- Japan

- /

- Capital Markets

- /

- TSE:8699

HS Holdings (TSE:8699) Net Profit Margin Rises to 32%, Challenging Undervaluation Narrative

Reviewed by Simply Wall St

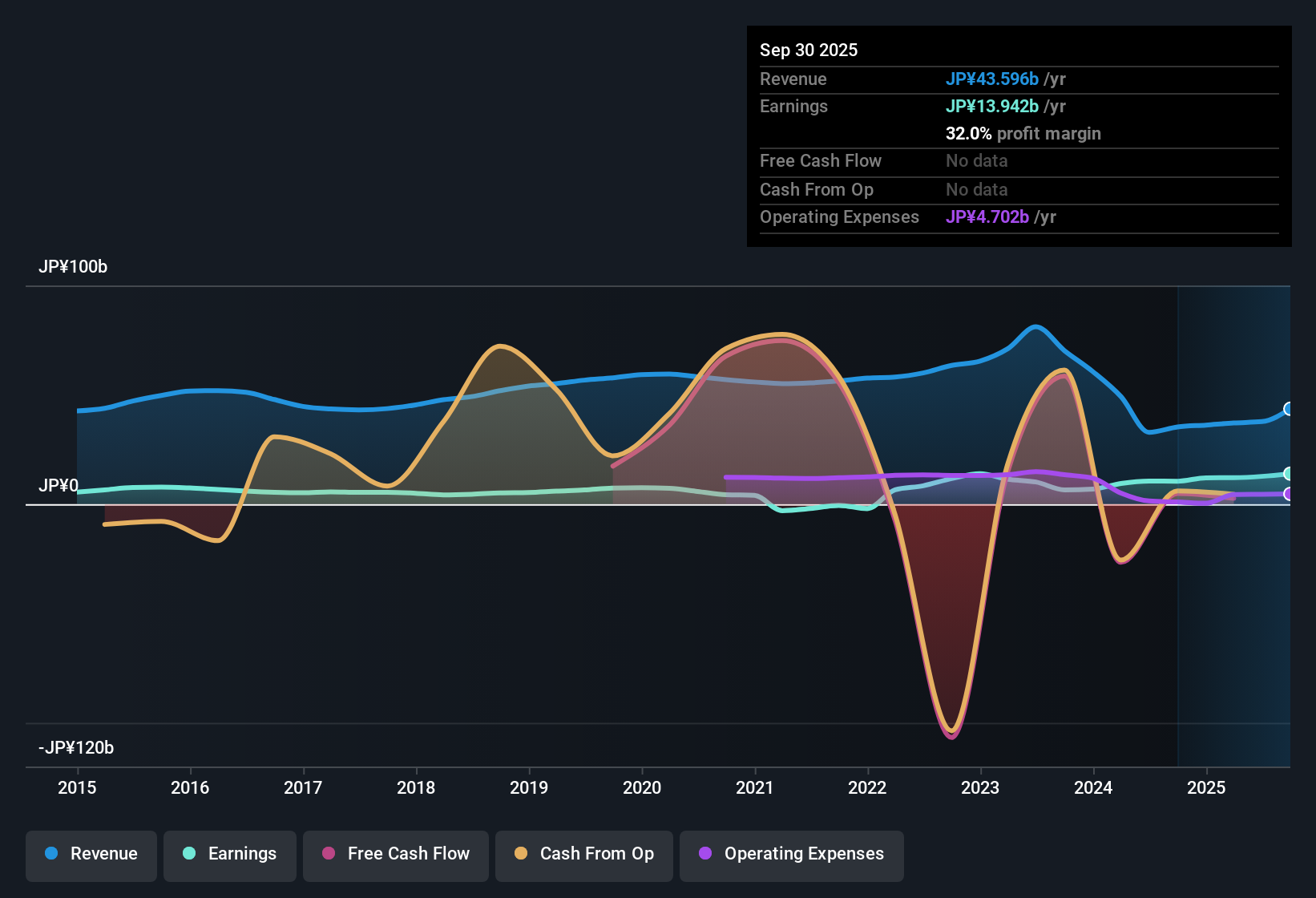

HS Holdings (TSE:8699) posted a net profit margin of 32%, up from last year’s 29.6%. Earnings have grown at an annual rate of 32.6% over the past five years and 33.4% in the most recent year. The stock trades at a Price-to-Earnings Ratio of 2.2x, which is notably lower than both its peer average of 14.7x and the JP Capital Markets industry average of 16.1x. The current share price sits below the estimated fair value of ¥6,072.71. These numbers highlight a trend of rising profitability and an attractive valuation relative to peers, capturing investor attention without any material risks reported.

See our full analysis for HS Holdings.The real question is how these headline numbers stack up against the widely discussed narratives. Some beliefs may be confirmed, while others could be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Profit Growth Stays Strong at 32.6%

- HS Holdings achieved a 32.6% annual growth rate in its earnings over the past five years, with last year's rate slightly higher at 33.4%. This demonstrates that long-term expansion is not just a short-term spike.

- High double-digit earnings growth heavily supports optimism around the company's future, as ongoing margin improvement and consistent profit expansion anchor the positive case.

- Sustained profitability gains at this scale reinforce confidence that growth may be more durable than a one-off, especially since margins improved in tandem with the earnings run-rate.

- It is rare to see a firm combine strong margin trends with high compound growth, which sets up a favorable context for ongoing performance.

P/E Ratio of 2.2x Signals Deep Discount

- The stock is currently trading at a Price-to-Earnings Ratio of 2.2x, far below both its peer average of 14.7x and the broader JP Capital Markets industry average of 16.1x.

- What stands out is how this low valuation multiple challenges typical market skepticism about overheating or overpriced growth stocks.

- Trading at such a steep discount to both sector and peer averages, the share price suggests that the market is not rewarding the company for its exceptional growth and margin improvement. This may be due to industry context or overlooked fundamentals.

- For investors who focus on value, this pricing gap relative to sector norms strengthens the investment case, particularly as no material risks are flagged and profit margins have improved at the same time.

Share Price Still Trails DCF Fair Value

- With the current share price at ¥1,003.00 and the DCF fair value estimated at ¥6,072.71, the discount between where the stock trades and where valuation models place it is notable.

- This is significant because the share price lag not only suggests potential upside but also raises the possibility that positive news is not fully reflected yet.

- A fair value gap of this size is uncommon alongside high and improving margins plus a favorable rewards profile, which hints that the market may be behind in recognizing HS Holdings’ performance.

- For investors seeking hidden value, the combination of sizable earnings growth, robust profit margins, and a substantial fair value gap is difficult to overlook.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on HS Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid earnings growth and a strong profit margin, the low share price may indicate the market is overlooking the company or undervaluing its consistent performance.

Want to focus on companies where sustained profit and steady growth are clearly recognized? Use stable growth stocks screener (2094 results) to target those proving their reliability across unpredictable markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HS Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8699

HS Holdings

Provides merger and acquisition intermediary services in Japan.

Excellent balance sheet and good value.

Market Insights

Community Narratives