- Japan

- /

- Capital Markets

- /

- TSE:6196

Strike Company Limited (TSE:6196) Profit Margin Decline Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

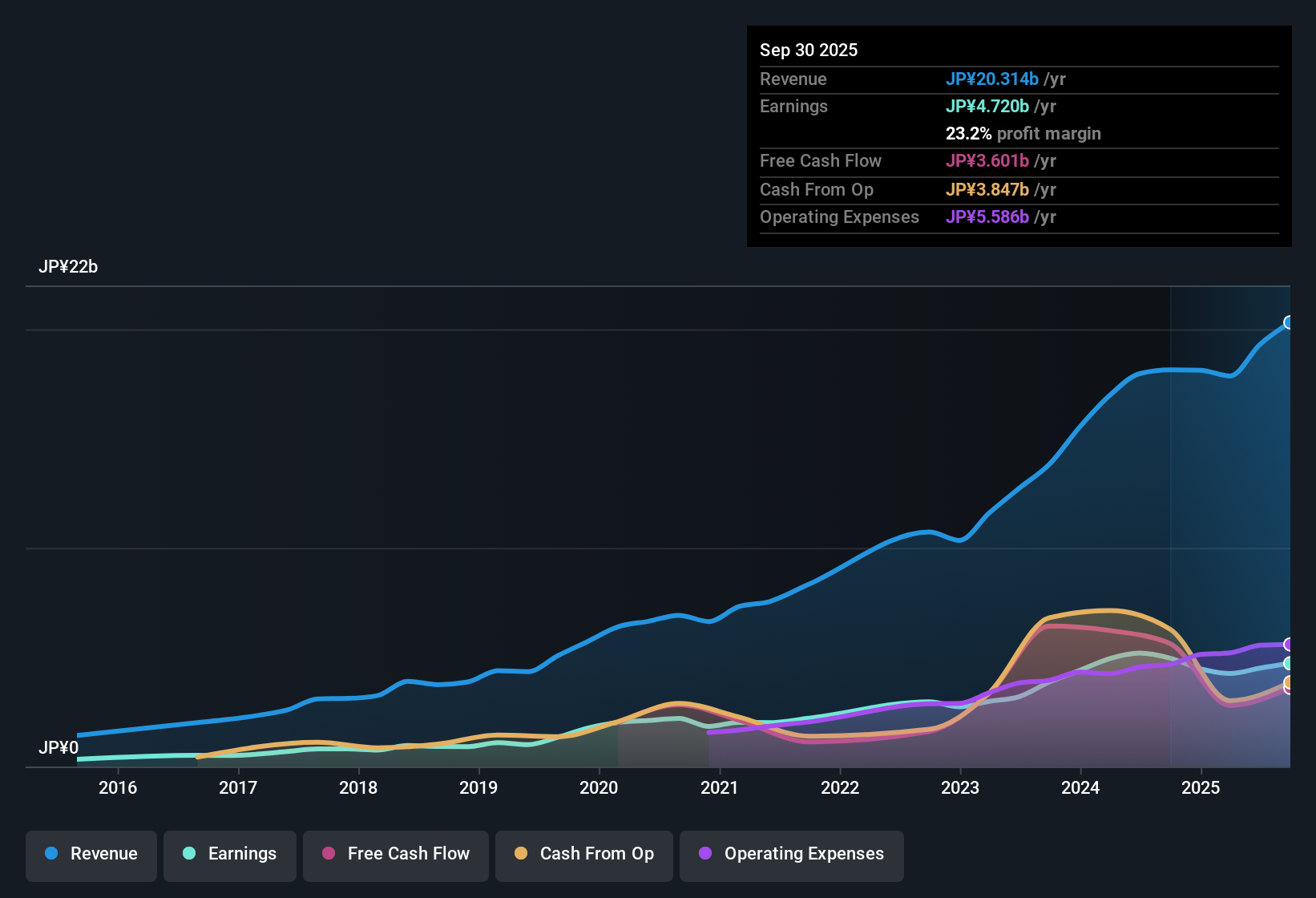

Strike Company Limited (TSE:6196) reported net profit margins of 23.2%, a step down from 27.3% last year, with recent financials showing negative EPS growth over the latest period. Over the past five years, earnings have grown at an average rate of 18.7% per year. Looking ahead, earnings are forecast to rise 17.9% annually, which is well ahead of the broader JP market’s 7.9% yearly estimate. With shares trading below estimated fair value, investors are balancing high-quality past growth, strong profit and revenue forecasts, and reasonable valuation at the industry level.

See our full analysis for Strike CompanyLimited.Next, we will see how this set of results measures up to the most widely held narratives, both those that reinforce the consensus and those that challenge it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Fall as Growth Outpaces Sector

- Net profit margin slipped to 23.2%, down from 27.3% a year ago. Both earnings and revenue growth projections for the next five years, at 17.9% and 16.9% per year respectively, remain well above Japan’s broader market averages.

- The latest figures strongly support the case that Strike CompanyLimited maintains a growth premium over sector peers, as demonstrated by its forecast-beating pace. However, the cooling margin draws attention to a more demanding operating environment.

- Consensus narrative notes that this resilience, with profitability across cycles and above-market growth, is valued by long-term investors.

- However, a margin drop after years of steady expansion tempers enthusiasm and highlights the importance of future margin stabilization for potential upside.

Valuation Sits Below DCF Fair Value

- Shares are trading at 3,805.00, below both the DCF fair value estimate of 6,436.47 and the analyst price target of 5,485.00. The company’s 15.5x P/E is lower than the 16.1x sector average but above the 13.2x peer group, indicating mixed signals for value-focused investors.

- It is notable that even with lower recent margins and short-term earnings headwinds, the prevailing market view points out that the stock’s discount to intrinsic value provides a margin of safety rarely seen in above-market growers.

- DCF models suggest there could be substantial upside if future growth and margin targets are met.

- Conversely, trading above peer groups by P/E raises questions about how much of the growth narrative is already reflected in the price.

Steady Top-Line Expansion Fuels Investor Optimism

- Strike’s revenue is projected to climb at 16.9% per year, ahead of the broader Japanese market’s 4.5% trend, maintaining a multi-year record of compounded, above-average expansion.

- The prevailing market view underscores that consistent top-line outperformance can be a strong draw for growth-minded investors. However, the gap between high expectations and margin compression will require close monitoring going forward.

- High revenue growth forecasts bolster positive sentiment regarding the business model’s underlying strength.

- Slower margin momentum suggests that not all of this growth will translate equally to profits, putting the quality of future earnings into sharper focus.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Strike CompanyLimited's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Strike Company’s rapid revenue growth contrasts with slipping profit margins. This raises doubts about how much of its expansion will translate into lasting shareholder value.

For investors who prioritize consistent, reliable results, use stable growth stocks screener (2095 results) to discover companies that combine strong top-line momentum with steady, resilient margins.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6196

Strike CompanyLimited

Provides mergers and acquisitions brokerage services for small and medium-sized companies in Japan.

Flawless balance sheet and good value.

Market Insights

Community Narratives