- Japan

- /

- Diversified Financial

- /

- TSE:8593

A Fresh Look at Mitsubishi HC Capital (TSE:8593) Valuation Following Indonesian Energy Efficiency Venture

Reviewed by Simply Wall St

Mitsubishi HC Capital (TSE:8593) has signed a strategic alliance with PT. Amerindo Energy Solutions to develop the Energy Efficiency as a Service market in Indonesia. The company's investment supports growth in energy-saving services and advances its innovation and sustainability goals.

See our latest analysis for Mitsubishi HC Capital.

Mitsubishi HC Capital's latest partnership comes as momentum in its shares continues to build, supported by strong longer-term performance. The stock boasts a share price return of 19% year to date, while the total shareholder return over five years stands at a robust 215%. This reflects investors’ growing confidence in its strategic direction and expanding global reach.

If this kind of international growth story has you curious, it might be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

After such a strong run, investors may wonder if Mitsubishi HC Capital’s current valuation still offers upside. They may also question whether the stock’s recent gains indicate that the market has already priced in the company’s future growth trajectory.

Price-to-Earnings of 11.6x: Is it justified?

At a last close price of ¥1,242, Mitsubishi HC Capital trades at a price-to-earnings (P/E) ratio of 11.6x, representing notably better value than both its industry peers and the wider Japanese market.

The price-to-earnings multiple measures how much investors are willing to pay for each ¥1 of the company's earnings. In diversified financials, this ratio helps gauge market expectations for future profitability and growth potential in a sector where steady earnings are highly valued.

With a P/E ratio of 11.6x, Mitsubishi HC Capital stands out as undervalued compared to its peer group average of 18.3x and the industry average of 12.5x. The stock also looks attractively priced next to an estimated fair P/E of 15.7x, which may indicate room for market re-rating if performance persists.

Explore the SWS fair ratio for Mitsubishi HC Capital

Result: Price-to-Earnings of 11.6x (UNDERVALUED)

However, short-term price swings or any slowdown in earnings growth could quickly challenge the case for Mitsubishi HC Capital’s undervaluation.

Find out about the key risks to this Mitsubishi HC Capital narrative.

Another View: What Does the DCF Model Suggest?

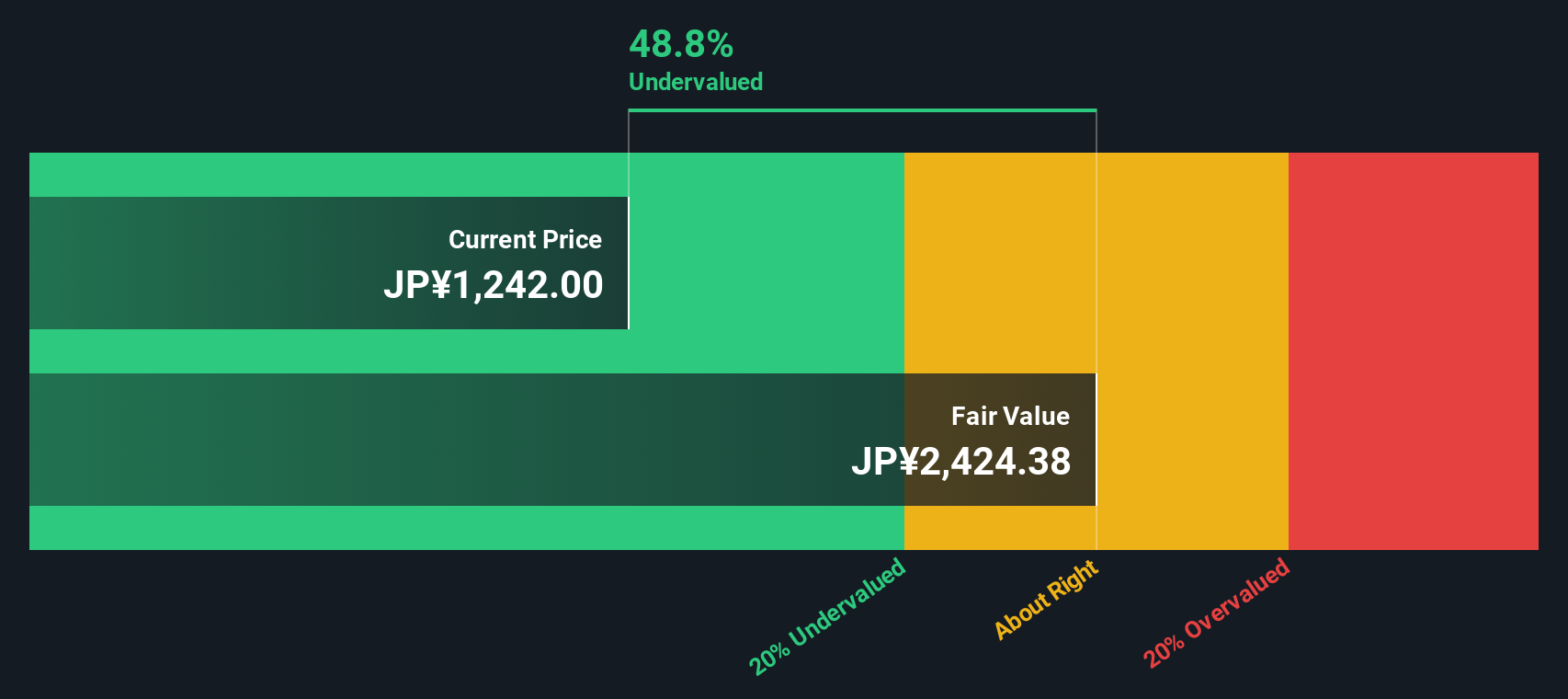

While Mitsubishi HC Capital looks undervalued compared to other stocks based on its earnings multiple, the SWS DCF model paints an even starker picture. According to our DCF model, the shares are trading about 49% below fair value, which points to a potentially substantial upside. But does this large estimated discount factor in enough of the risks, or could the market be missing something big?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi HC Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi HC Capital Narrative

If you want to dig deeper or reach your own conclusions from the data, it takes just a few minutes to craft your own perspective. Do it your way

A great starting point for your Mitsubishi HC Capital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity pass you by. Let Simply Wall Street’s powerful screeners point you toward stocks set to make real waves.

- Unlock outperformers that are trading below their true worth by checking out these 863 undervalued stocks based on cash flows, a screener packed with potential for long-term gains.

- Grow your portfolio’s income stream and stability when you uncover these 16 dividend stocks with yields > 3%, which consistently rewards shareholders with yields above 3%.

- Stay ahead in AI innovation and growth by getting started with these 24 AI penny stocks, featuring companies at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8593

Mitsubishi HC Capital

Engages in the lease, installment sale, and other financing activities in Japan, North America, the United Kingdom, rest of Europe, the Middle and Near East, Asia, Oceania, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives