A Look at Seiko Group (TSE:8050) Valuation After Dividend Hike and New Earnings Outlook

Reviewed by Simply Wall St

Seiko Group (TSE:8050) just announced higher dividends for both the quarter and the full year, as well as updated earnings guidance for fiscal 2026. This signals stronger confidence from management in future performance.

See our latest analysis for Seiko Group.

Seiko Group’s steady confidence has clearly resonated with investors, as the share price has climbed 41.3% year-to-date and the one-year total shareholder return stands at a robust 67.8%. The company’s multi-year track record is even more impressive, with a 142% total return over three years and a striking 447% total return over five years. This underscores consistent long-term momentum and renewed optimism following the updated dividend and earnings outlook.

If you’re inspired by Seiko’s growth story and want to widen your search, this is a great moment to discover fast growing stocks with high insider ownership

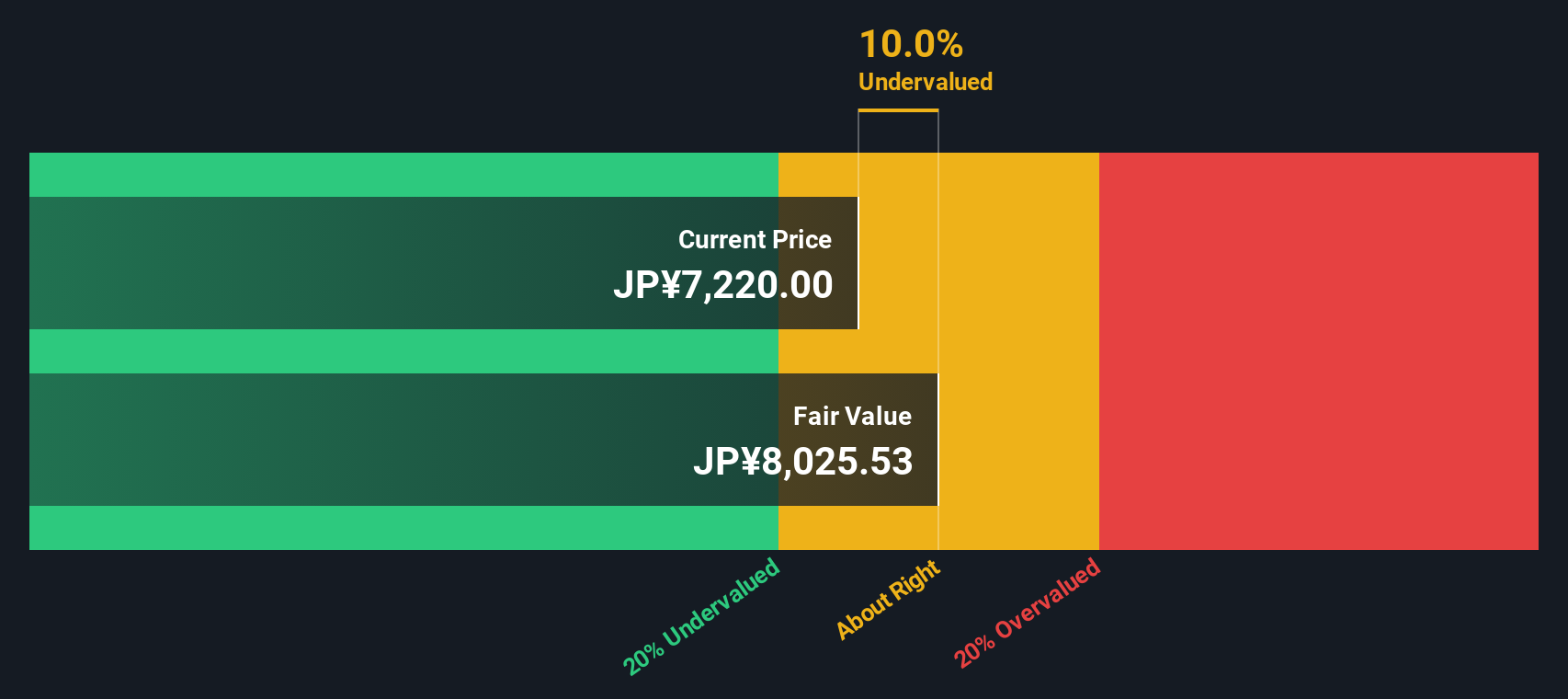

But with shares making such a strong run, the big question is whether Seiko Group remains undervalued or if the market has already priced in all that future growth. This could potentially leave limited upside for new investors.

Price-to-Earnings of 16.6x: Is it justified?

Seiko Group is currently trading at a price-to-earnings (P/E) ratio of 16.6x, which is an important signal of how the market is valuing its future profits against peers.

The price-to-earnings ratio reflects how much investors are willing to pay today for a single yen of the company's earnings. For Seiko Group, this multiple highlights how its earnings performance and growth prospects compare both within its sector and against similar businesses.

At 16.6x, Seiko Group is priced below the peer group average of 24.9x, making it look attractive on a relative basis. This suggests either the market underappreciates Seiko's past and projected profit growth or is cautious about future risks. Compared to the estimated fair P/E ratio of 16.9x, the stock also appears fairly valued. This indicates the market price could potentially move closer to this level over time as new information becomes available or as fundamentals change.

Compared to the broader JP Luxury industry average of 14.9x, Seiko Group’s P/E sits slightly higher, reflecting stronger recent profitability and also suggesting that investors may have elevated expectations. However, its robust earnings quality and impressive track record show that this premium may be warranted.

Explore the SWS fair ratio for Seiko Group

Result: Price-to-Earnings of 16.6x (UNDERVALUED)

However, slower revenue or earnings growth than expected, or shifts in investor sentiment, could moderate Seiko Group’s momentum going forward.

Find out about the key risks to this Seiko Group narrative.

Another View: What Does the SWS DCF Model Say?

Looking at Seiko Group from a different angle, the SWS DCF model estimates the fair value at ¥7,966 per share, which is around 14% higher than the current price. This suggests the stock could be undervalued based on long-term cash flows and raises the question of whether the market is missing something.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seiko Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seiko Group Narrative

If you’d like to put the numbers to the test and craft your own perspective, you can analyze the data yourself and share your findings in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Seiko Group.

Looking for more investment ideas?

Smart investors always stay ahead by seeking out new opportunities and diverse themes. Don’t settle for just one winner when the market has so much more to offer.

- Explore forward-thinking healthcare trends by reviewing these 30 healthcare AI stocks, which promise real breakthroughs in patient care, diagnostics, and AI-powered medicine.

- Unlock passive income potential by checking out these 17 dividend stocks with yields > 3%, featuring strong yields and reliable, shareholder-friendly payout records.

- Keep up with the latest in technology as you scan these 26 quantum computing stocks, focusing on advancements in quantum computing, advanced algorithms, and innovative hardware solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8050

Seiko Group

Engages in watches, devices solutions, systems solutions, apparels, clocks, fashion accessories, system clocks and other businesses in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives