- Japan

- /

- Capital Markets

- /

- TSE:8601

Daiwa Securities (TSE:8601) Valuation in Focus After Dividend Floor and Higher Interim Payout Announcement

Reviewed by Simply Wall St

Daiwa Securities Group (TSE:8601) just set a floor for its dividend policy by confirming a minimum annual dividend through March 2027. The company also announced a higher interim payout for shareholders this fiscal year.

See our latest analysis for Daiwa Securities Group.

After the dividend policy news, Daiwa Securities Group’s share price has been gaining momentum, climbing 9.5% over the past month and up 21.8% year-to-date. For those taking a longer view, the total shareholder return has soared 31.4% in the past year and an impressive 149% in three years. This signals durable outperformance and renewed confidence following these shareholder-friendly updates.

If you’re curious what’s moving elsewhere too, this is the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

Yet after these shareholder-friendly moves and a powerful run-up in returns, investors may be wondering if Daiwa Securities Group is still undervalued or if the market is already reflecting its growth story. Is there real upside left to capture?

Most Popular Narrative: 7% Overvalued

Daiwa Securities Group's widely followed fair value narrative sits at ¥1,191, while the last close price has pushed up to ¥1,277.5. This gap has triggered debate on what exactly is supporting such an optimistic price, especially given the new dividend floor and recent shareholder payouts.

Ongoing recovery and record-high AUMs in both securities and real estate asset management, along with positive contributions from Global X and alternative investments, indicate effective positioning in high-margin, recurring-fee businesses and product lines benefiting from client adoption of passive investment strategies. This development is expected to structurally improve net margins and earnings resilience.

Curious what’s powering this price? A sweeping story of asset management expansion, high-margin products, and a margin forecast that breaks the mold. Hungry to know which financial levers and headline-grabbing catalysts frame these bold analyst forecasts? Find out what goes into the numbers that rule this fair value debate.

Result: Fair Value of ¥1,191 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as Japan’s aging population and Daiwa’s heavy exposure to its domestic market could limit growth and future earnings resilience.

Find out about the key risks to this Daiwa Securities Group narrative.

Another View: Market Multiples Tell a Different Story

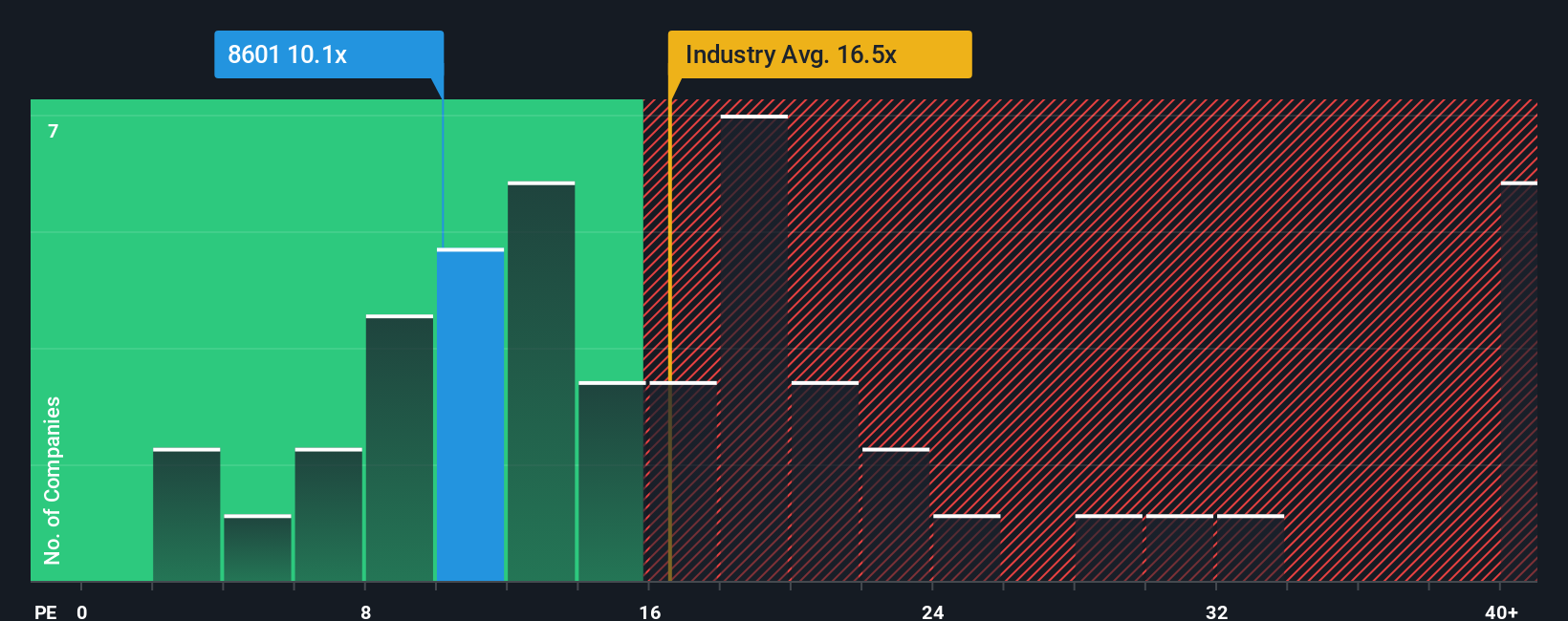

Taking a look at how the market values Daiwa Securities Group compared to peers, its price-to-earnings ratio stands at 11.3x. This is lower than both the JP Capital Markets industry average of 14x and its peer group at 13.8x, suggesting a relative value advantage. Interestingly, it is also lower than the fair ratio of 16.5x, meaning the market could be undervaluing Daiwa based on this approach.

Still, while current multiples offer an attractive entry point, does it mean the long-term risks and macro headwinds are truly reflected, or is the window for value about to close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daiwa Securities Group Narrative

If you want to challenge the consensus or look deeper on your own terms, it takes less than three minutes to craft your own perspective. Start with Do it your way.

A great starting point for your Daiwa Securities Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for one story when you can unlock countless opportunities? Tap into proven, high-potential ideas you might be overlooking and keep your portfolio ahead of the crowd.

- Uncover tomorrow’s AI leaders by checking out these 25 AI penny stocks, which are setting the pace in automation, data science, and intelligent platforms.

- Accelerate your growth potential with these 858 undervalued stocks based on cash flows that the market may be overlooking, offering compelling long-term upside.

- Secure your future cash flow by targeting these 15 dividend stocks with yields > 3%, known for consistently delivering reliable income and stability for shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8601

Daiwa Securities Group

Operates in the financial and capital markets in Japan and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives