- Japan

- /

- Food and Staples Retail

- /

- TSE:8182

Undiscovered Gems in Japan for September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index declined by 1.0%. Amid currency headwinds and a hawkish outlook from the Bank of Japan, investors are increasingly looking for resilient opportunities in smaller-cap stocks. In this environment, identifying high-potential stocks involves focusing on companies with strong fundamentals and unique growth drivers that can withstand economic fluctuations and benefit from evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Totech | 16.86% | 5.13% | 11.52% | ★★★★★★ |

| Techno Quartz | 18.64% | 16.15% | 22.17% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Mizuho MedyLtd | NA | 19.43% | 34.66% | ★★★★★★ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

We'll examine a selection from our screener results.

PS Construction (TSE:1871)

Simply Wall St Value Rating: ★★★★★☆

Overview: PS Construction Co., Ltd. engages in civil engineering and architecture businesses both in Japan and internationally, with a market cap of ¥47.11 billion.

Operations: PS Construction generates revenue primarily from its Civil Engineering Business (¥79.66 billion) and Construction Business (¥51.73 billion). The Manufacturing Business contributes ¥7.95 billion to the overall revenue.

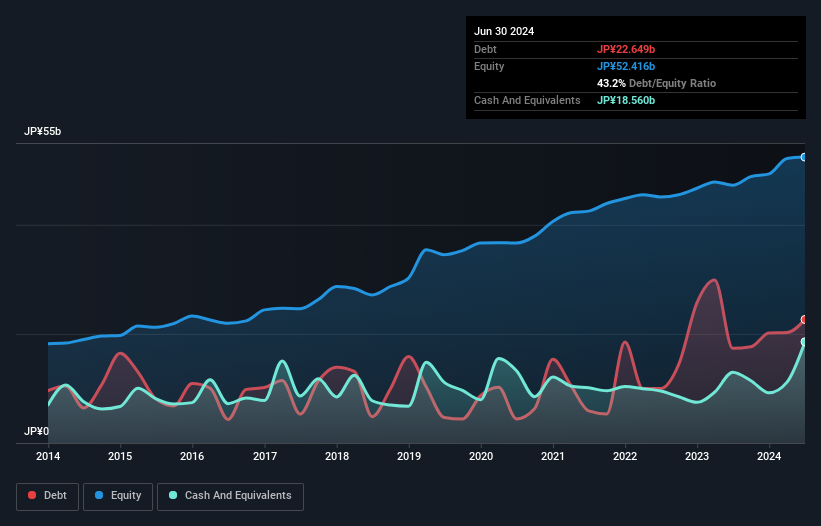

PS Construction has shown impressive earnings growth of 62.5% over the past year, outpacing the industry average of 25.6%. However, its debt-to-equity ratio has risen from 13.6% to 43.2% in five years, which may concern some investors despite a satisfactory net debt to equity ratio of 7.8%. The company is trading at a significant discount, around 80.5% below estimated fair value, and maintains high-quality earnings with strong interest coverage at 84.5x EBIT.

- Click here to discover the nuances of PS Construction with our detailed analytical health report.

Explore historical data to track PS Construction's performance over time in our Past section.

Toyo Construction (TSE:1890)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toyo Construction Co., Ltd. operates in marine and civil engineering as well as building construction both in Japan and internationally, with a market cap of ¥127.36 billion.

Operations: Toyo Construction Co., Ltd. generates revenue primarily from marine and civil engineering projects and building construction activities in Japan and internationally. The company's net profit margin stands at 5.23%.

Toyo Construction, a small-cap Japanese firm, has showcased impressive financial health with its debt to equity ratio dropping from 12.5% to 5.6% over the past five years. Its earnings surged by 49.8% last year, outpacing the construction industry's 25.6%. Additionally, Toyo is trading at approximately 5% below its estimated fair value and expects a dividend of ¥30 per share for H1 FY2025.

Inageya (TSE:8182)

Simply Wall St Value Rating: ★★★★★★

Overview: Inageya Co., Ltd. operates a retail business in Japan with a market cap of ¥56.50 billion.

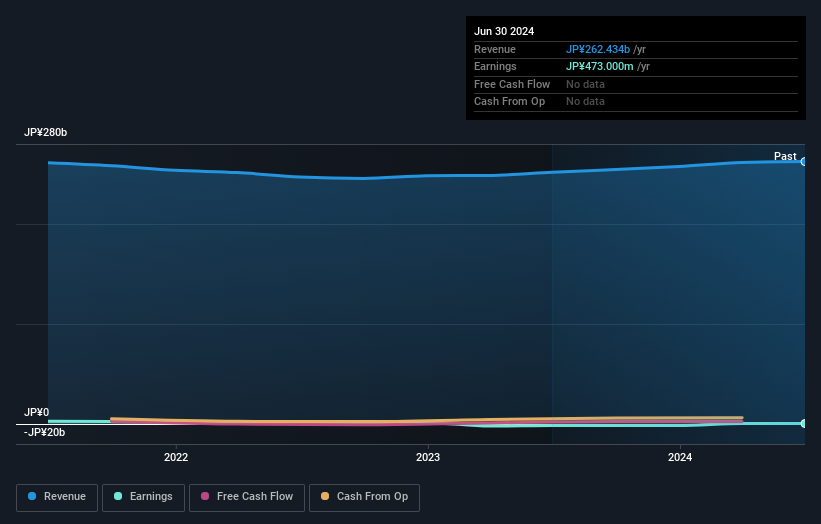

Operations: The company generates revenue primarily from its Ket Business (¥204.33 billion) and Drug Store Business (¥46.69 billion), with additional income from its Retail Support Business (¥10.96 billion).

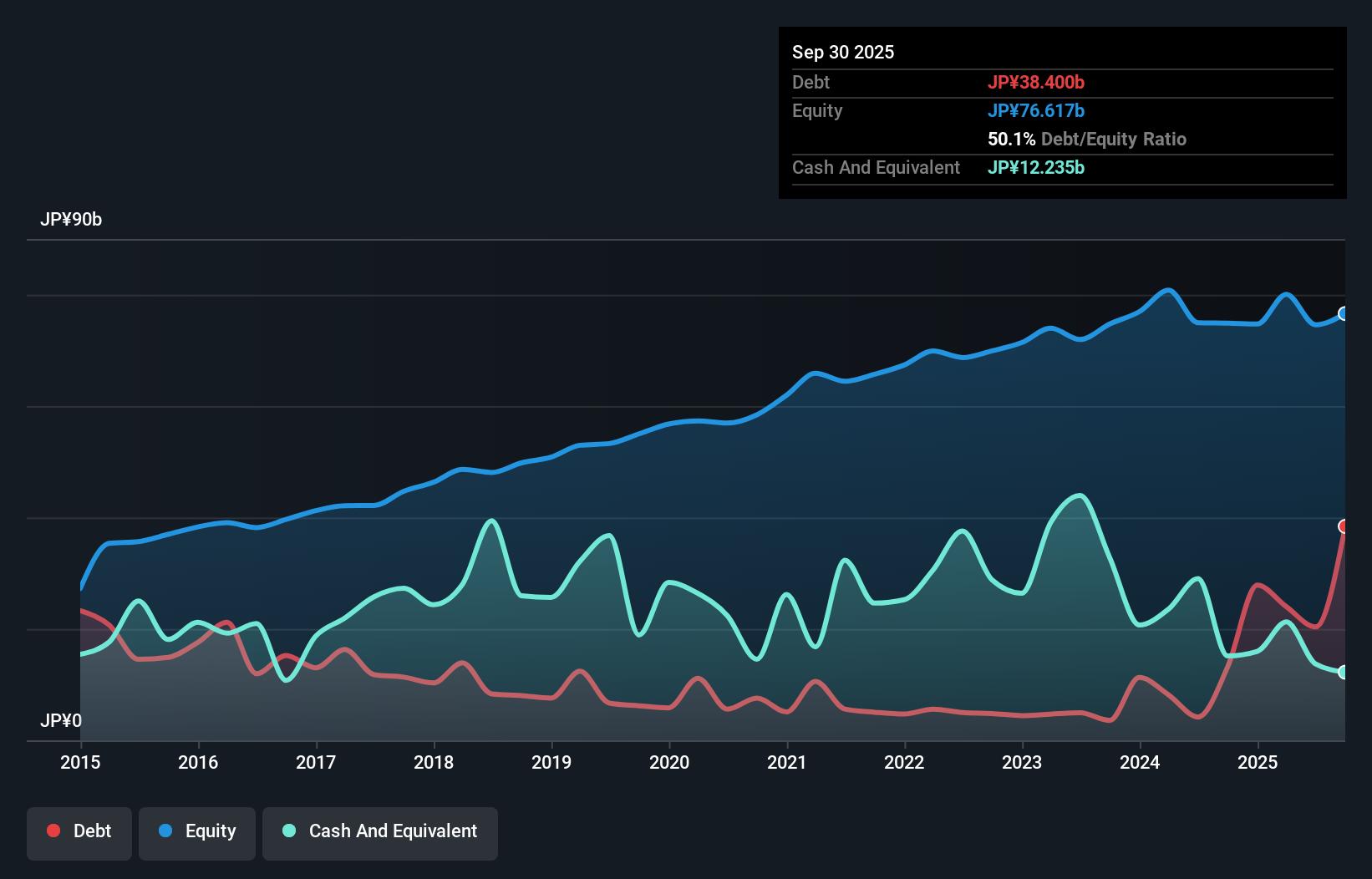

Inageya, a small cap in Japan's retail sector, has shown promising signs of growth. Trading at 27.5% below its estimated fair value and having reduced its debt to equity ratio from 16.5% to 10.1% over five years, the company seems financially sound. Recently profitable, Inageya announced a buyback program for up to 43,356 shares and raised its Q2 net profit forecast significantly from ¥400 million to ¥1.63 billion (US$11 million).

- Click to explore a detailed breakdown of our findings in Inageya's health report.

Gain insights into Inageya's past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 747 companies within our Japanese Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8182

Flawless balance sheet with acceptable track record.