Japan's stock markets have recently experienced sharp declines, with the Nikkei 225 Index falling by 6.0% and the broader TOPIX Index down by 5.6%, partly due to pressure on technology stocks and a strengthening yen impacting exporters. Despite these challenges, economic indicators such as rising inflation and increased business investment suggest potential opportunities for discerning investors. In this environment, identifying good stocks involves looking for companies that can navigate currency fluctuations, leverage technological advancements, and capitalize on domestic economic trends. Here are three undiscovered gems in Japan to watch this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Soliton Systems K.K | 0.61% | 5.36% | 20.91% | ★★★★★★ |

| Hoshi Iryo-Sanki | NA | 7.03% | 12.64% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| NJS | NA | 4.22% | 1.83% | ★★★★★★ |

| Akatsuki | 248.27% | 4.31% | 6.86% | ★★★★★☆ |

| Cresco | 8.62% | 7.79% | 9.50% | ★★★★★☆ |

| Dear LifeLtd | 93.05% | 20.12% | 18.05% | ★★★★★☆ |

| CAC Holdings | 14.97% | -0.57% | 5.02% | ★★★★☆☆ |

| GENOVA | 6.23% | 24.87% | 31.14% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Create SD Holdings (TSE:3148)

Simply Wall St Value Rating: ★★★★★★

Overview: Create SD Holdings Co., Ltd., with a market cap of ¥217.09 billion, operates in Japan through its subsidiaries in the drug store, dispensing pharmacy, and nursing care sectors.

Operations: Create SD Holdings generates revenue primarily from its drugstore segment, which accounted for ¥422.33 billion. The company operates in Japan and focuses on the drug store, dispensing pharmacy, and nursing care sectors.

Create SD Holdings, a small cap in Japan's retail sector, has shown steady earnings growth of 4.7% per year over the past five years. The company is debt-free and boasts high-quality earnings, enhancing its financial stability. Recently, it announced a dividend increase to JPY 37 per share for FY2024 from JPY 27 last year but expects to lower it to JPY 34 for FY2025. For the full year ending May 31, 2025, Create SD projects net sales of JPY 457.60 billion and an operating profit of JPY 22 billion.

- Navigate through the intricacies of Create SD Holdings with our comprehensive health report here.

Gain insights into Create SD Holdings' past trends and performance with our Past report.

Fukuda Denshi (TSE:6960)

Simply Wall St Value Rating: ★★★★★★

Overview: Fukuda Denshi Co., Ltd. manufactures and sells medical instruments both in Japan and internationally, with a market cap of ¥195.15 billion.

Operations: Fukuda Denshi generates revenue primarily from its Treatment Devices (¥59.71 billion), Consumables (¥40.23 billion), Biopsy Devices (¥30.66 billion), and Biological Information Monitors (¥9.72 billion). The company incurs costs associated with these segments, impacting its overall profitability.

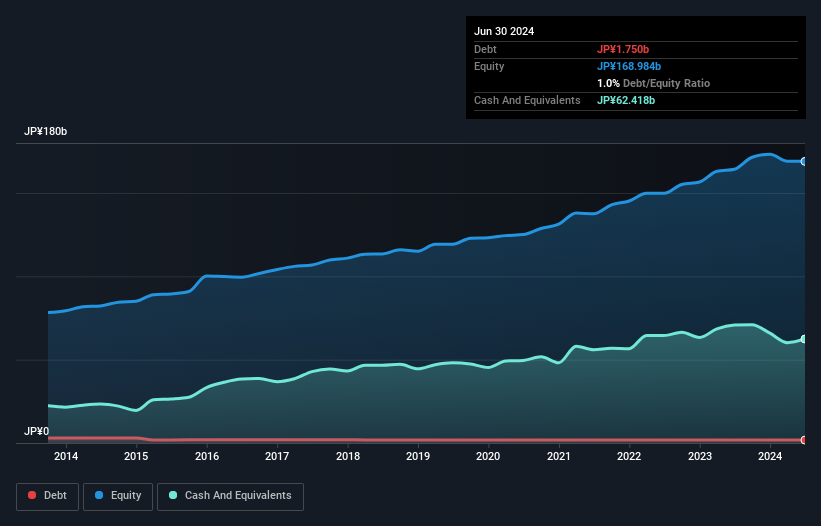

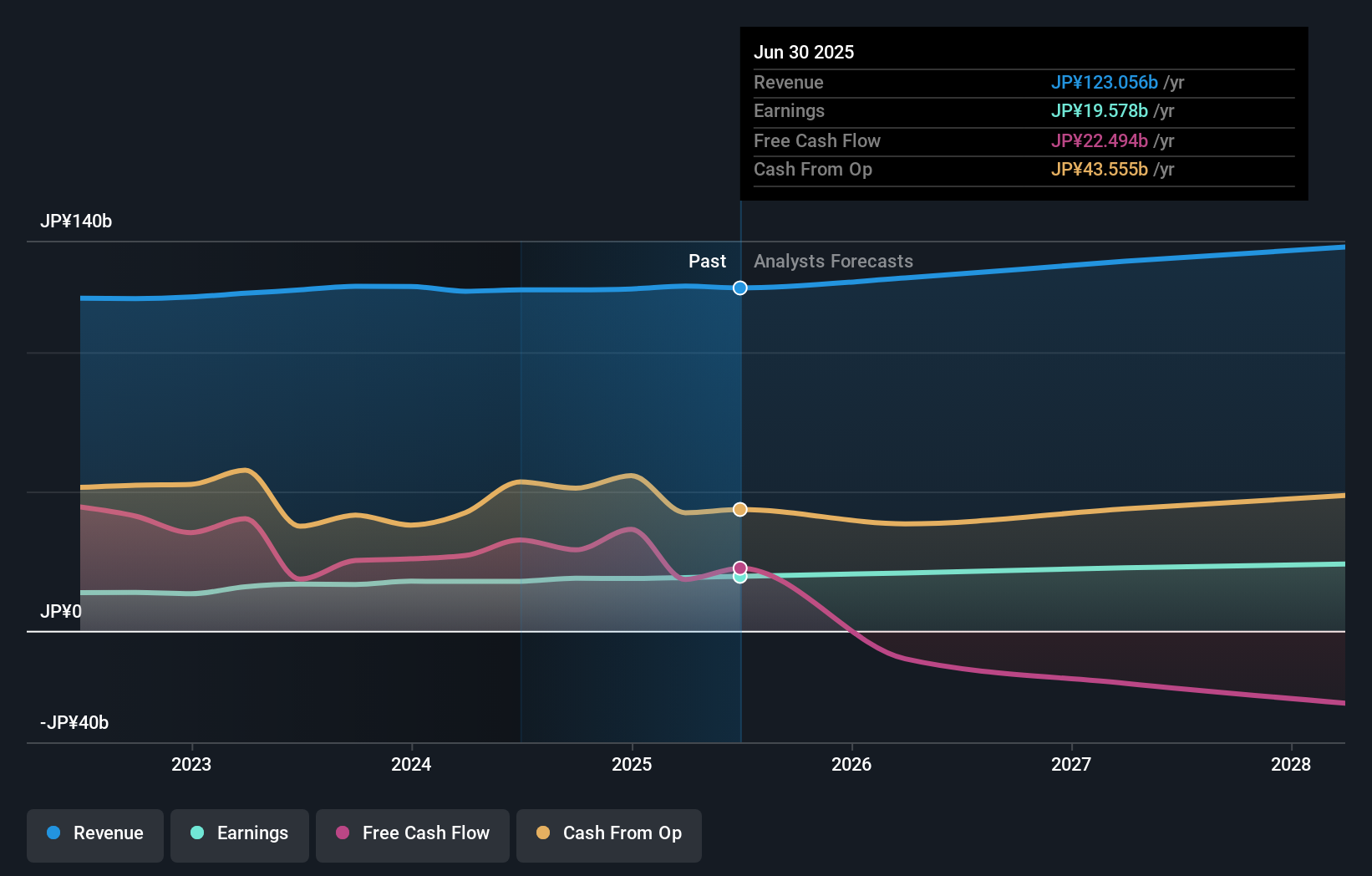

Fukuda Denshi has seen its debt to equity ratio improve from 1.5% to 1% over the past five years, indicating better financial health. The company is trading at a significant discount of 39.5% below its estimated fair value, making it an attractive option in the medical equipment sector. Earnings have grown annually by 15.4%, and it remains profitable with a solid cash position exceeding total debt, ensuring stability for future operations.

- Click here and access our complete health analysis report to understand the dynamics of Fukuda Denshi.

Explore historical data to track Fukuda Denshi's performance over time in our Past section.

SKY Perfect JSAT Holdings (TSE:9412)

Simply Wall St Value Rating: ★★★★★★

Overview: SKY Perfect JSAT Holdings Inc. provides satellite-based multichannel pay TV and satellite communications services primarily in Asia, with a market cap of ¥252.19 billion.

Operations: SKY Perfect JSAT Holdings Inc. generates revenue primarily from its Media Business (¥66.53 billion) and Space Business (¥64.75 billion).

SKY Perfect JSAT Holdings has demonstrated solid performance with earnings growing 12.2% over the past year, surpassing the Media industry's -8.6%. The debt to equity ratio has improved from 48.2% to 24.2% in five years, indicating better financial health. Recently, they announced a new Spaceport Engineering Division aimed at enhancing non-geostationary satellite services, reflecting their strategic focus on future growth areas and operational efficiency improvements in this niche market.

- Take a closer look at SKY Perfect JSAT Holdings' potential here in our health report.

Assess SKY Perfect JSAT Holdings' past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 740 more companies for you to explore.Click here to unveil our expertly curated list of 743 Japanese Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9412

SKY Perfect JSAT Holdings

Provides satellite-based multichannel pay TV and satellite communications services primarily in Asia.

Flawless balance sheet, undervalued and pays a dividend.