- Japan

- /

- Hospitality

- /

- TSE:3350

Assessing Metaplanet’s Valuation After Bold Digital Asset Moves and Recent Price Swings

Reviewed by Bailey Pemberton

- If you have ever wondered whether Metaplanet is a smart buy or just the latest buzz, you are not alone. This stock has curiosity and excitement swirling around it.

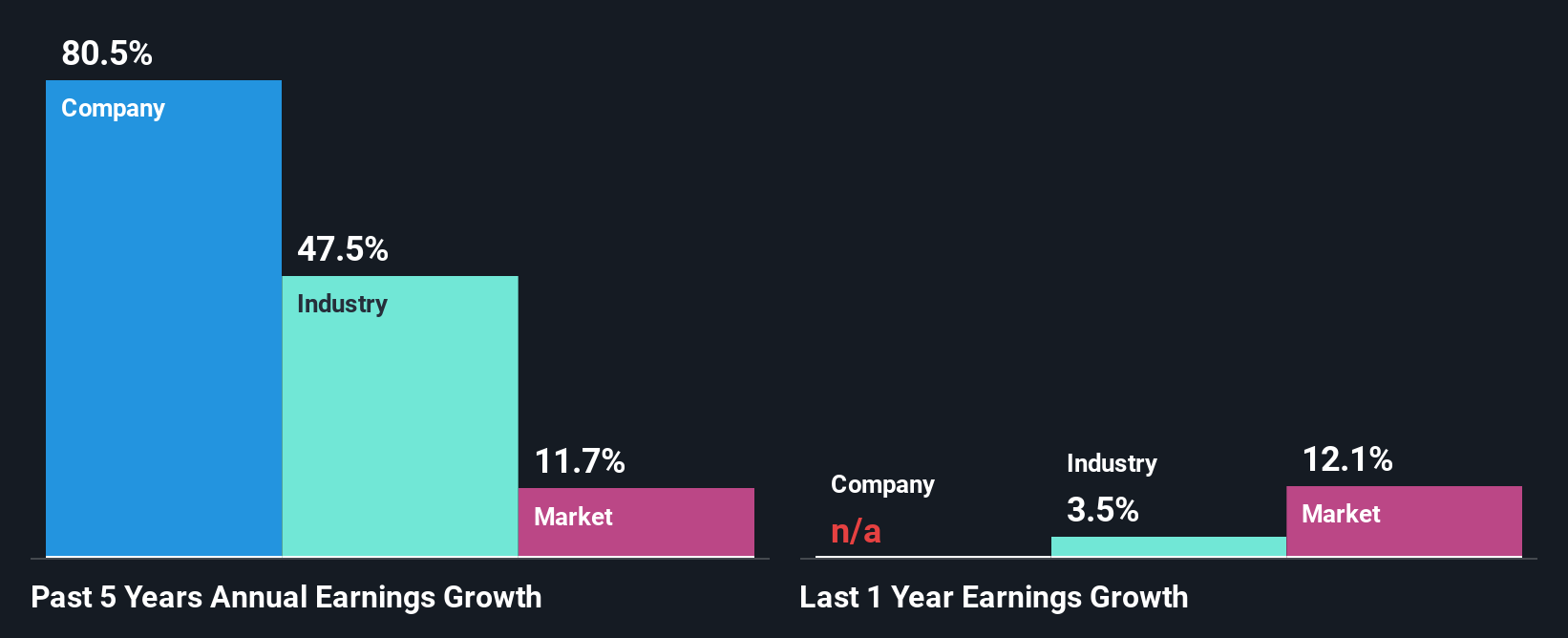

- Despite being down 18.2% over the last week and 15.9% over the past month, Metaplanet has soared an incredible 47.3% over the past year and a staggering 619.1% across three years. These figures hint at both volatility and long-term growth potential.

- Recent headlines have spotlighted Metaplanet's bold moves into digital assets, which drove optimism among investors and drew global attention to its strategy. This surge in media coverage has played a major part in fueling speculation and driving those impressive price swings.

- According to our valuation model, Metaplanet scores just 2 out of 6 on key value checks. This suggests there is plenty to unpack. Here is a walk-through of how this score is calculated and an exploration of ways to weigh what the stock is really worth by the end of this article.

Metaplanet scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Metaplanet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model helps estimate a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach provides insight into what the business is fundamentally worth based on projected performance, rather than market sentiment.

For Metaplanet, the latest reported Free Cash Flow stands at approximately ¥1.91 billion. According to current estimates, this cash flow is expected to grow at a rate of about 6.7% in the near term, with extrapolated projections suggesting it could reach roughly ¥2.47 billion by 2035. It is important to note that only the first five years of forecasts are based on analyst estimates. The remaining years rely on extended projections from Simply Wall St.

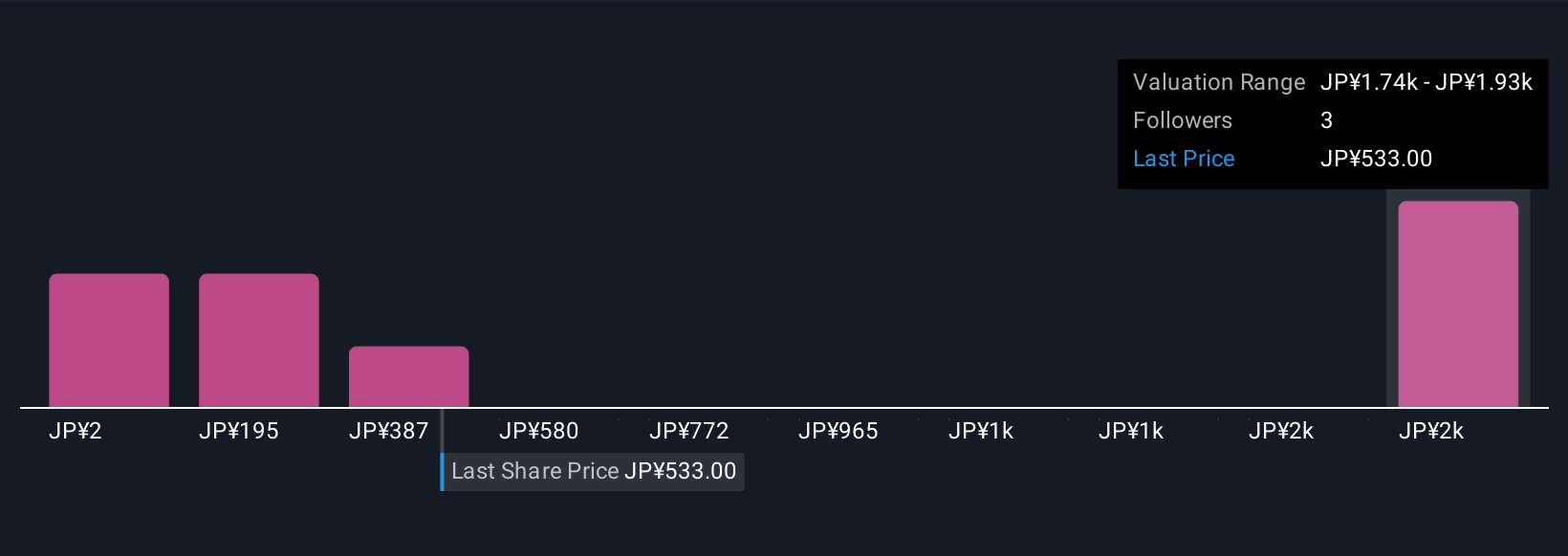

After discounting these future figures back to their present value, the DCF method puts Metaplanet’s fair value at ¥35.65 per share. Compared to the market, this indicates the stock is currently priced at an 848.2% premium to its calculated worth, suggesting significant overvaluation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Metaplanet may be overvalued by 848.2%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Metaplanet Price vs Earnings

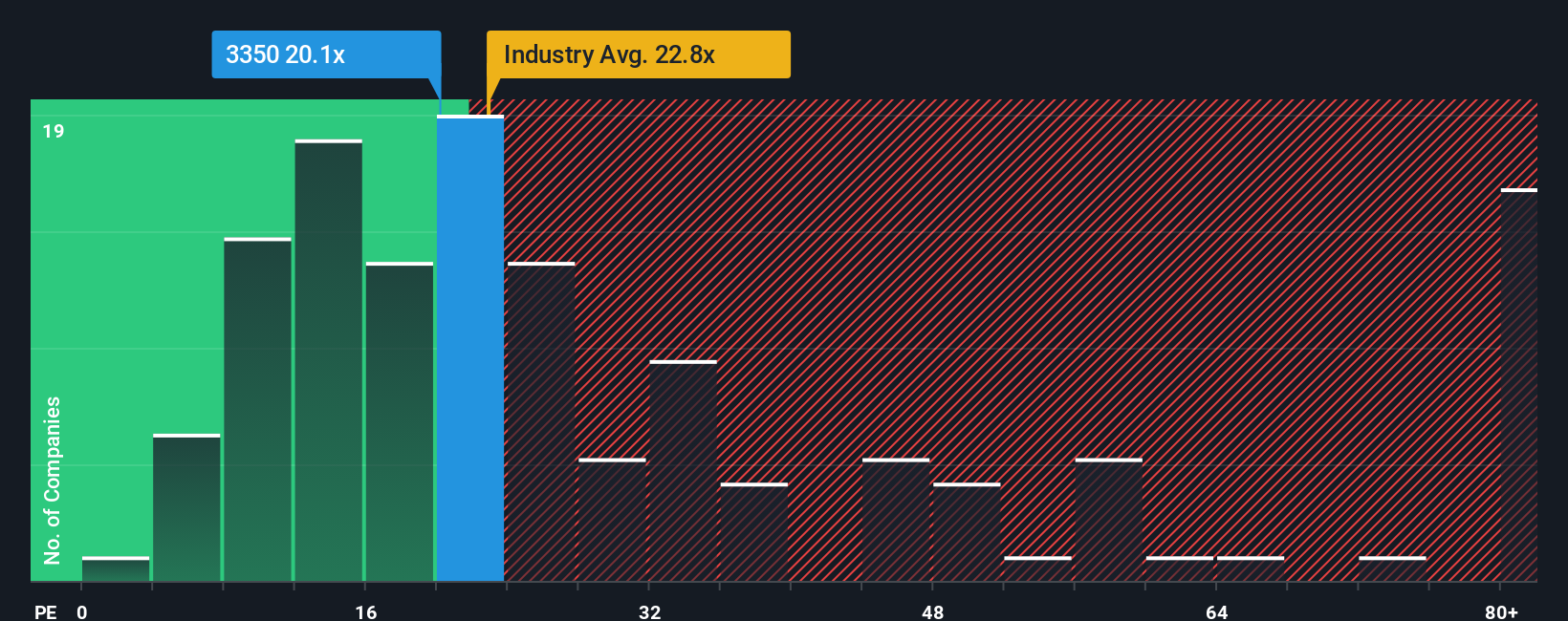

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Metaplanet because it connects a company’s share price to its underlying earnings, giving investors a quick sense of how much they are paying for each yen of profit. A lower PE often signals a bargain if earnings are stable or growing, while a higher PE suggests heightened optimism about near-term prospects or lower perceived risk.

When using the PE ratio, it is crucial to consider both growth expectations and risk. Companies expected to grow quickly or with stable earnings typically command higher PEs, reflecting investor confidence. Conversely, if profits are uncertain or growth prospects are muted, the “normal” or “fair” PE should be lower to account for those increased risks.

Currently, Metaplanet is trading at a PE ratio of 21.11x. This is lower than the hospitality industry average of 22.61x but notably higher than the peer average of 15.24x. Simply Wall St offers an additional insight with its proprietary “Fair Ratio,” calculated as 60.64x for Metaplanet. The Fair Ratio incorporates not just earnings growth and industry trends, but also other essentials like market cap, profit margins, and company-specific risks. This makes it a more individualized benchmark than the generic industry or peer figures.

Because Metaplanet’s Fair Ratio (60.64x) is substantially higher than its actual PE (21.11x), the stock appears undervalued by this metric. The spread indicates that the current market price does not fully reflect the fundamentals and growth prospects factored into the Fair Ratio.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Metaplanet Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your unique story about a company, connecting your expectations for Metaplanet’s future revenue, earnings, and profit margins to a clear fair value estimate. Narratives transform data into an investment outlook, letting you back up your view of Metaplanet with tangible numbers and forecasts.

Narratives are available on Simply Wall St’s Community page, where millions of investors are already using them as an accessible and insightful decision-making tool. By linking the company’s story, financial forecasts, and a calculated fair value, Narratives help you easily compare your view with the current market price. This enables you to assess whether you’re spotting a bargain or a potential risk.

These tools stay up-to-date, automatically reflecting new information like earnings and news, so your perspective evolves with the company. For example, one investor’s Narrative for Metaplanet might set a high fair value of ¥80 per share when expecting substantial growth, while another, more cautious view could peg fair value at just ¥12 per share. This highlights how different stories shape very different conclusions.

Do you think there's more to the story for Metaplanet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives