- Japan

- /

- Hospitality

- /

- TSE:3350

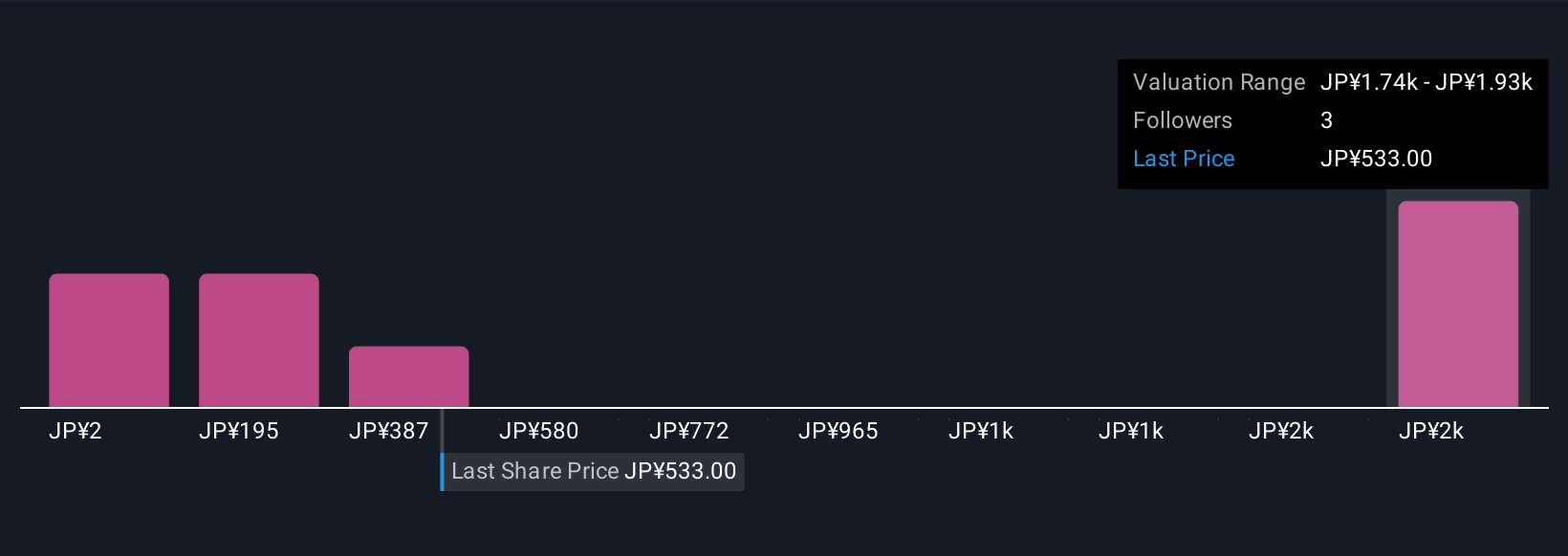

Metaplanet (TSE:3350) Is Down 12.9% After Announcing Bitcoin-Backed Share Buyback—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 28, 2025, Metaplanet Inc. announced a significant share repurchase program, authorizing the buyback of up to 150,000,000 shares (13.13% of its outstanding shares) for ¥75,000 million, set to expire by October 28, 2026.

- The buyback is structured to leverage Bitcoin-backed financing as bridge capital for corporate initiatives and an upcoming preferred stock issuance.

- With the company using Bitcoin assets to facilitate the buyback, we’ll explore how this financial approach influences Metaplanet’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Metaplanet's Investment Narrative?

Before the news of Metaplanet’s large-scale buyback, the big picture centered on high-growth Bitcoin operations, aggressive earnings upgrades, and ongoing business expansions, all set against a backdrop of rapid management turnover and share price volatility. The new buyback program, leveraging Bitcoin assets as bridge capital, is a material shift that could reshape short-term catalysts and risk perception. On one hand, the program signals strong board confidence, potential capital return, and strategic use of digital assets, potentially supporting share price in the near term. However, using Bitcoin-backed financing introduces heightened exposure to crypto price swings, which could amplify both upside and downside risk in an already volatile stock. Investors have to believe in both Metaplanet’s execution and Bitcoin’s resilience to stay comfortable as shareholders after this move. Recent price declines underscore how quickly sentiment can shift when risk increases.

But, in contrast to the buyback optimism, increased Bitcoin leverage introduces a new layer of risk that investors should keep top of mind. Metaplanet's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Metaplanet - why the stock might be worth over 4x more than the current price!

Build Your Own Metaplanet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Metaplanet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metaplanet's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives