- Japan

- /

- Capital Markets

- /

- TSE:8698

Monex Group, Inc. (TSE:8698) Not Lagging Industry On Growth Or Pricing

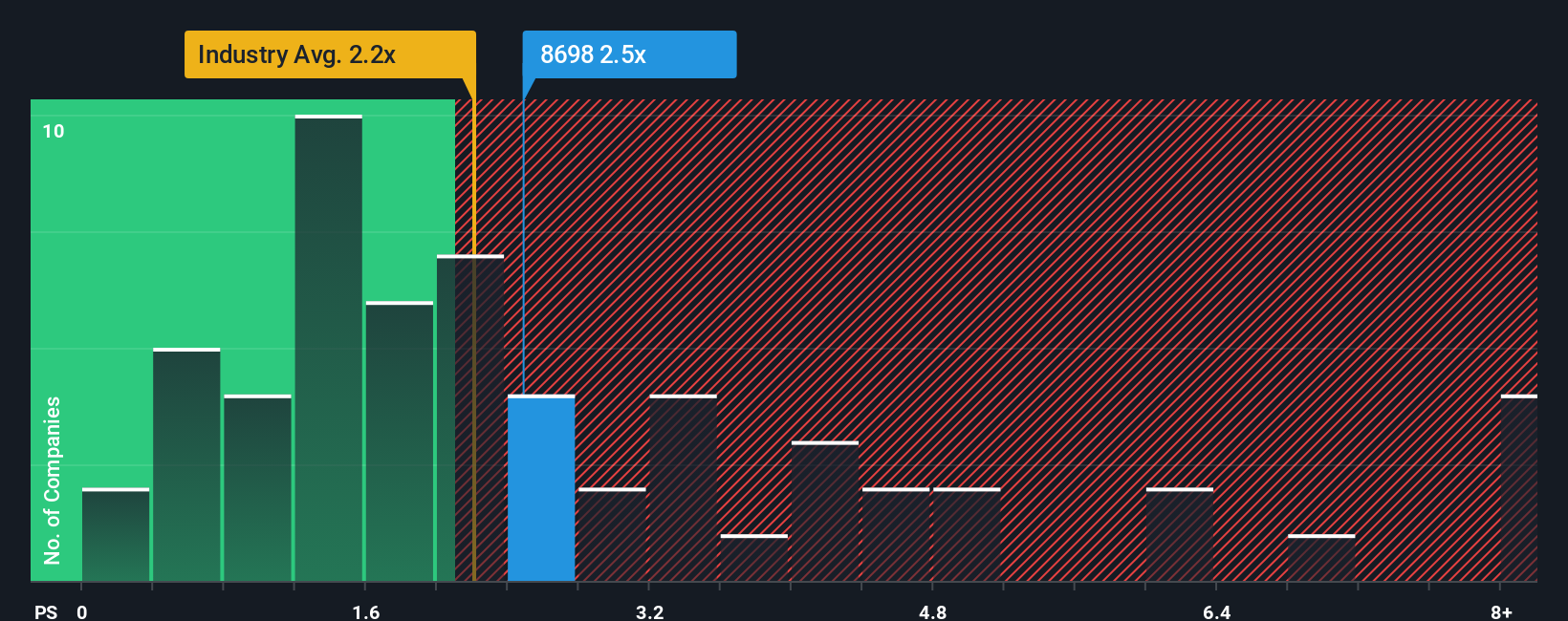

There wouldn't be many who think Monex Group, Inc.'s (TSE:8698) price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S for the Capital Markets industry in Japan is similar at about 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Monex Group

How Monex Group Has Been Performing

Recent times have been advantageous for Monex Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Monex Group.How Is Monex Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Monex Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Still, revenue has fallen 8.4% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 1.1% during the coming year according to the three analysts following the company. Although, this is simply shaping up to be in line with the broader industry, which is also set to decline 2.3%.

With this in consideration, it's clear to see why Monex Group's P/S stacks up closely with its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From Monex Group's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, we see that Monex Group maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Monex Group that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8698

Monex Group

An online financial institution, provides retail online brokerage services.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives