- Japan

- /

- Food and Staples Retail

- /

- TSE:8242

H2O Retailing (TSE:8242): Is the Stock Undervalued After Profit Forecast and Dividend Boost?

Reviewed by Simply Wall St

H2O Retailing (TSE:8242) just raised its net profit forecast for the year, supported by extraordinary income from the sale of investment securities related to TOHO’s tender offer. The company also announced a higher second quarter dividend.

See our latest analysis for H2O Retailing.

Shares have perked up lately, rising more than 5% over the past month following revised guidance and a boosted dividend. However, the year-to-date share price return remains slightly negative. H2O Retailing’s one-year total shareholder return of 6.75% and an impressive 238% over five years reinforce a steady record of long-term value creation. This suggests momentum may be turning a corner after a quieter stretch.

If these recent moves have you interested in finding more opportunities, now's a great time to check out fast growing stocks with high insider ownership.

With profits forecasted higher and the dividend on the rise, investors are left wondering if H2O Retailing’s recent uplift signals an attractive entry point, or if the market has already accounted for all the future gains.

Price-to-Earnings of 17.1x: Is it justified?

H2O Retailing's shares are currently trading at a price-to-earnings (P/E) ratio of 17.1x, which puts the stock in a more expensive bracket than the Japanese Consumer Retailing industry average of 12.8x. This elevated P/E signals that investors are willing to pay a premium for the company’s expected future earnings compared to many industry peers.

The price-to-earnings ratio is a classic metric used to assess how much investors are paying for each yen of net profit. For mature retailers, it often reflects the company's perceived stability and future growth expectations, providing a snapshot of market sentiment around profitability potential.

While H2O Retailing commands a higher multiple than its sector average, it is actually more attractively valued than typical peers, which trade at an average P/E of 21.5x. In addition, it still trades below its estimated “fair” P/E of 22.7x, suggesting some room for re-rating if company fundamentals improve further or market sentiment shifts in its favor.

Explore the SWS fair ratio for H2O Retailing

Result: Price-to-Earnings of 17.1x (ABOUT RIGHT)

However, weaker revenue growth or a shift in market sentiment could quickly offset optimism. This reminds investors that momentum is never guaranteed.

Find out about the key risks to this H2O Retailing narrative.

Another View: What Does Our DCF Model Say?

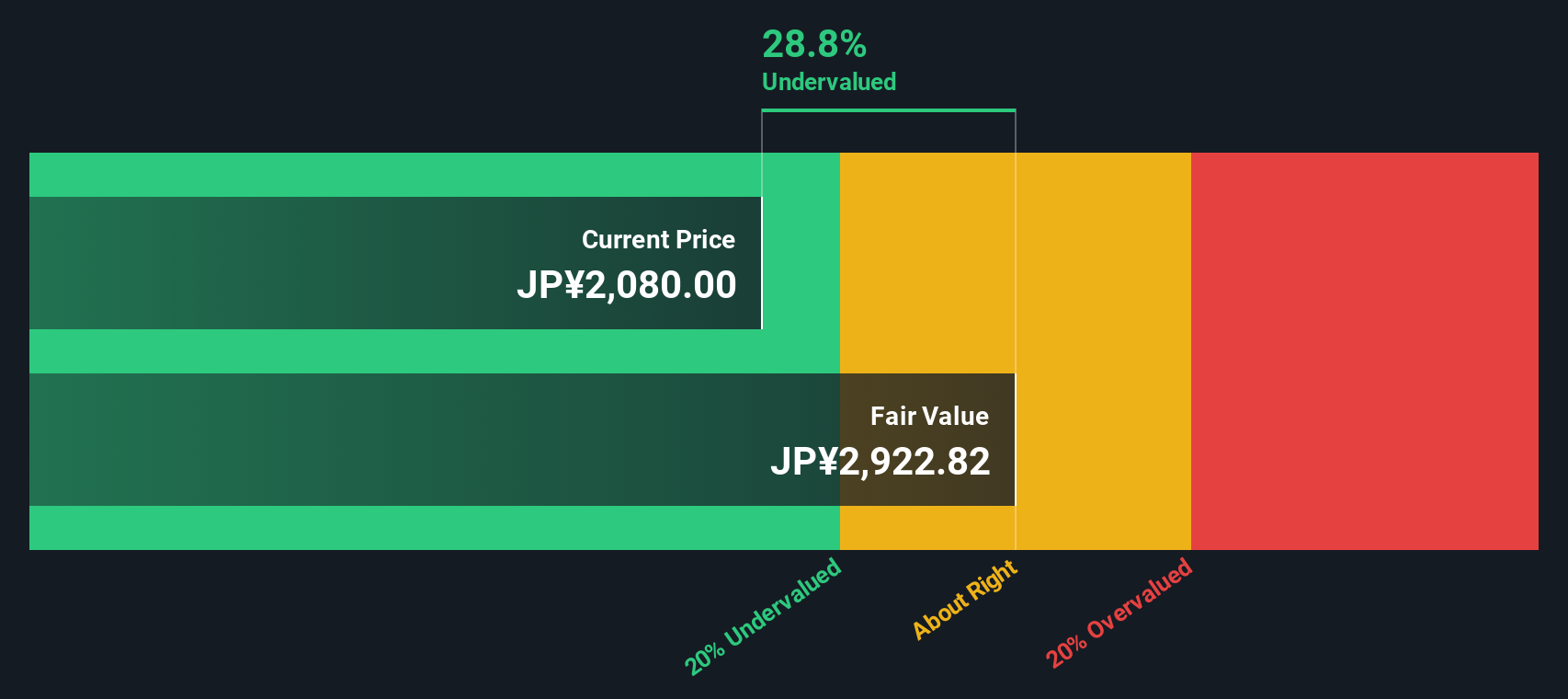

While the current price-to-earnings ratio offers one perspective, the SWS DCF model provides a different picture. According to this analysis, H2O Retailing is trading nearly 27% below its fair value estimate. Could the market be underestimating the company’s true potential, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out H2O Retailing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own H2O Retailing Narrative

If you have a different perspective or want to analyze things your own way, you can easily build your own H2O Retailing narrative in just a few minutes. Do it your way.

A great starting point for your H2O Retailing research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the best opportunities slip past you. Take your next step as a smarter investor and see what you could be missing with these handpicked stock ideas:

- Put your capital to work by targeting companies offering stable income. these 15 dividend stocks with yields > 3% boasts yields above 3%.

- Seize the chance to participate in groundbreaking AI trends. Find these 25 AI penny stocks at the forefront of intelligent automation and innovation.

- Unlock serious growth potential by tapping into these 3575 penny stocks with strong financials with robust financials that could outperform in the coming market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H2O Retailing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8242

H2O Retailing

Engages in the development, operation, and management of commercial facilities in Japan.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives