- Japan

- /

- Diversified Financial

- /

- TSE:3769

GMO Payment Gateway (TSE:3769): Reassessing Valuation After Dividend Hike and New Earnings Guidance

Reviewed by Simply Wall St

GMO Payment Gateway (TSE:3769) just grabbed investor attention by announcing a meaningful boost to its annual dividend for the year ended September 2025. The company also shared expectations for a further hike next year.

See our latest analysis for GMO Payment Gateway.

Bullish moves such as the dividend hike and newly released earnings targets appear to have warmed up sentiment around GMO Payment Gateway. The share price has jumped 28% since the start of the year, with one-year total shareholder return reaching 31%. After a tough few years, momentum is starting to build again as investors digest the latest guidance and board actions.

If recent gains in payment technology stocks have you curious about broader opportunities, now’s a great time to discover fast growing stocks with high insider ownership

With shares soaring and optimism building, investors now face a familiar dilemma: Does GMO Payment Gateway still offer value at current levels, or has the market already factored in its renewed growth prospects?

Price-to-Earnings of 34.4x: Is it justified?

GMO Payment Gateway’s stock currently trades at a price-to-earnings ratio of 34.4x, a figure that stands well above sector averages. This indicates a premium relative to peers at the last close of ¥9,888.

The price-to-earnings (P/E) ratio compares the company’s share price to its earnings per share and serves as a barometer for how much investors are willing to pay today for a unit of current earnings. In the diversified financials sector, P/E ratios help gauge growth expectations and relative valuations.

With a P/E far exceeding not just the industry average but also its closest peers, the market appears to be pricing in strong future growth or competitive advantages. However, when compared to the estimated fair P/E ratio of 18.2x, this premium appears stretched. If market expectations moderate or earnings growth declines, there is potential for the valuation to contract toward fairer levels.

Against the JP Diversified Financial industry average of 12.4x and the peer group’s 22.6x, GMO Payment Gateway appears particularly pricey. The gap with its fair-value multiple is even more pronounced, highlighting the elevated expectations reflected in today’s price.

Explore the SWS fair ratio for GMO Payment Gateway

Result: Price-to-Earnings of 34.4x (OVERVALUED)

However, any slowdown in annual revenue or net income growth could challenge current valuations and quickly shift market sentiment for GMO Payment Gateway.

Find out about the key risks to this GMO Payment Gateway narrative.

Another View: Our DCF Model Tells a Different Story

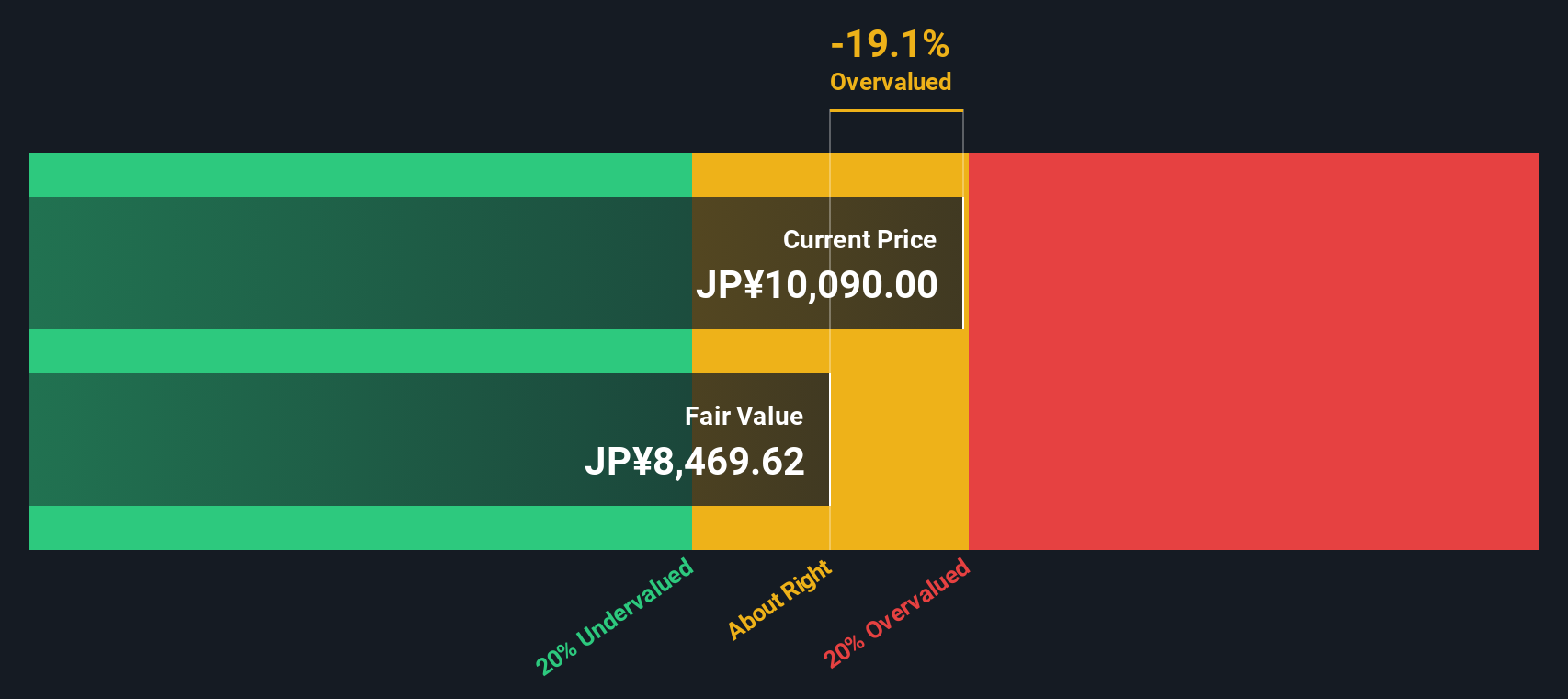

While the current price-to-earnings ratio suggests GMO Payment Gateway may be expensive, the SWS DCF model comes to a similar conclusion. At ¥9,888, shares are trading about 16% above our estimate of fair value. This challenges the ambitious growth implied by its high multiple and raises the question of whether the market could be overreaching.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GMO Payment Gateway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GMO Payment Gateway Narrative

If you see things differently or want to dive deeper on your own, you can easily shape your own take in just a few minutes. Do it your way

A great starting point for your GMO Payment Gateway research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let your portfolio miss the next big opportunity. Power up your search for standout stocks with these smart, hand-picked ideas from our screener.

- Catch the momentum by chasing growth stories among these 26 AI penny stocks at the forefront of artificial intelligence innovations and disruption.

- Boost your passive income strategy by targeting these 14 dividend stocks with yields > 3% delivering attractive yields well above average market returns.

- Ride the wave of technological change with these 81 cryptocurrency and blockchain stocks driving advances in digital assets and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3769

GMO Payment Gateway

Provides payment related and financial services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success