- Japan

- /

- Hospitality

- /

- TSE:2752

3 Japanese Growth Stocks With Insider Ownership Up To 33%

Reviewed by Simply Wall St

In the wake of recent economic turbulence and a hawkish stance from the Bank of Japan, Japanese markets have experienced significant volatility, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down 6.0%. Amid this backdrop, identifying growth companies with high insider ownership can provide investors with valuable insights into stocks that may offer resilience and potential for long-term gains. A good stock in these conditions often features strong internal confidence, as evidenced by substantial insider ownership, which can signal alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Medley (TSE:4480) | 34% | 28.7% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 21.8% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.8% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Here's a peek at a few of the choices from the screener.

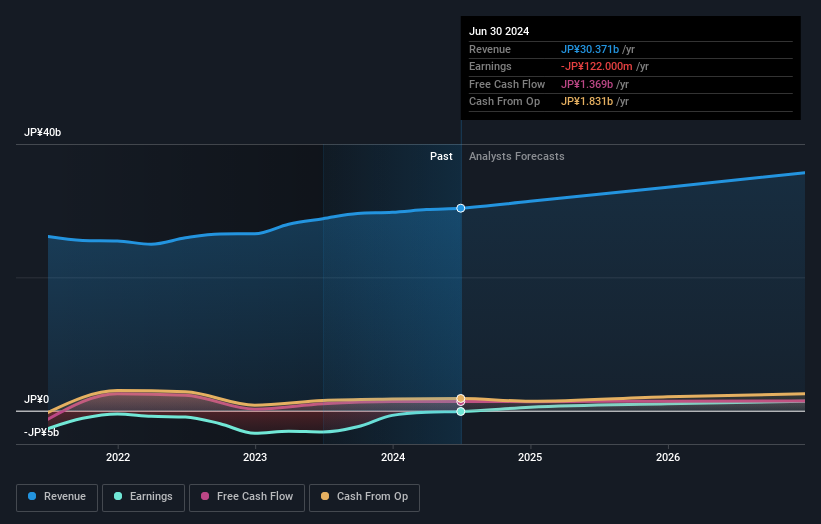

Fujio Food Group (TSE:2752)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc. operates restaurants in Japan and internationally, with a market cap of ¥61.50 billion.

Operations: Revenue segments for Fujio Food Group Inc. include restaurant operations in Japan and international markets, totaling ¥61.50 billion.

Insider Ownership: 29.5%

Fujio Food Group, trading at 28.2% below its estimated fair value, is forecast to grow earnings by 72.84% annually and become profitable within three years, outpacing average market growth. Although its revenue growth of 6.2% per year lags behind high-growth benchmarks, it still surpasses the JP market's average of 4.2%. The company shows no significant insider trading activity in the past three months, reflecting stability in insider sentiment.

- Dive into the specifics of Fujio Food Group here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Fujio Food Group shares in the market.

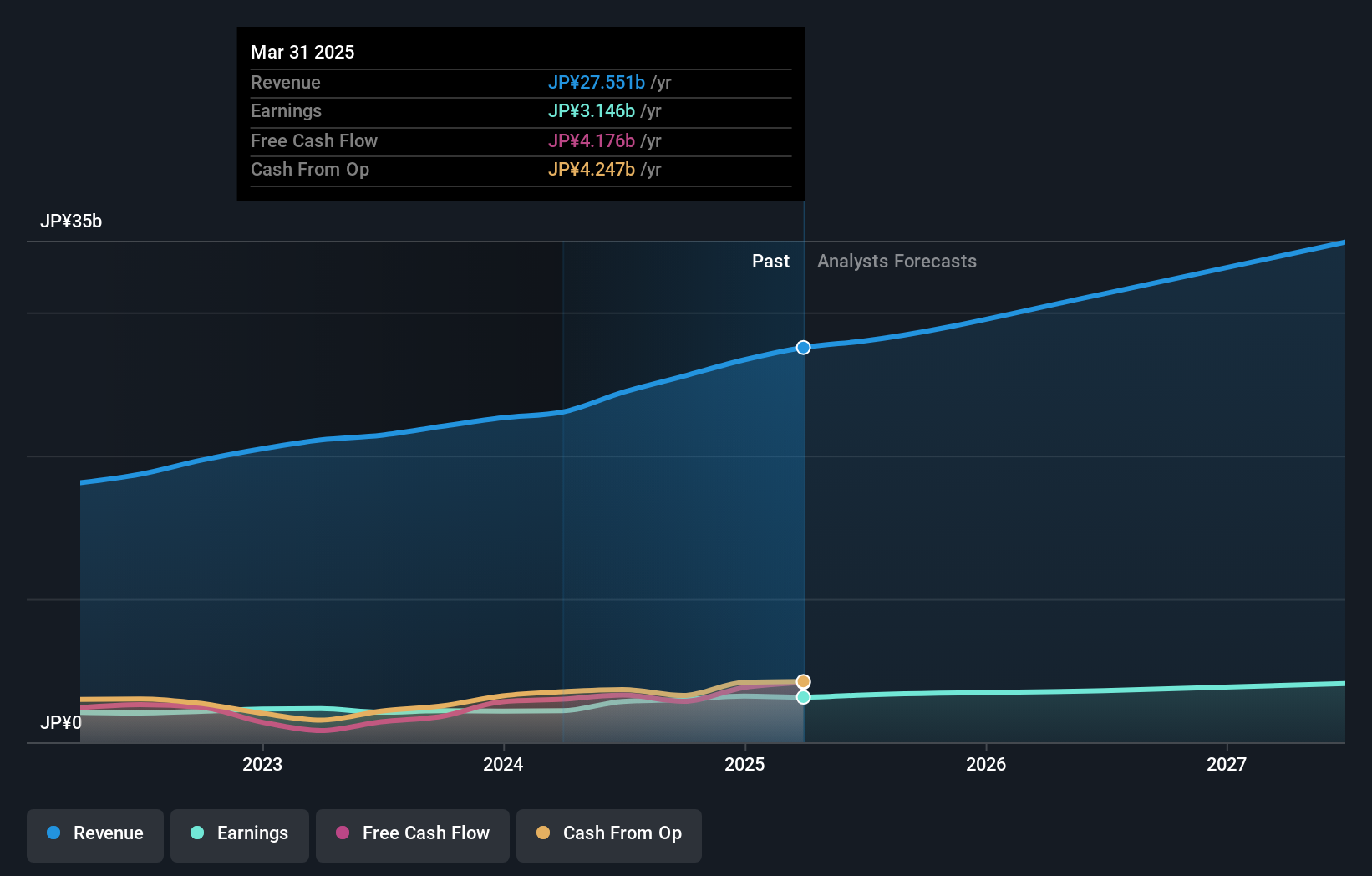

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Avant Group Corporation, with a market cap of ¥54.58 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company generates revenue through its subsidiaries by offering services in accounting, business intelligence, and outsourcing.

Insider Ownership: 33.9%

Avant Group, trading at 60.6% below its estimated fair value, is expected to grow revenue by 16.9% per year and earnings by 18.9% annually, both outpacing the JP market averages. Recent buyback activity saw the repurchase of 364,100 shares for ¥477.64 million between April and June 2024, indicating confidence in future prospects. With no significant insider trading over the past three months and a high forecasted return on equity of 25%, Avant Group demonstrates strong growth potential with substantial insider ownership.

- Navigate through the intricacies of Avant Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Avant Group's shares may be trading at a discount.

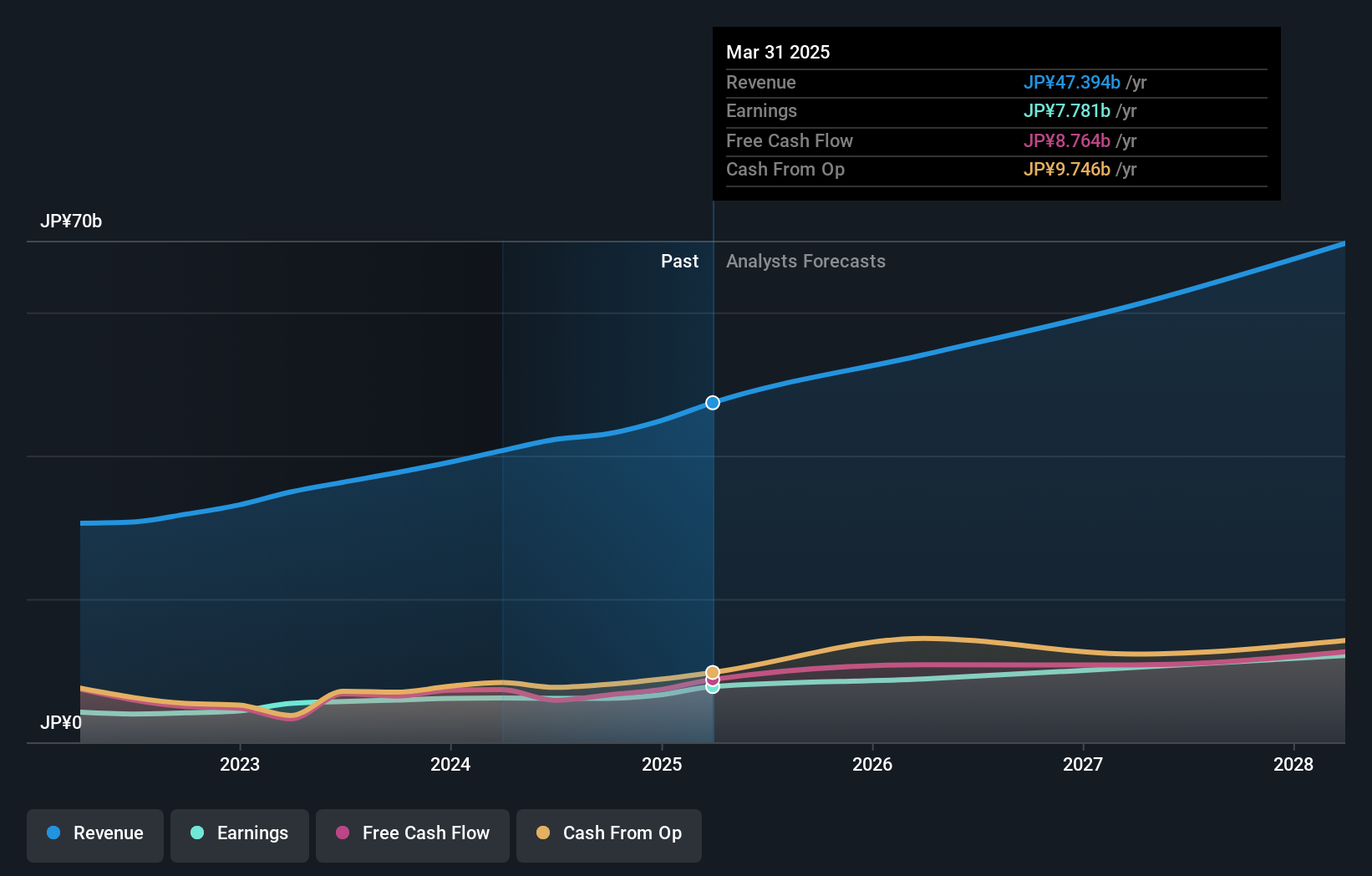

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥125.34 billion.

Operations: Revenue from the provision of IT solutions amounts to ¥42.26 billion.

Insider Ownership: 28.8%

Simplex Holdings, trading at 45.9% below its estimated fair value, is forecast to grow earnings by 20.2% per year and revenue by 12.8% annually, both outpacing the JP market averages. Despite a highly volatile share price over the past three months and an unstable dividend track record, recent dividend increases to ¥42.00 per share indicate potential confidence in future performance. No significant insider trading has been reported recently, underscoring stable insider ownership dynamics.

- Click to explore a detailed breakdown of our findings in Simplex Holdings' earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Simplex Holdings shares in the market.

Seize The Opportunity

- Discover the full array of 99 Fast Growing Japanese Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2752

Reasonable growth potential with mediocre balance sheet.