- China

- /

- Food and Staples Retail

- /

- SHSE:603233

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to react positively to the Trump administration's policy shifts, with major indices like the S&P 500 reaching new highs amid AI enthusiasm and potential trade deal optimism, investors are increasingly looking for stable income sources amidst this dynamic environment. Dividend stocks, known for their ability to provide consistent returns through regular payouts, become particularly attractive as they offer a blend of income and potential capital appreciation in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

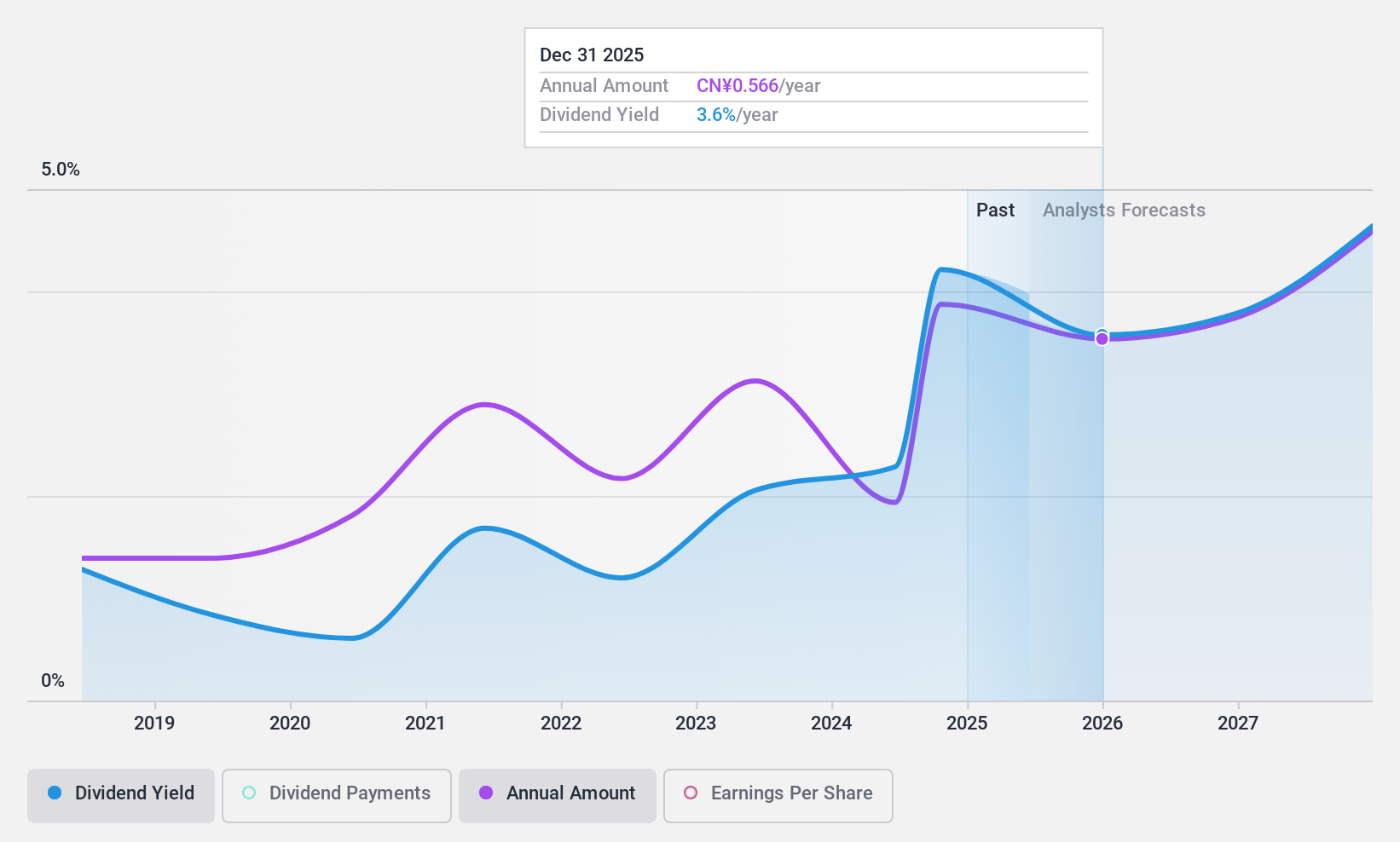

Huaihe Energy (Group)Ltd (SHSE:600575)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huaihe Energy (Group) Co., Ltd operates in the logistics and trade sector in China with a market capitalization of approximately CN¥12.94 billion.

Operations: Huaihe Energy (Group) Co., Ltd's revenue is primarily derived from its logistics and trade operations within China.

Dividend Yield: 3.6%

Huaihe Energy's dividend payments have been volatile over the past five years, with a history of annual drops exceeding 20%. Despite this, the company's dividends are covered by both earnings and cash flows, with payout ratios of 46% and 74.1%, respectively. Its dividend yield is in the top quartile of China's market at 3.6%. The company recently announced a private placement of shares, which could impact future dividends.

- Unlock comprehensive insights into our analysis of Huaihe Energy (Group)Ltd stock in this dividend report.

- Our expertly prepared valuation report Huaihe Energy (Group)Ltd implies its share price may be too high.

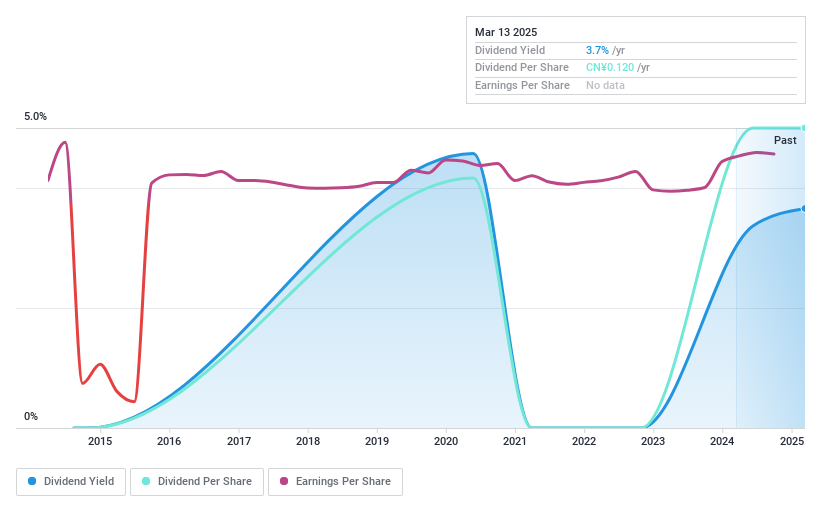

DaShenLin Pharmaceutical Group (SHSE:603233)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DaShenLin Pharmaceutical Group Co., Ltd. operates in China, focusing on the manufacturing, wholesaling, and retailing of pharmaceutical products with a market cap of CN¥16.11 billion.

Operations: DaShenLin Pharmaceutical Group generates its revenue through the manufacturing, wholesaling, and retailing of pharmaceutical products in China.

Dividend Yield: 4.4%

DaShenLin Pharmaceutical Group's dividend yield is among the top 25% in China's market, though its seven-year history shows volatility and unreliability. Despite this, dividends are covered by earnings and cash flows, with payout ratios of 82.8% and 47.5%, respectively. The stock trades at a significant discount to estimated fair value, but recent profit margins have declined from last year. Upcoming shareholder meetings may provide further insights into future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of DaShenLin Pharmaceutical Group.

- In light of our recent valuation report, it seems possible that DaShenLin Pharmaceutical Group is trading behind its estimated value.

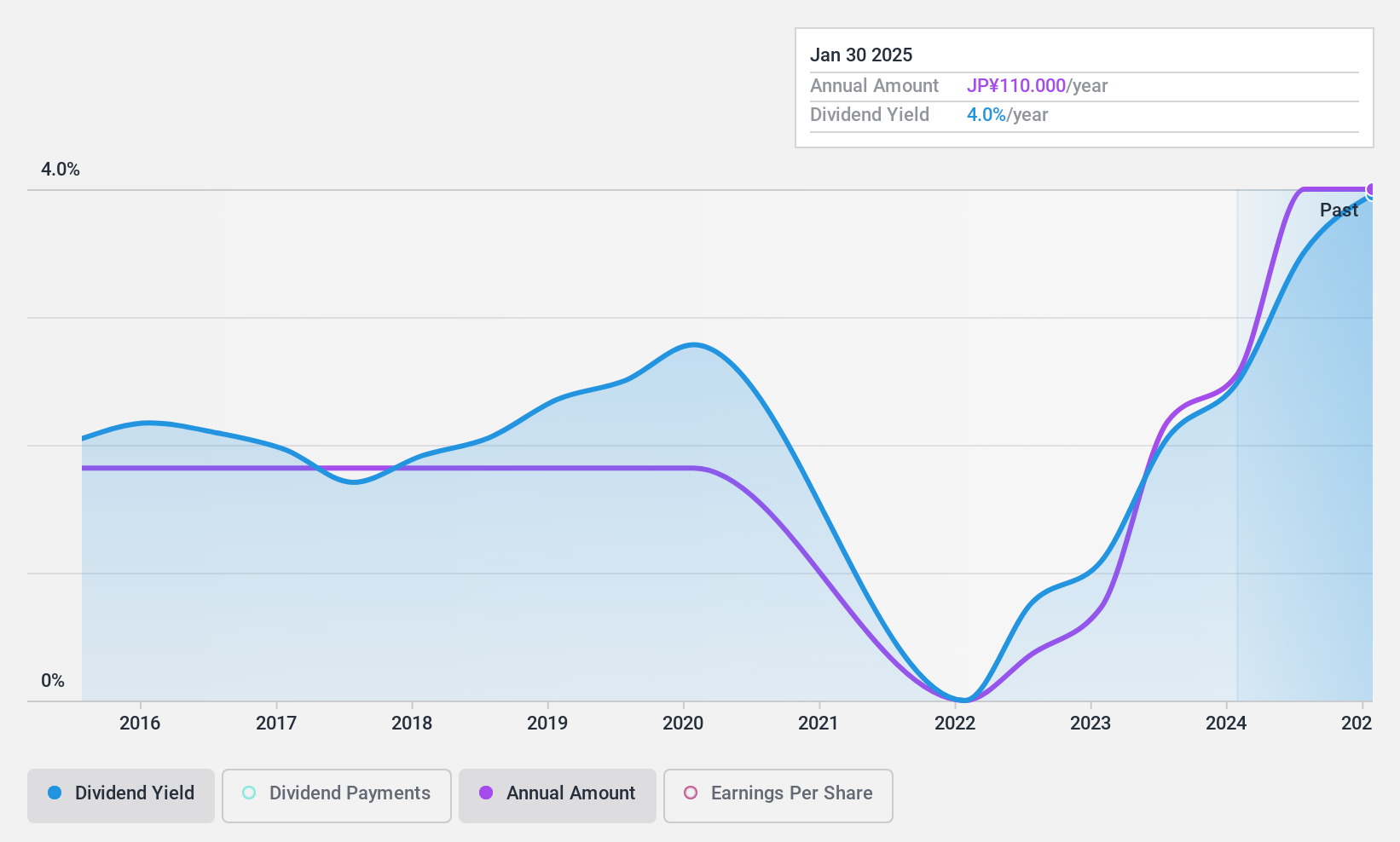

Toho (TSE:8142)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toho Co., Ltd. operates in the food wholesale, cash and carry, and supermarket sectors mainly in Japan, with a market capitalization of approximately ¥31.38 billion.

Operations: Toho Co., Ltd.'s revenue is derived from its operations in food wholesale, cash and carry, and supermarket businesses.

Dividend Yield: 3.8%

Toho's dividend payments have been volatile over the past decade, though they are well covered by earnings and cash flows with payout ratios of 32.4% and 20%, respectively. The dividend yield is slightly below the top tier in Japan's market at 3.77%. Recent guidance indicates expected net sales of ¥246 billion and profit attributable to owners at ¥4 billion for fiscal year ending January 2025, suggesting potential stability in financial performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Toho.

- Our valuation report here indicates Toho may be undervalued.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1972 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603233

DaShenLin Pharmaceutical Group

Manufactures, wholesales, and retails pharmaceutical products in China.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives