- Japan

- /

- Hospitality

- /

- TSE:3547

Kushikatsu Tanaka (TSE:3547) Earnings Growth Surges 77%, Reinforcing Bullish Market Narratives

Reviewed by Simply Wall St

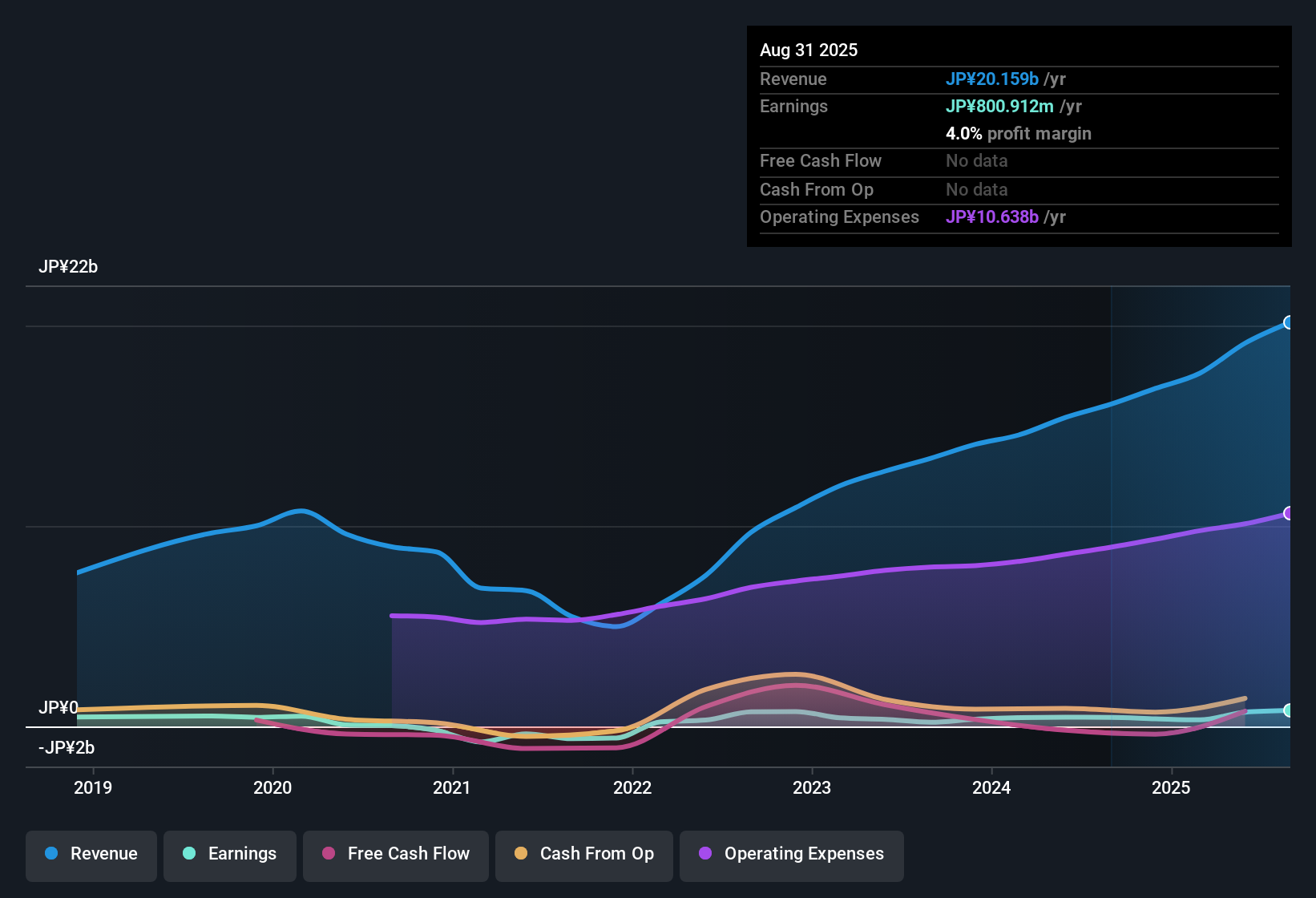

Kushikatsu Tanaka Holdings (TSE:3547) delivered standout earnings results this year, with earnings growth of 77.3% handily beating its own five-year average of 47% per year. Net profit margins reached 4%, improving from last year’s 2.8%. Current earnings and revenue growth forecasts of 13% and 12.5% per year respectively both top the Japanese market averages. Investors will be watching the continued momentum in profit and revenue growth, especially as the company trades below estimated fair value and margins move higher despite some recent share price volatility.

See our full analysis for Kushikatsu Tanaka Holdings.Now let's see how the latest financial results compare with the prevailing narratives in the market. Some long-held views could be confirmed, while others might face new challenges.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Outpace Sector Pressure

- Net profit margins improved to 4%, up from 2.8% last year, while many Japanese hospitality peers are reporting persistent cost pressure.

- What is surprising is that, despite sector-wide concerns about margin compression from rising material and labor costs, Kushikatsu Tanaka Holdings managed to widen margins as input prices rose and is now outperforming the Japanese hospitality industry’s average margin trend.

- Operating in line with sector drivers such as digital ordering and takeout helped sustain profitability against the backdrop of cost inflation.

- The company’s ability to enhance margins highlights management’s operational resilience, even as the broader industry faces continued cost headwinds that typically affect profits.

Growth Forecasts Top Market Averages

- Earnings are expected to grow 13% per year and revenue by 12.5% per year, both exceeding the Japanese market averages of 8.1% and 4.4%, respectively.

- Wider coverage notes that steady store expansion and ongoing adaptation to shifting consumer trends support a case for continuing above-average growth. Investors should watch for potential downside from sector cost increases or changes in consumer spending.

- Store network updates and greater takeout penetration support the positive outlook for earnings momentum relative to peers.

- However, the strong forecasts could still come under pressure if cost inflation intensifies, especially since even modest outperformance in this sector can be sensitive to shifts in expenses.

DCF Fair Value Highlights Valuation Gap

- The current share price of ¥2,214 trades at a 24% discount to the DCF fair value of ¥2,897.22, and at a P/E of 25.4x versus peer and sector averages of 27.3x and 24.3x.

- In addition, ongoing brand strength and revenue growth support the argument that valuation remains appealing for long-term investors, as the shares trade below DCF fair value and have a relatively modest earnings multiple compared to peers.

- Sector caution persists, but this discount may attract buyers looking for undervalued quality and improving profitability.

- Share price volatility in the last three months reminds investors that valuation discounts alone may not guarantee smooth near-term gains.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kushikatsu Tanaka Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite widening profit margins and an attractive valuation, Kushikatsu Tanaka Holdings’ strong forecasts still risk being challenged if sector cost inflation intensifies or consumer spending shifts.

If steady and resilient financial performance matters most to you, focus on companies with a proven track record by using our stable growth stocks screener (2098 results) for more reliable growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kushikatsu Tanaka Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3547

Kushikatsu Tanaka Holdings

Engages in the restaurant management activities in Japan.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives