- Japan

- /

- Food and Staples Retail

- /

- TSE:8167

Retail Partners (TSE:8167) Margin Expansion Reinforces Bullish Efficiency Narrative

Reviewed by Simply Wall St

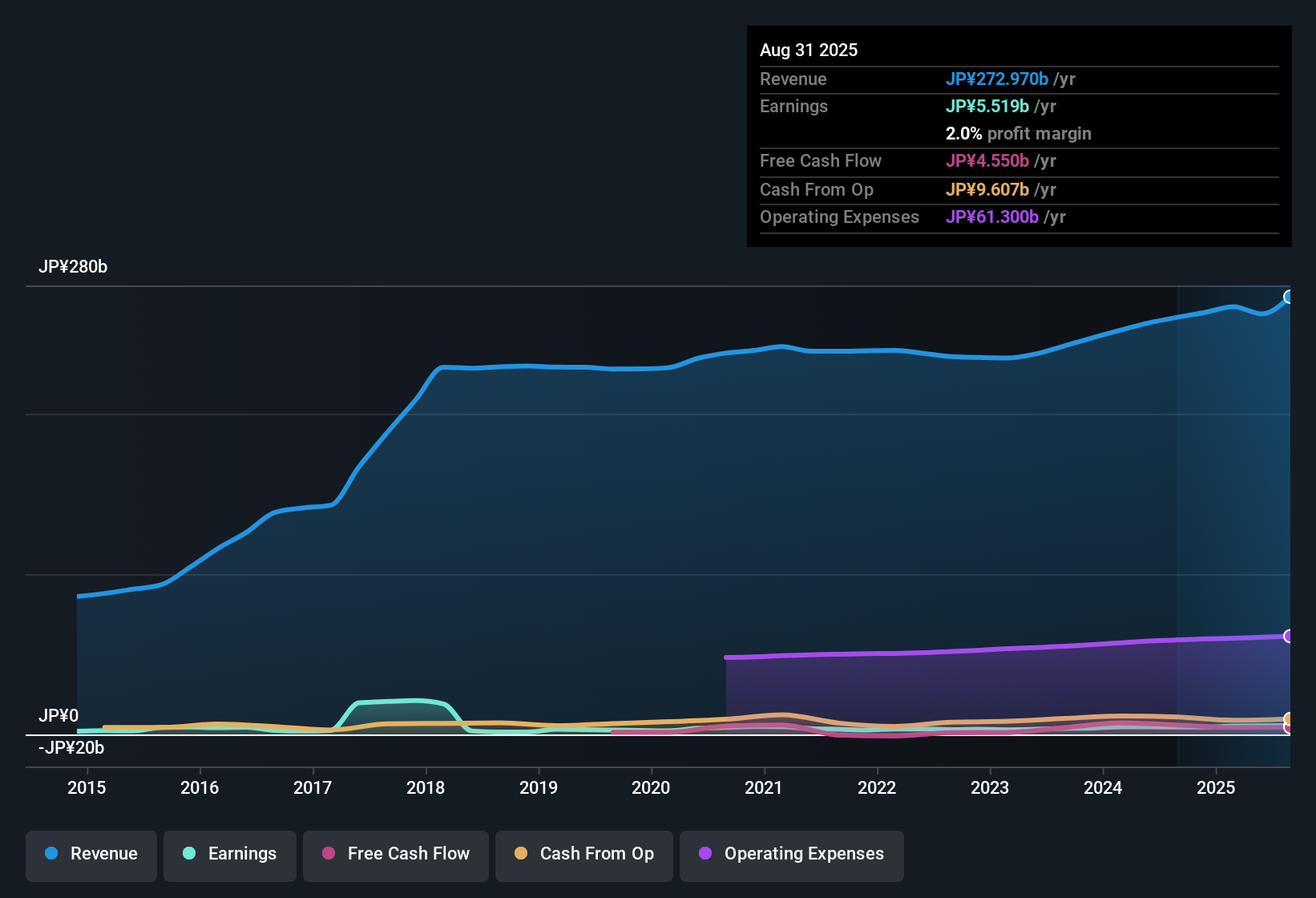

Retail Partners (TSE:8167) delivered earnings growth of 19.7% over the past year, well surpassing its five-year average trend of 6.5% per year. Net profit margins also improved to 2.1% from 1.8% a year earlier. With a price-to-earnings ratio of 10.7x now sitting below both peer and industry averages, the results highlight high-quality earnings and rising profitability. The favorable risk-reward profile, including strong value, earnings growth, and an attractive dividend, may leave investors viewing this positive momentum as a compelling setup for further gains.

See our full analysis for Retail Partners.Next, we will see how these results compare to the major narratives investors have been following, and whether the latest numbers support or shake up the story so far.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Five-Year Trend

- Net profit margin reached 2.1%, a significant increase from 1.8% a year ago and showing a steady climb above the company’s five-year average annual earnings growth of 6.5%.

- A key claim in the prevailing market view is that operational discipline is a differentiator. This margin expansion heavily supports optimism around efficiency improvements.

- With the margin improvement above longer-term averages, it becomes harder for critics to argue that recent performance is a one-off event.

- Momentum in profit quality signals that the company is navigating sector changes more adeptly than many competitors.

Share Price Trades at Discount to DCF Fair Value

- Shares are priced at ¥1,371, standing nearly 21% below the DCF fair value of ¥1,728.22. The price-to-earnings ratio of 10.7x falls under both the peer (11.8x) and industry (13.1x) averages.

- The prevailing market view highlights that such a valuation gap can spur investor interest, especially when paired with the company’s robust earnings and sector tailwinds.

- The discount sharpens the appeal for value-focused investors who see the fair value gap as a margin of safety supported by improving profitability.

- However, the market may be watching for confirmation that recent momentum can be sustained before re-rating the stock closer to fair value.

Dividend and Growth Shine Amid No Major Risks

- The company is identified as offering both good value and an attractive dividend alongside demonstrated profit and revenue growth, with no risk statements currently flagged.

- In the prevailing market view, this combination of upside drivers, earnings growth and dividend appeal, positions Retail Partners as a standout in a changing sector landscape.

- Investors searching for both stability and upside typically value this profile, especially when not weighed down by flagged risks or warnings.

- The absence of listed operational or financial risks gives further confidence that recent growth is built on solid fundamentals.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Retail Partners's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite recent gains in margins and valuation, Retail Partners’ long-term earnings growth has lagged behind several large-cap peers that have consistently expanded at a faster pace.

If steady, predictable growth is your top priority, use our stable growth stocks screener (2090 results) to quickly uncover companies delivering reliable earnings and revenue through all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8167

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives