- Japan

- /

- Diversified Financial

- /

- TSE:7172

Japan Investment Adviser (TSE:7172) Net Margin Jumps to 32.9%, Reinforcing High-Quality Growth Narrative

Reviewed by Simply Wall St

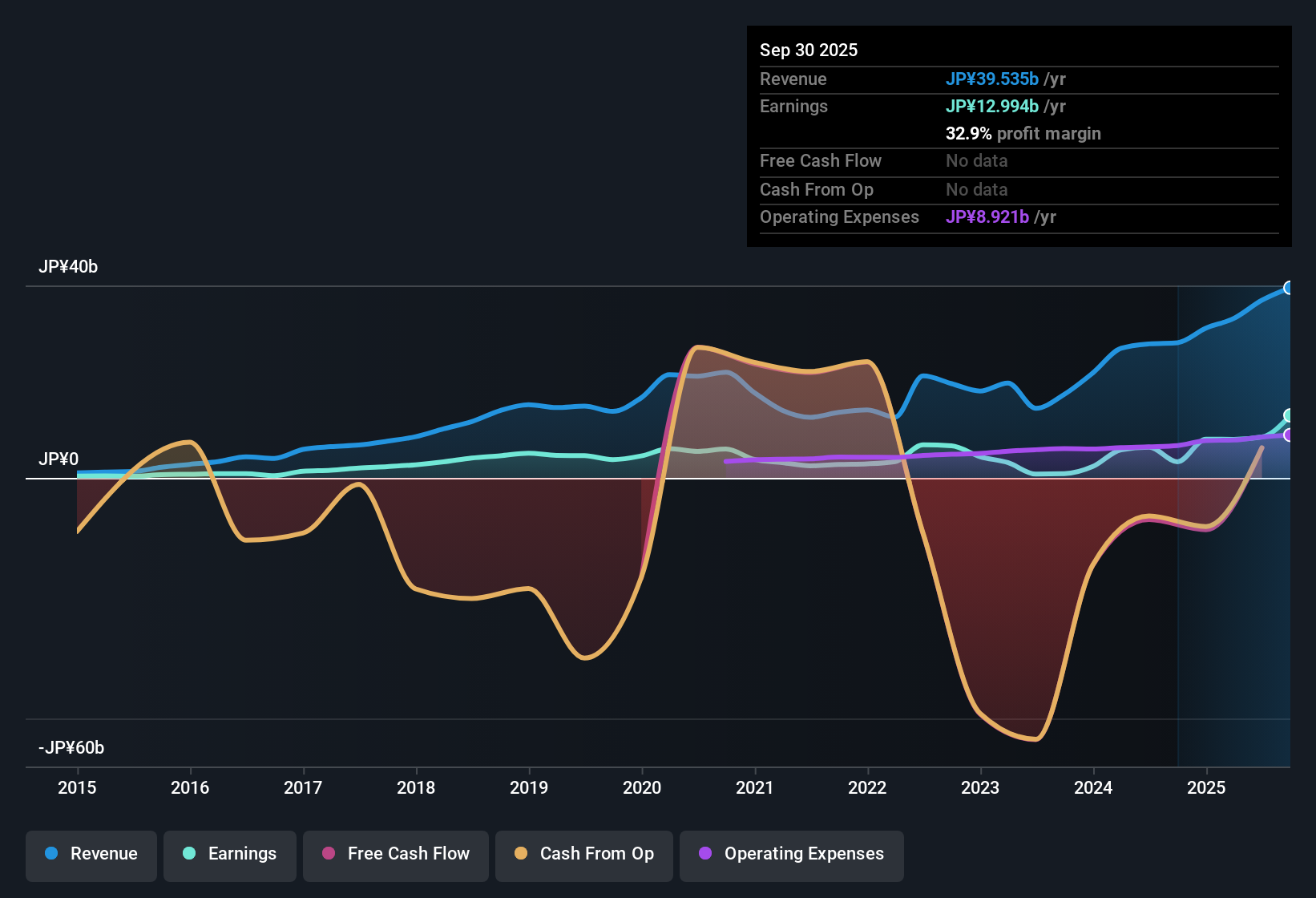

Japan Investment Adviser (TSE:7172) is making headlines with annual revenue forecasted to jump by 31.2% per year, vastly outpacing the Japanese market’s 4.5% average. EPS is expected to climb at a similarly impressive 30.7% rate, while current net profit margins have expanded to 32.9% from 11.9% a year earlier. With annual earnings growth hitting a remarkable 288.1%, significantly higher than the five-year average of 20.3%, these robust results reinforce the company’s high earnings quality and suggest investors are in for a dynamic period of growth.

See our full analysis for Japan Investment Adviser.The next step is to see how these headline numbers compare to the narratives that have taken hold among investors and analysts. Let’s stack up the actual results against the prevailing market stories to see where the consensus holds and where the latest earnings might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Surge Signals Quality Shift

- Net profit margins have climbed to 32.9%, a sharp increase from 11.9% in the previous year, underlining a significant shift in the company's profitability and cost structure.

- This strongly supports the bullish case that Japan Investment Adviser is not only growing its top line, but also improving the quality of its earnings at a remarkable pace.

- The profitability leap from 11.9% to 32.9% aligns closely with bullish narratives around high-quality growth and sets the company apart from typical sector peers.

- With annual earnings growth at 288.1%, far outpacing the five-year average of 20.3%, bullish investors point to this momentum as a sign of sustainable earnings power.

Relative Value Despite Premium Price

- The current share price of ¥1,773 trades above the company’s DCF fair value of ¥1,346.35; however, the price-to-earnings ratio of 8.3x sits well below industry (11.6x) and peer (14.1x) averages, suggesting a discount on earnings-based valuation even as the market assigns a premium to growth.

- It is notable that while the market pushes the share price above DCF fair value, some analysts still view the discounted P/E as a compelling entry point.

- The DCF gap invites caution, but profitability and growth expectations may justify a multiple expansion.

- Peer and industry P/E averages indicate that investors are paying less for each unit of earnings compared to similar companies, which adds nuance to concerns about overvaluation.

Profitability Outpaces Sector Trends

- Revenue is forecasted to grow 31.2% per year, vastly exceeding the broader Japanese market’s projected 4.5% annual growth and positioning Japan Investment Adviser as a clear outlier in terms of top-line expansion.

- This momentum is heavily cited in prevailing market narratives, supporting the view that strong sector tailwinds and company-specific execution may continue to drive outstanding growth.

- With earnings expected to rise at 30.7% annually against the market's 7.8%, analysts highlight that few firms in the sector can match this velocity of expansion.

- The continuous outperformance against sector benchmarks reinforces market conviction that the company will remain a growth leader in Japanese financial services.

- Investors wonder if this trend can continue; see how market leaders view the company's edge. 📊 Read the full Japan Investment Adviser Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Investment Adviser's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Japan Investment Adviser’s impressive growth and profitability, the current share price trades above its DCF fair value. This raises concerns about overvaluation risk, even as the market remains enthusiastic.

For investors seeking stocks that offer stronger value for each dollar invested, check out these 831 undervalued stocks based on cash flows to find opportunities where valuations align more closely with growth prospects and financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7172

Exceptional growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives