- Japan

- /

- Hospitality

- /

- TSE:7550

Zensho Holdings (TSE:7550): Evaluating Valuation Following Swift Share Buyback and Steady Dividend

Reviewed by Simply Wall St

Zensho Holdings (TSE:7550) moved quickly on its newly announced share repurchase plan, buying back 200,000 shares just one day after revealing the program. The rapid execution, along with a steady dividend, underscores its approach to shareholder returns.

See our latest analysis for Zensho Holdings.

After a turbulent month that saw the share price slide, Zensho Holdings’ rapid buyback and steady dividend have caught investor attention. While the 1-year total shareholder return sits at -4.3%, the remarkable 3-year total return of 148% hints that long-term momentum remains intact, even if short-term sentiment wavers.

If this kind of bold capital move has you wondering where else to look, consider exploring fast growing stocks with high insider ownership for more high-growth companies with strong insider confidence.

With a recently completed buyback, firm top-line growth, and the stock still about 23% below its average analyst target, investors may wonder if Zensho Holdings is trading at a discount or if the market is already factoring in future gains.

Price-to-Earnings of 38.3x: Is it justified?

The market currently prices Zensho Holdings at a price-to-earnings (P/E) ratio of 38.3x, which is a key metric for investors deciding if the company's recent buybacks and growth expectations support the share price.

The price-to-earnings ratio reflects how much investors are willing to pay today for a single yen of Zensho Holdings' earnings. In the context of consumer services and hospitality, where growth can ebb and flow, a high P/E often signals optimism about future profit expansion or a premium for perceived earnings stability.

This multiple is roughly in line with the company’s estimated "fair" P/E ratio of 39.6x. This indicates that the recent price movements may be justified. However, compared to the Japanese Hospitality industry average of 23.2x, Zensho Holdings trades at a much higher valuation. This suggests that the market expects stronger future earnings or sees the company as structurally superior to most peers. If the market shifts toward the fair ratio, there may be room for price adjustment.

Explore the SWS fair ratio for Zensho Holdings

Result: Price-to-Earnings of 38.3x (ABOUT RIGHT)

However, weaker short-term sentiment or a slowdown in revenue and profit growth could challenge the case for Zensho Holdings’ current valuation premium.

Find out about the key risks to this Zensho Holdings narrative.

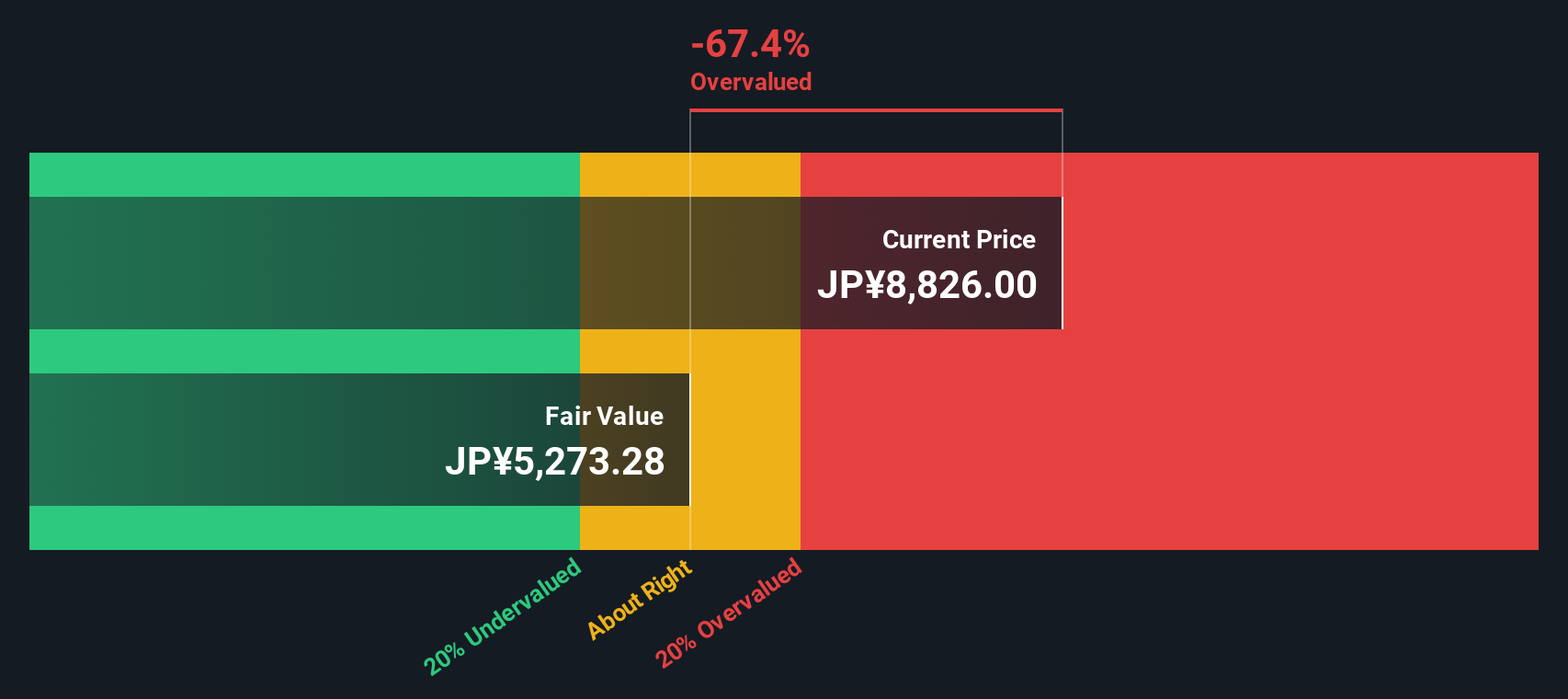

Another View: Discounted Cash Flow Puts Price Above Fair Value

While the current price-to-earnings ratio suggests Zensho Holdings is fairly valued relative to its sector, our DCF model presents a different perspective. According to this cash flow-based approach, the shares trade well above their estimated fair value of ¥5,273, raising questions about future upside from current levels.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zensho Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zensho Holdings Narrative

If you think the numbers tell a different story or would rather dig into the details yourself, you can shape your own view in just a few minutes. So why not Do it your way?

A great starting point for your Zensho Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors act early. Don’t let unique opportunities pass you by. Use the Simply Wall Street Screener to access forward-thinking trends and niche sectors right now.

- Capture unusually high yields from companies built for long-term income by starting with these 16 dividend stocks with yields > 3% for stocks featuring robust dividend payouts above 3%.

- Fuel your portfolio with innovation when you scan these 26 AI penny stocks and gain exposure to the top AI-driven companies positioned for growth.

- Capitalize on strong cash flow valuations by tapping into these 926 undervalued stocks based on cash flows which could reveal sensible bargains that may be overlooked by the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zensho Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7550

Zensho Holdings

Engages in the management of food service chain restaurants, and development of sales systems and food processing systems in Japan, Americas, China, Europe, ASEAN, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives