- Japan

- /

- Food and Staples Retail

- /

- TSE:417A

Blue Zones Holdings (TSE:417A): Assessing Valuation After Stock Split, Dividend Boost, and Shareholder Updates

Reviewed by Simply Wall St

Blue Zones HoldingsLtd (TSE:417A) just revealed a 5-for-1 stock split and updated its Articles of Incorporation, along with a boost to its interim dividend. These moves are intended to improve share liquidity and increase shareholder value.

See our latest analysis for Blue Zones HoldingsLtd.

After a challenging patch earlier this year, Blue Zones HoldingsLtd’s recent stock split and dividend boost are sparking renewed interest. The share price climbed 2.45% over the past month. The move aims to increase investor accessibility and potentially restore momentum. Although the 1-year total shareholder return is still down nearly 8%, the impressive three-year total return of nearly 30% highlights longer-term resilience.

If these changes have you rethinking what’s possible in today’s market, now’s the perfect opportunity to broaden your investing horizons and discover fast growing stocks with high insider ownership

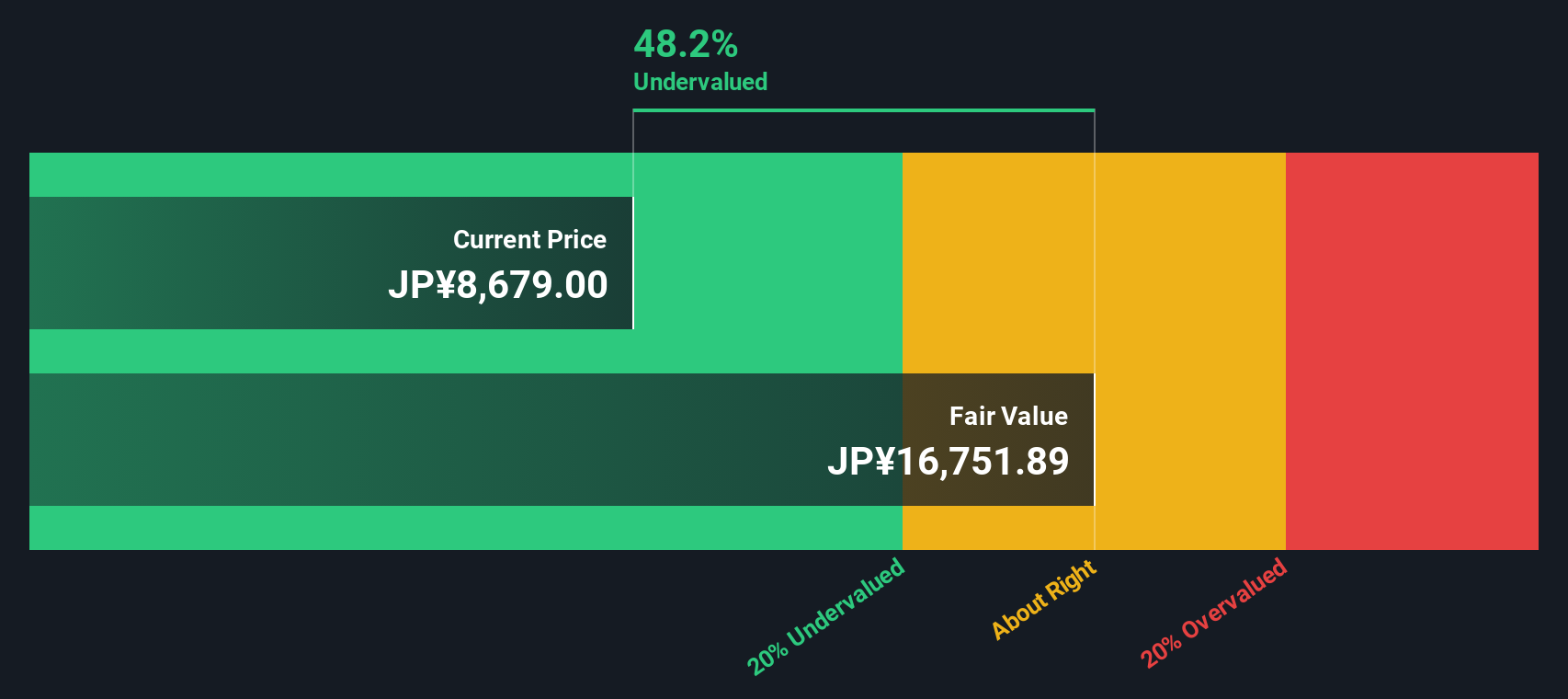

With the stock still trading nearly 20% below analyst targets and showing a substantial discount to intrinsic value, investors are left to wonder: is Blue Zones HoldingsLtd a bargain, or is future growth already reflected in the price?

Price-to-Earnings of 16.5x: Is it justified?

Blue Zones HoldingsLtd trades at a price-to-earnings (P/E) ratio of 16.5x, notably lower than the peer average of 42.1x. This suggests the stock is priced at a considerable discount relative to companies in its sector.

The P/E ratio represents how much investors are willing to pay for each yen of earnings. It is a central metric for comparing companies’ profit expectations within an industry. For consumer retail stocks like Blue Zones HoldingsLtd, it helps signal whether investors expect growth to accelerate or stall.

The current P/E suggests the market is pricing in more modest growth prospects, even though the company’s recent earnings trends have outpaced its sector. Compared to the estimated fair P/E of 19.3x, the current ratio hints there might be room for valuation to shift closer to that benchmark, especially as performance data evolves.

Against the wider industry, Blue Zones HoldingsLtd stands out as attractively valued. While its P/E is higher than the JP Consumer Retailing industry average (13x), it is still below the peer average. This underlines its competitive pricing appeal in the current market landscape. With an estimated fair ratio also higher than the current one, there could be further upside if broader sentiment corrects toward this level.

Explore the SWS fair ratio for Blue Zones HoldingsLtd

Result: Price-to-Earnings of 16.5x (UNDERVALUED)

However, slowing revenue growth and recent negative quarterly returns could weigh on investor sentiment and temper optimism about a swift turnaround in Blue Zones HoldingsLtd’s outlook.

Find out about the key risks to this Blue Zones HoldingsLtd narrative.

Another View: What Does Our DCF Model Reveal?

While the market is focusing on multiples, the SWS DCF model offers a different angle. It estimates Blue Zones HoldingsLtd’s fair value at around ¥16,702. With the current share price nearly 49% below this figure, some might see untapped opportunity. Could the long-term upside be greater than it appears?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Blue Zones HoldingsLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Blue Zones HoldingsLtd Narrative

If you see things differently or want to chart your own course, you can shape a unique story from the numbers in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Blue Zones HoldingsLtd.

Looking for more investment ideas?

Smart investing means staying ahead of trends, so don’t miss your chance to uncover exciting opportunities across different sectors using proven tools from Simply Wall Street.

- Capture the momentum of emerging tech breakthroughs by checking out these 27 AI penny stocks which are poised to transform industries and propel real-world innovation.

- Enhance your portfolio’s income potential by browsing these 15 dividend stocks with yields > 3% that regularly reward shareholders with robust yields above 3%.

- Step into tomorrow’s economy early with these 81 cryptocurrency and blockchain stocks driving disruption in digital assets, secure payments, and financial infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Zones HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:417A

Blue Zones HoldingsLtd

Engages in the operation of supermarkets in Japan.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives