- Japan

- /

- Diversified Financial

- /

- TSE:7172

Arata And 2 Other Undiscovered Gems With Strong Financial Health

Reviewed by Simply Wall St

Japan's stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, driven by better-than-expected U.S. economic data and a stronger-than-anticipated expansion in Japan's GDP for the second quarter of the year. This positive sentiment has created an opportune moment to explore lesser-known stocks with robust financial health. In this article, we will highlight three such companies, starting with Arata, that demonstrate strong financial stability and potential for growth amidst current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Arata (TSE:2733)

Simply Wall St Value Rating: ★★★★★★

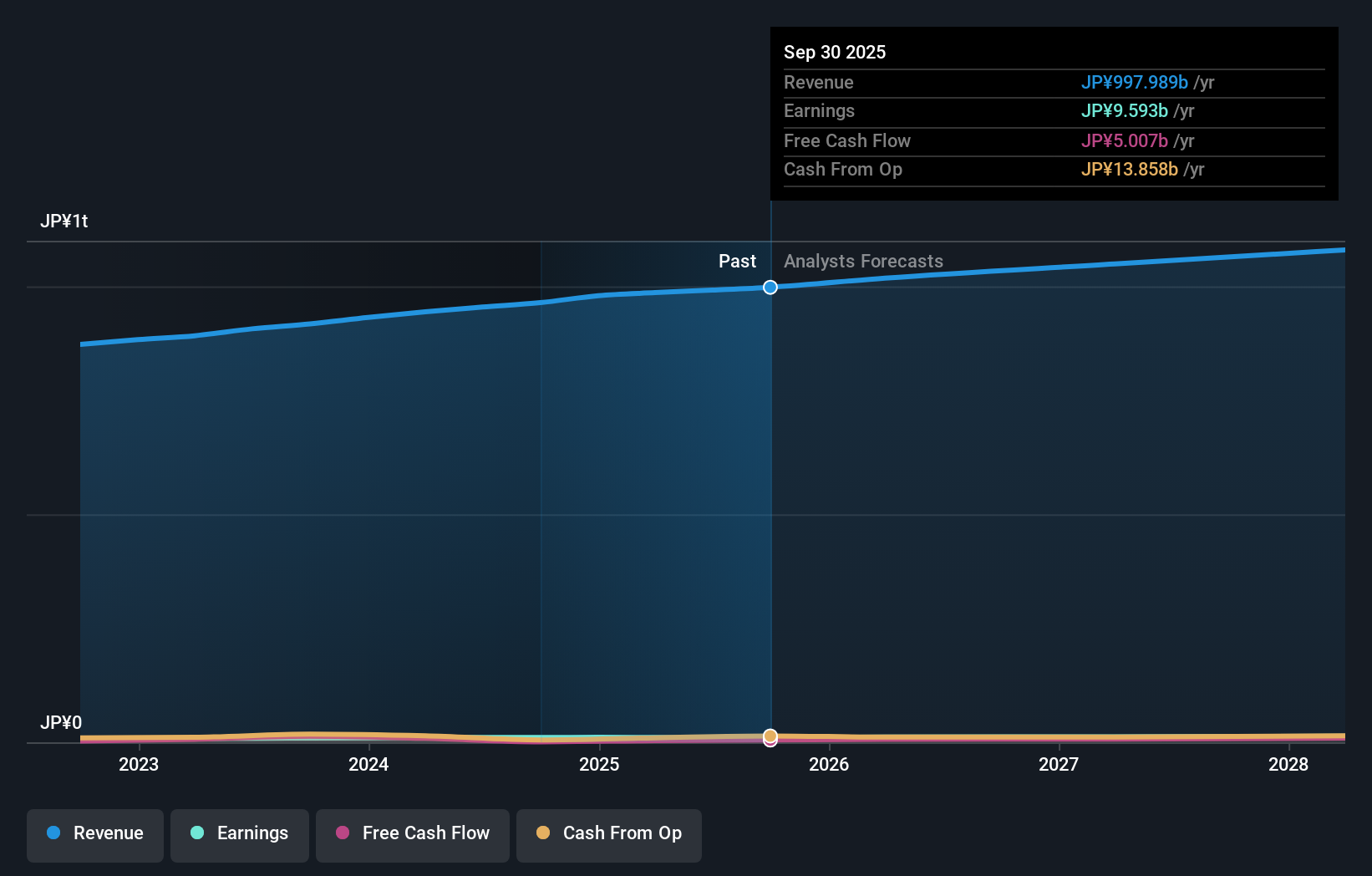

Overview: Arata Corporation is a Japanese company involved in the wholesale distribution of daily goods, cosmetics, household goods, and pet supplies with a market cap of ¥115.46 billion.

Operations: Arata generates revenue primarily from its wholesale business of daily necessities and cosmetics, which totaled ¥944.15 billion.

Earnings growth for Arata over the past year hit 25.5%, significantly outpacing the Retail Distributors industry at 6.9%. The company’s debt to equity ratio has improved from 45.4% to 29.6% in five years, with a net debt to equity ratio of just 4.1%. Trading at 56.1% below its estimated fair value, Arata repurchased 718,600 shares for ¥2.29 billion under its recent buyback program announced in November last year, demonstrating solid financial health and strategic capital management.

Global Security Experts (TSE:4417)

Simply Wall St Value Rating: ★★★★★☆

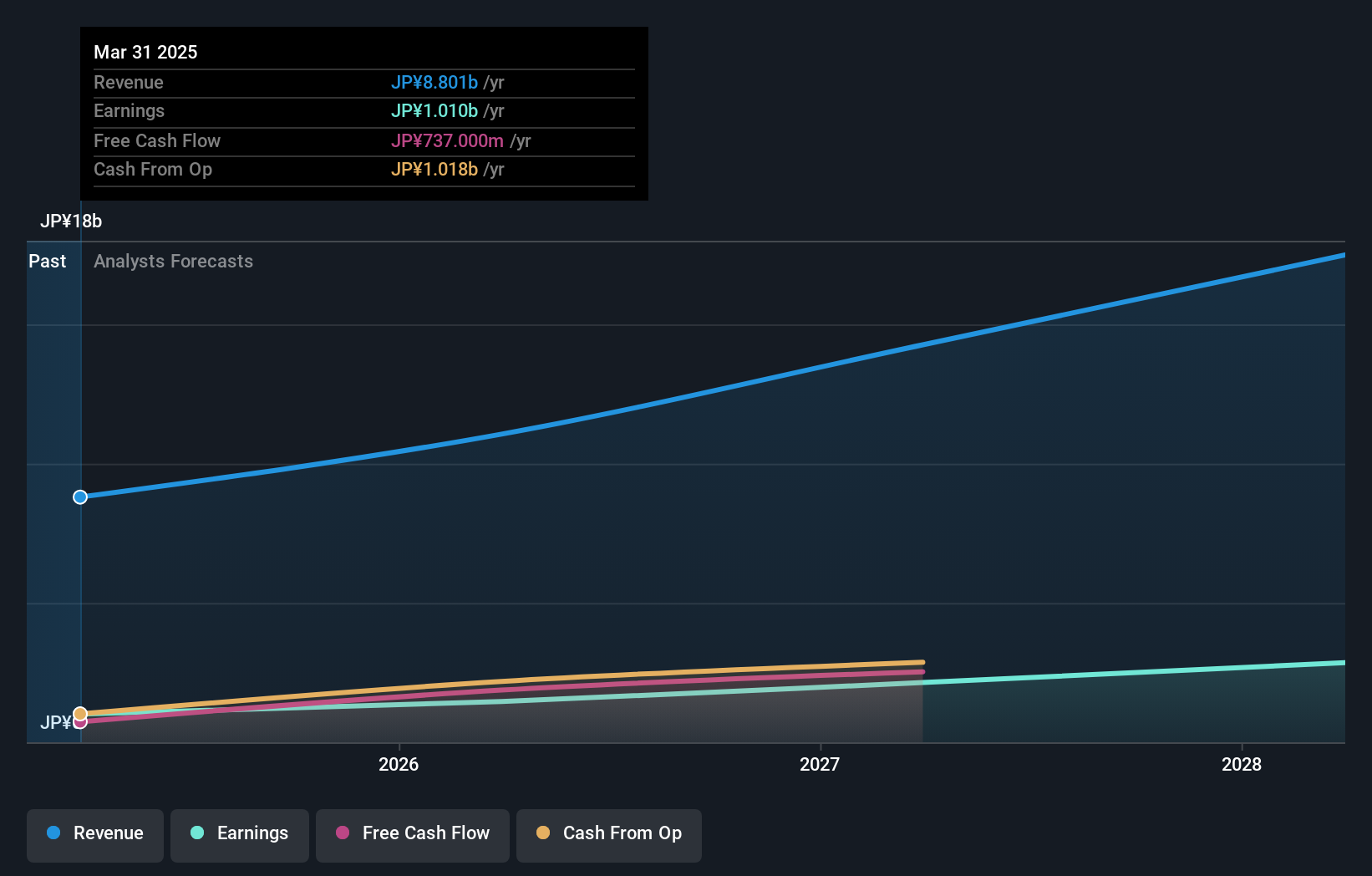

Overview: Global Security Experts Inc. is a cybersecurity education company in Japan with a market cap of ¥41.64 billion.

Operations: Global Security Experts Inc. generates revenue primarily through its cybersecurity education services in Japan. With a market cap of ¥41.64 billion, the company focuses on educational programs and training modules designed to enhance cybersecurity awareness and skills.

Global Security Experts, a small-cap company, has shown impressive growth with earnings increasing by 54.4% over the past year, outpacing the IT industry's 10.1%. The firm’s net debt to equity ratio stands at a satisfactory 21.6%, and its interest payments are well covered by EBIT at 599.5x coverage. Recently, it completed a share repurchase of 47,600 shares for ¥281.32 million, reflecting confidence in its financial health and future prospects.

- Click to explore a detailed breakdown of our findings in Global Security Experts' health report.

Assess Global Security Experts' past performance with our detailed historical performance reports.

Japan Investment Adviser (TSE:7172)

Simply Wall St Value Rating: ★★★★☆☆

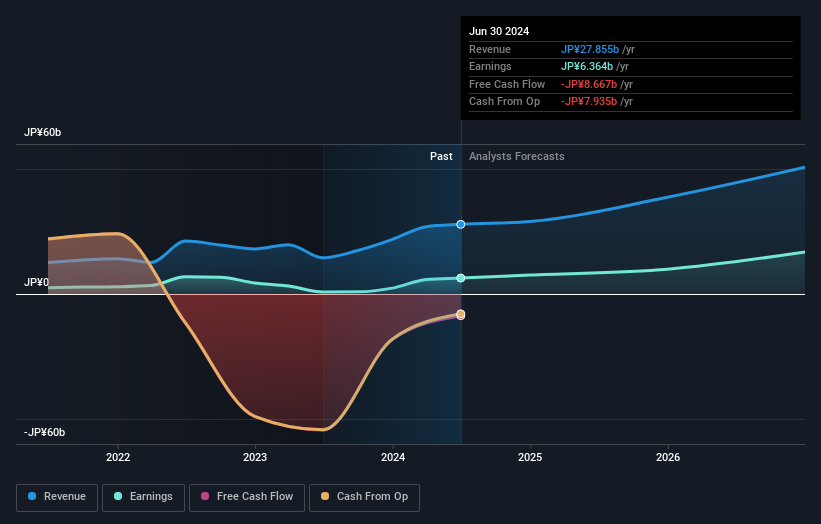

Overview: Japan Investment Adviser Co., Ltd. provides various financial solutions in Japan and has a market cap of ¥67.01 billion.

Operations: The company generates revenue primarily from its Finance Solution segment, which reported ¥27.86 billion.

Japan Investment Adviser has shown significant earnings growth, rising 710.7% over the past year, outpacing the Diversified Financial industry’s 24.9%. Trading at a good value relative to peers and industry, it is currently priced 32.8% below estimated fair value. Despite a high net debt to equity ratio of 158.5%, its interest payments are well covered by EBIT (6.2x). The company repurchased shares in the latest year and forecasts earnings growth of 48.58% annually.

- Take a closer look at Japan Investment Adviser's potential here in our health report.

Evaluate Japan Investment Adviser's historical performance by accessing our past performance report.

Key Takeaways

- Unlock our comprehensive list of 753 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7172

Undervalued with high growth potential.