- Japan

- /

- Capital Markets

- /

- TSE:8704

Traders HoldingsLtd's (TYO:8704) Shareholders Are Down 56% On Their Shares

If you love investing in stocks you're bound to buy some losers. Long term Traders Holdings Co.,Ltd. (TYO:8704) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 56% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 37% lower in that time. The falls have accelerated recently, with the share price down 23% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Traders HoldingsLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Traders HoldingsLtd moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 56% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Traders HoldingsLtd further; while we may be missing something on this analysis, there might also be an opportunity.

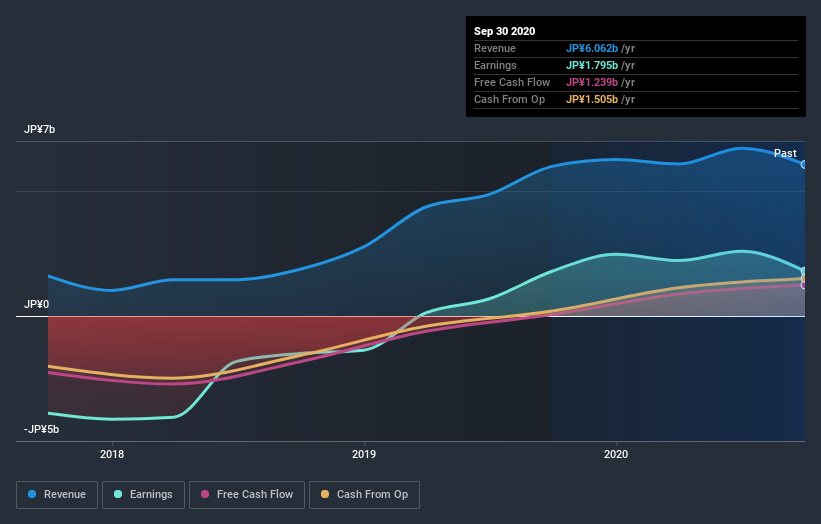

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Traders HoldingsLtd shareholders are down 37% for the year, but the market itself is up 5.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Traders HoldingsLtd has 1 warning sign we think you should be aware of.

But note: Traders HoldingsLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

When trading Traders HoldingsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Traders HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:8704

Traders HoldingsLtd

Through its subsidiaries, engages in the foreign exchange and securities trading activities in Japan.

Excellent balance sheet and good value.

Market Insights

Community Narratives