- Japan

- /

- Food and Staples Retail

- /

- TSE:5884

What You Can Learn From KURADASHI.Co.,Ltd.'s (TSE:5884) P/S After Its 26% Share Price Crash

The KURADASHI.Co.,Ltd. (TSE:5884) share price has fared very poorly over the last month, falling by a substantial 26%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

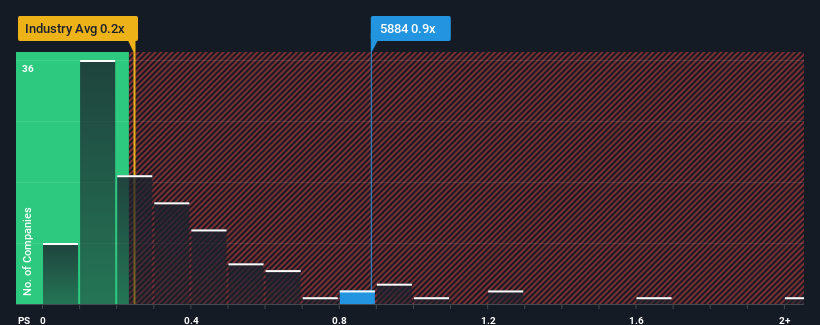

Even after such a large drop in price, when almost half of the companies in Japan's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.2x, you may still consider KURADASHI.Co.Ltd as a stock probably not worth researching with its 0.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for KURADASHI.Co.Ltd

How KURADASHI.Co.Ltd Has Been Performing

KURADASHI.Co.Ltd has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on KURADASHI.Co.Ltd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as KURADASHI.Co.Ltd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 4.1% gain to the company's revenues. Pleasingly, revenue has also lifted 123% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 4.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why KURADASHI.Co.Ltd is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From KURADASHI.Co.Ltd's P/S?

KURADASHI.Co.Ltd's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that KURADASHI.Co.Ltd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for KURADASHI.Co.Ltd you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if KURADASHI.Co.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5884

KURADASHI.Co.Ltd

Engages in the management of social good market under the Kuradashi brand in Japan.

Low risk with worrying balance sheet.

Market Insights

Community Narratives