- Japan

- /

- Capital Markets

- /

- TSE:8628

Strong Half-Year Results and Higher Dividend Could Be a Game Changer for Matsui Securities (TSE:8628)

Reviewed by Sasha Jovanovic

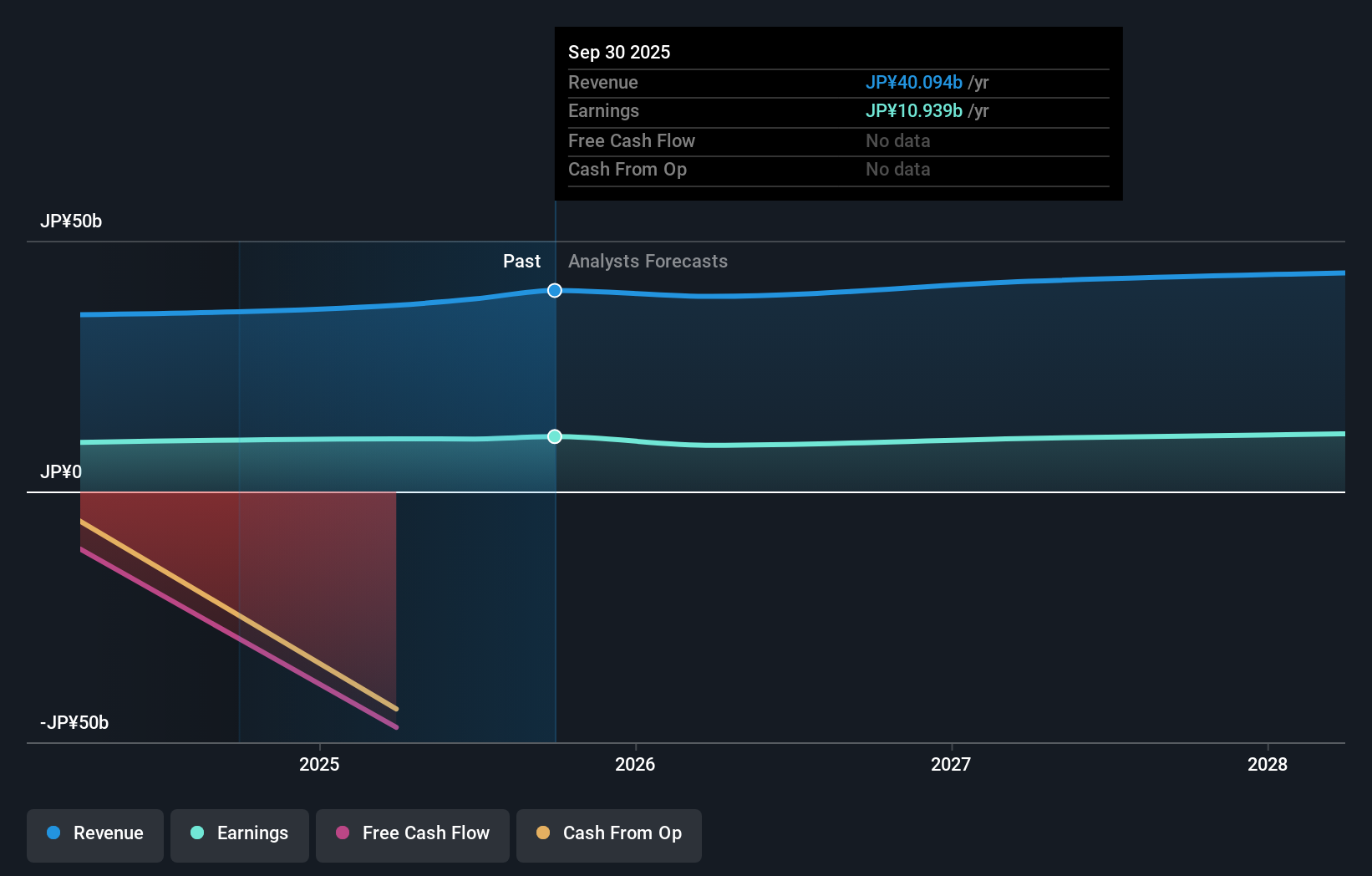

- Matsui Securities Co., Ltd. recently reported its half-year results, showing a 17.5% increase in operating revenue and a rise in net profit to ¥6.54 billion for the six months ended September 30, 2025, compared to the prior year.

- The company's interim dividend announcement of ¥25.00 per share, up from ¥22.00 last year, highlights its commitment to shareholder returns amid ongoing financial growth.

- With new dividend levels reflecting improved financial performance, we'll explore how Matsui Securities' earnings momentum shapes its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Matsui Securities' Investment Narrative?

For an investor to own Matsui Securities today, belief in the company’s sustained ability to grow profitably, despite modest industry growth and a premium valuation, is essential. The recent half-year results, with operating revenue up 17.5% and a stronger interim dividend, offer tangible evidence of short-term earnings momentum and management’s focus on returns to shareholders. This upbeat announcement could help offset concerns around Matsui’s removal from key indexes and revenue forecasts that previously suggested only slow expansion relative to the broader Japanese market. The unexpectedly robust net profit and higher dividend may refresh near-term catalysts by attracting renewed attention from retail investors, but persistent risks remain: shares still trade above fair value estimates, and earnings growth rates lag sector and market averages. Whether this recent beat marks a turning point or a brief reprieve is a question current shareholders can’t ignore. On the other hand, index removal is a material factor that shouldn't be overlooked.

Matsui Securities' shares are on the way up, but they could be overextended by 49%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Matsui Securities - why the stock might be a potential multi-bagger!

Build Your Own Matsui Securities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matsui Securities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Matsui Securities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matsui Securities' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8628

Matsui Securities

Provides online securities brokerage services to retail investors in Japan.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives