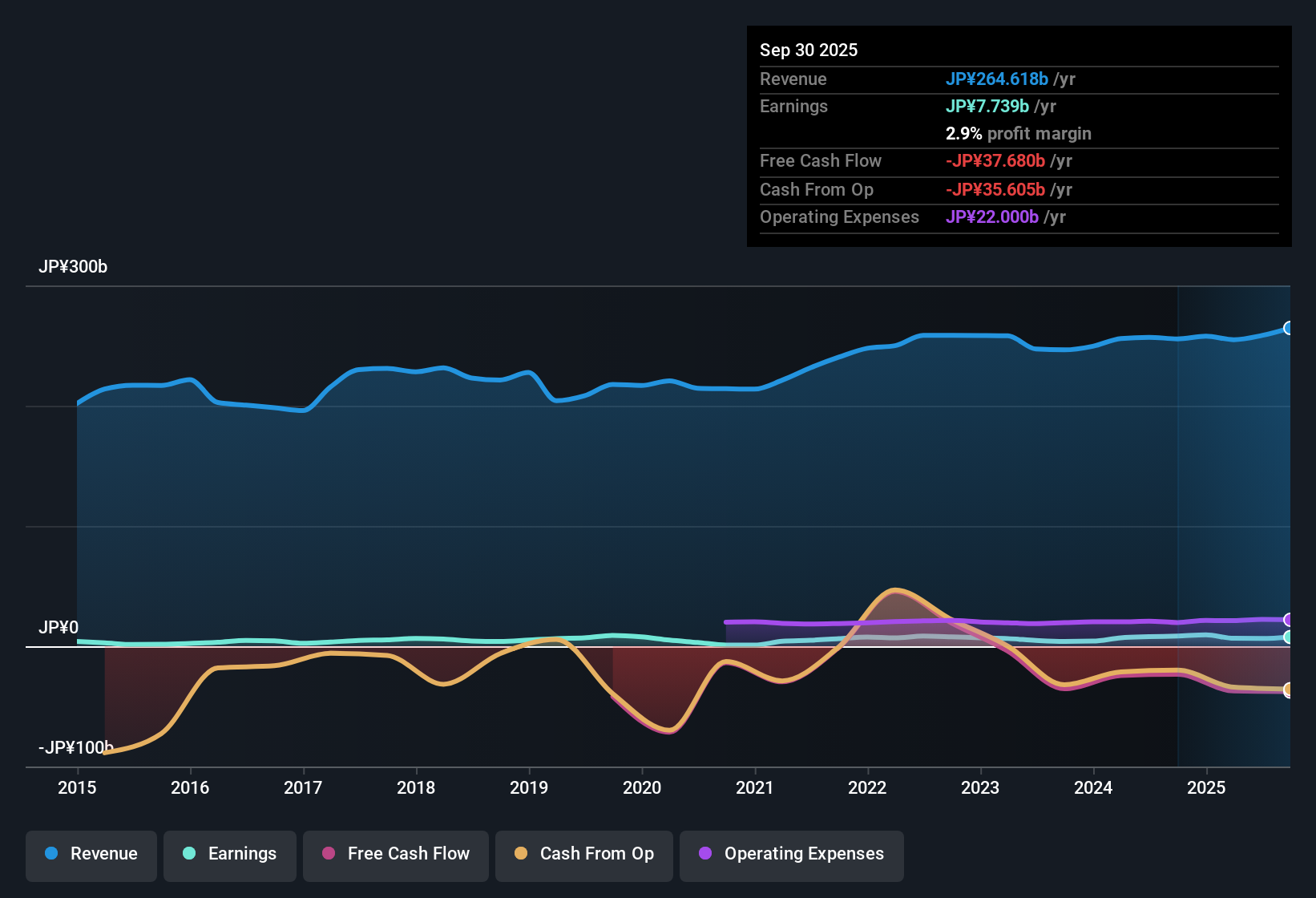

NEC Capital Solutions (TSE:8793) posted a negative year-on-year earnings result, as net profit margin slipped from 3.3% last year to 2.9% most recently. Over the past five years, the company has delivered an average annual earnings growth rate of 13.6%. However, the latest results mark a break from that trend. With high-quality earnings but shrinking margins, investors are weighing the company’s strong history of profit growth against a more challenging near-term outlook.

See our full analysis for NEC Capital Solutions.Next, we will weigh these results against the broader narratives shaping the outlook for NEC Capital Solutions to see which stories hold up and which ones might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Valuation Gap: Shares Trade at 30% Discount to DCF Fair Value

- NEC Capital Solutions' current share price of ¥3,810 is around 30% below its DCF fair value estimate of ¥5,405.90, and its price-to-earnings ratio sits at 10.6x versus a diversified financials industry average of 12.3x.

- Despite the attractive discount, analysis shows investors are balancing the historically strong profit growth with evidence of margin compression and a year of negative growth.

- The company is priced well below peers, which makes the value story stand out, but the lower net profit margin of 2.9% compared to 3.3% last year tempers bullish conviction.

- This valuation sets the stage for stable, income-oriented investors. However, recent profitability declines mean buyers should watch for a turnaround in margins before expecting a rerating.

- With both a lower P/E multiple than the market and a sizable valuation gap to its intrinsic value, NEC Capital Solutions offers a value opportunity. Yet, recent margin trends reinforce the need to keep an eye on operating performance.

- For a deeper dive into how this valuation lines up against the company's potential and market expectations, see what the numbers say in the consensus narrative.

📊 Read the full NEC Capital Solutions Consensus Narrative.

Profit Growth Trend Outpaces Sector but Momentum Slows

- Five-year average annual earnings growth is 13.6%, a pace that surpasses many peers, but the most recent year broke this trend with negative growth.

- Still, analysis underscores that NEC Capital Solutions is seen as a steady, reliable player in a mature sector. Recent operating results affirm this reputation, though future optimism hinges on a return to historical growth rates.

- What stands out is the high quality of past earnings, which bolsters trust for long-term holders even as near-term numbers disappoint.

- This backdrop appeals to investors focused on income and defensive positioning, given the company’s consistently stable performance over multiple years.

Margins Narrow: Profitability Faces Near-Term Constraints

- Net profit margin shrank from 3.3% to 2.9% year on year, marking a notable squeeze that contrasts with the company’s reputation for high quality earnings.

- Market watchers recognize NEC Capital Solutions remains a low-volatility, defensive pick. However, the immediate challenge is clear: profitability gains may be subdued unless margin pressures ease in coming periods.

- The declining margin both limits upside and reinforces perception as a stable, downside-protected holding rather than a sudden growth story.

- Despite its operational strengths and sector maturity, the investment thesis now rides on the company successfully managing or reversing this margin compression.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NEC Capital Solutions's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite NEC Capital Solutions’ remarkable long-term growth, recent shrinking margins and a break in its steady profit trend raise questions about sustained momentum.

If consistent earnings and reliable expansion matter most to you, consider focusing on companies that continue to perform year after year with stable growth stocks screener (2093 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC Capital Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8793

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives