- Japan

- /

- Capital Markets

- /

- TSE:8697

Japan Exchange Group (TSE:8697) Margin Decline Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

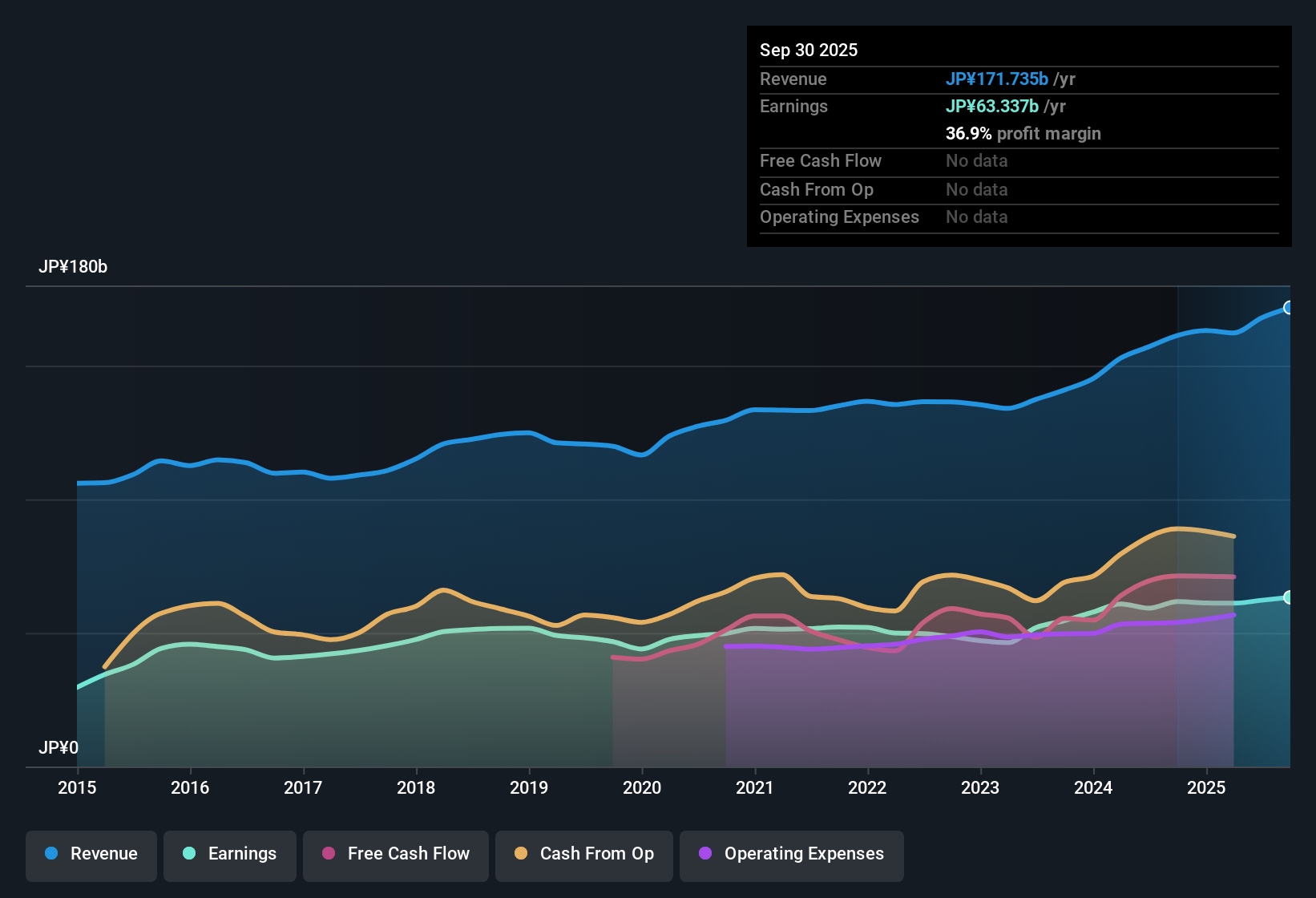

Japan Exchange Group (TSE:8697) reported net profit margins of 36.9% this year, down from 38.3% the previous year. Over the past twelve months, earnings grew by 2.7%, trailing the company’s five-year average annual growth rate of 5.3%. Looking forward, earnings and revenue growth are both expected to remain slower than the broader Japanese market averages. The current price-to-earnings ratio of 28x indicates a valuation premium over peers. With net profits trending upward but at a modest pace, and valuation factors coming into focus, investors may find the landscape nuanced as earnings season unfolds.

See our full analysis for Japan Exchange Group.Now that we have the headline numbers, let’s see how they match up with the key narratives investors are watching this season. This is also where opinions might diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Pressure Despite High Quality Profits

- Current net profit margins are 36.9%, a drop from last year’s 38.3%. This signals that while profitability remains strong, margins are trending lower compared to the prior period.

- Bulls highlight how the company’s reputation for high earnings quality secures its place among leading global exchanges. However, the softening margin adds nuance:

- Momentum in modernizing trading infrastructure and consistent revenue from high trading volumes are positives frequently cited by optimistic investors.

- Still, the downward margin trend suggests JPX may not capture the same scale of upside as peers if sector growth accelerates further this year.

Growth Lagging Behind Market Peers

- JPX’s earnings are forecast to grow just 2.3% per year and revenue at 2.7% per year, both well below the Japanese market averages of 7.9% and 4.5% respectively.

- Prevailing narrative sees the company as a reliable “picks-and-shovels” play in a buoyant equity market, but these muted growth rates challenge claims of outsized upside:

- Institutional and retail enthusiasm for stable revenue streams may cushion sentiment, even as headline growth underperforms the broader market.

- Expectations for meaningful acceleration rest heavily on broader market conditions, not on JPX’s organic drivers or innovation pace.

Valuation Premium Signals Heightened Expectations

- The price-to-earnings ratio of 28x stands well above both industry and peer averages, while the current share price of 1,724.00 is also above the DCF fair value estimate of 964.25.

- This valuation gap heavily supports the view that investors are pricing in continued operational strength, but also increases vulnerability if profit growth stalls:

- Compared to other Japanese exchanges, the company’s market price points toward high market conviction in its systemically important role and steady business profile.

- However, the limited expected earnings growth means deliverables must remain solid to justify this premium over time.

See our latest analysis for Japan Exchange Group.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Exchange Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Japan Exchange Group commands strong margins but faces sluggish earnings growth and a rich valuation, which limits significant upside compared to faster-growing peers.

If you want greater potential for robust expansion, focus on high growth potential stocks screener (57 results) to discover established companies forecast to deliver far stronger earnings growth ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8697

Japan Exchange Group

Operates as a financial instruments exchange holding company in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives