- Japan

- /

- Hospitality

- /

- TSE:9936

Ohsho Food Service (TSE:9936): Assessing Valuation Following New Guidance and Interim Dividend Cut

Reviewed by Simply Wall St

Ohsho Food Service (TSE:9936) grabbed investor attention after releasing its full-year earnings guidance and announcing a sharp reduction in its interim dividend. These developments shed light on operational expectations and signal possible shifts in capital allocation.

See our latest analysis for Ohsho Food Service.

After steady gains earlier in the year, Ohsho Food Service’s 1-year total shareholder return stands at 4.03%. Its 3- and 5-year total returns of 69% and 72% highlight its longer-term outperformance. However, recent momentum has faded, with the latest 30-day share price return at -8.23% and a 90-day dip of nearly 20%. The market seems to be digesting the implications of new earnings guidance alongside the dividend cut, and is re-evaluating growth prospects and risk in the near term.

If shifting sentiment here has you curious about potential opportunities, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With fundamentals evolving and analyst targets suggesting upside, the key question is whether current weakness offers real value or if markets have already factored in all of Ohsho Food Service’s future growth.Price-to-Earnings of 20.6x: Is it justified?

Ohsho Food Service trades on a price-to-earnings ratio of 20.6x, which puts it below the averages for both its industry and peer group. This suggests the stock may be attractively valued at its last close of ¥3,180.

The price-to-earnings ratio, or P/E, reflects how much investors are willing to pay for each yen of current annual earnings. For hospitality sector companies with established profitability, this ratio is a central marker of expected growth, competitive positioning, and return potential.

In Ohsho Food Service's case, the 20.6x P/E compares favorably against the broader JP Hospitality industry average of 23.2x, as well as a much higher peer average of 50.7x. Relative to the estimated fair price-to-earnings ratio of 21x, the company appears to be priced with some caution. This may signal that the market sees limited near-term growth, but fundamental value remains. The fair ratio offers a potential benchmark the market could revert to if sentiment shifts.

Explore the SWS fair ratio for Ohsho Food Service

Result: Price-to-Earnings of 20.6x (UNDERVALUED)

However, slowing revenue and net income growth may raise concerns if these trends continue, which could potentially limit near-term upside despite attractive valuation signals.

Find out about the key risks to this Ohsho Food Service narrative.

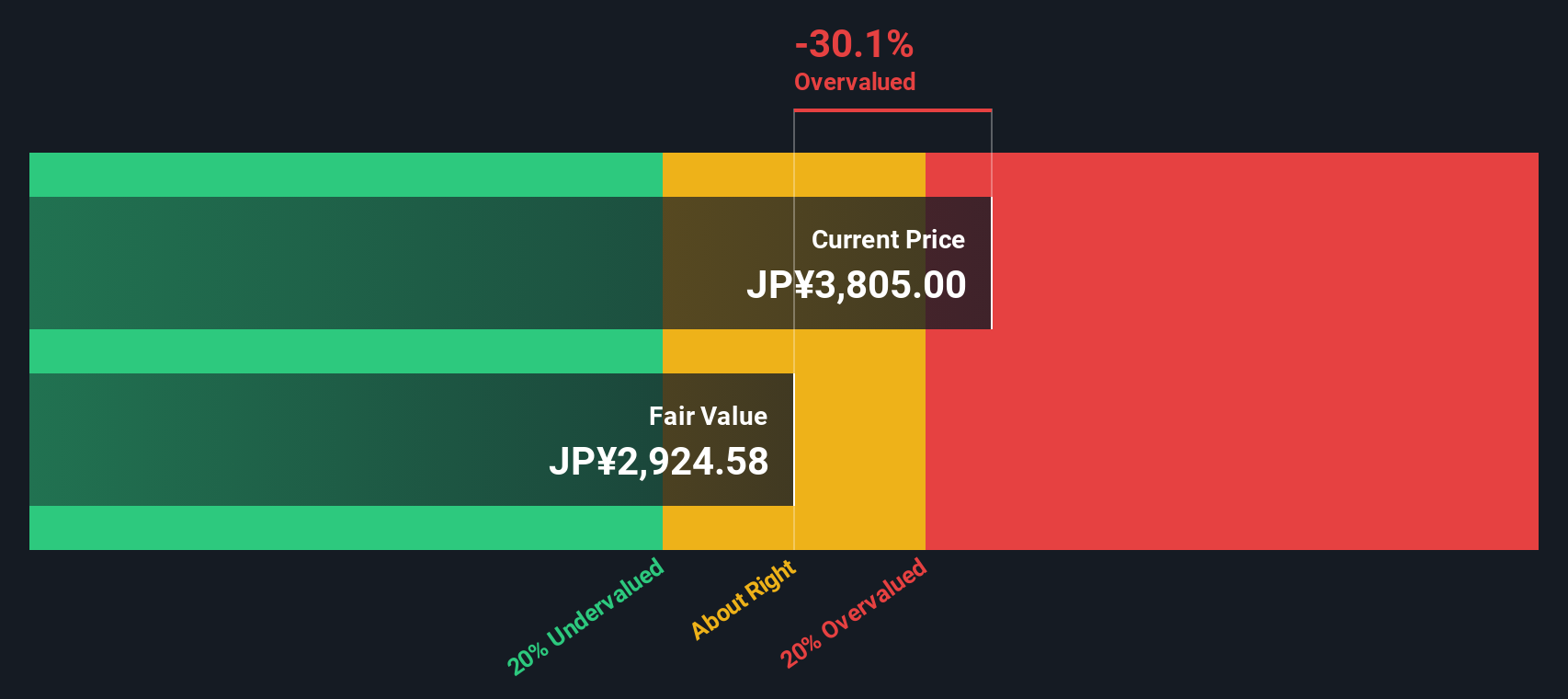

Another View: Discounted Cash Flow Suggests Limited Upside

While the P/E ratio analysis paints Ohsho Food Service as undervalued, our DCF model shows the shares trading about 3% above estimated fair value (¥3,180 vs. ¥3,086). This method considers expected future cash flows and implies the current price may be slightly optimistic. Is the market too hopeful, or will earnings growth prove the DCF model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ohsho Food Service for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ohsho Food Service Narrative

If you see the numbers differently or want to take a hands-on approach, you can craft your own Ohsho Food Service narrative quickly and easily. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ohsho Food Service.

Looking for more investment ideas?

If you want your portfolio to catch tomorrow’s winners instead of following yesterday’s trends, don’t wait. Make your next smart investing move right now.

- Unlock opportunities for income growth by reviewing these 16 dividend stocks with yields > 3% for robust yields and a track record of rewarding shareholders.

- Get ahead of the curve with these 25 AI penny stocks, where artificial intelligence powers companies ready to reshape entire industries.

- Join market contrarians who are snapping up value through these 872 undervalued stocks based on cash flows proven to be trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9936

Ohsho Food Service

Operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan.

Flawless balance sheet and fair value.

Market Insights

Community Narratives