- Japan

- /

- Hospitality

- /

- TSE:3350

Did Metaplanet's (TSE:3350) ¥21.29 Billion Private Placement Reshape Its Investment Outlook?

Reviewed by Sasha Jovanovic

- On November 20, 2025, Metaplanet Inc. announced board approval for a major private placement, issuing 23,610,000 Class B shares and 2,100,000 Series 23 and 24 Stock Acquisition Rights, with expected gross proceeds of ¥21.29 billion and participation from prominent institutional investors.

- This capital infusion marks a significant broadening of Metaplanet’s institutional shareholder base, including new investors such as Nautical Funding Ltd. and SMALLCAP World Fund, Inc.

- We'll explore how the influx of capital from institutional funds could influence Metaplanet’s capital structure and future investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Metaplanet's Investment Narrative?

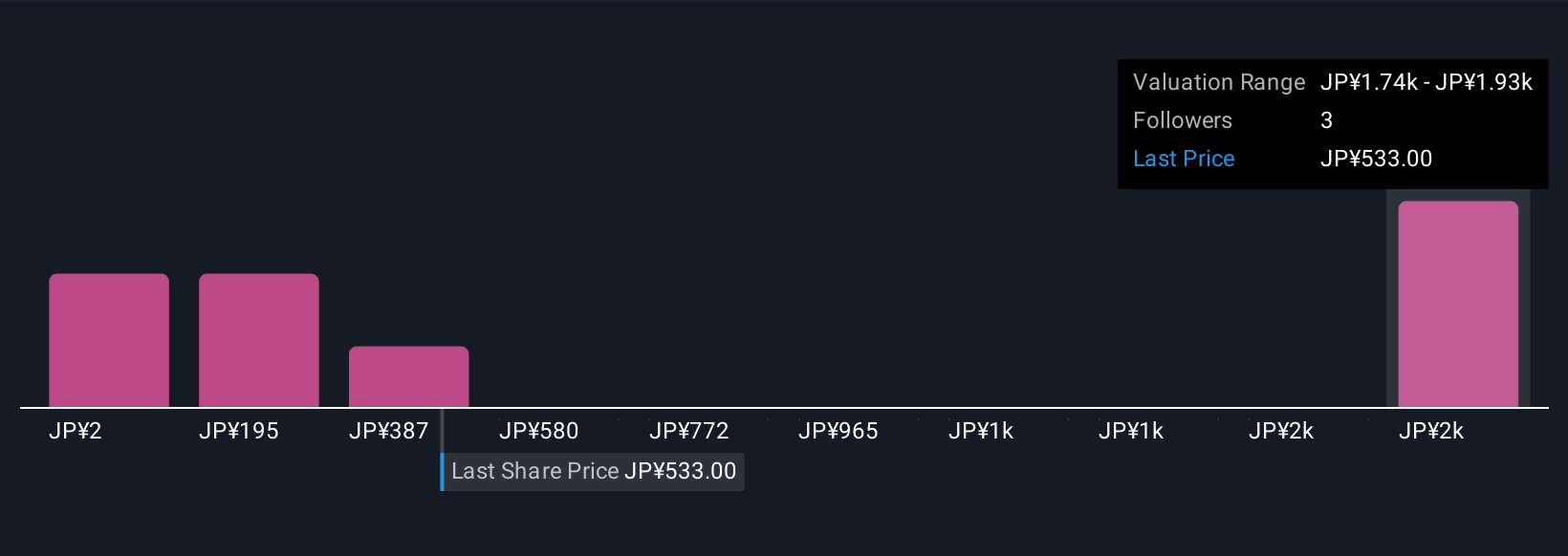

To believe in Metaplanet as a shareholder right now, you’d need conviction around its transformation into a high-growth, Bitcoin-focused financial business and confidence in its ability to leverage new institutional capital. The recent ¥21.29 billion private placement with participation from several significant funds is a clear signal that institutional players are buying into Metaplanet’s expansion and could help address the company’s prior reliance on smaller-scale financing. In the short term, this capital injection may act as a catalyst, strengthening the company’s resources for further investment and business growth, while also potentially easing concerns around liquidity and funding for acquisitions. However, these developments bring some risk: dilution from the new shares, corporate governance due to the still-inexperienced board and management team, and integrating new shareholders' interests. The news has shifted the near-term focus to whether this larger institutional backing will reduce volatility and refocus attention on core earnings growth.

On the other hand, the risk from a rapidly changing board should not be underestimated. Metaplanet's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Metaplanet - why the stock might be worth less than half the current price!

Build Your Own Metaplanet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metaplanet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Metaplanet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metaplanet's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives