Yamaha (TSE:7951) Valuation in Focus After Major Buyback Announcement and Capital Strategy Update

Reviewed by Simply Wall St

Yamaha (TSE:7951) just revealed a share buyback plan, aiming to repurchase 20 million shares, which is about 4% of its share capital, by March 2026. Management says this move is intended to bolster shareholder returns and improve capital efficiency.

See our latest analysis for Yamaha.

Yamaha’s buyback news comes just weeks after its most recent earnings call, highlighting management’s confidence even as the stock’s momentum has cooled. The share price sits at ¥993.5, and while this latest move may help reset sentiment, the 1-year total shareholder return is still down 5.9%, with a longer-term five-year total return of -41%. Short-term volatility persists, but investors may be watching for signs that these capital moves could spark a turnaround.

If strategic shifts like buybacks pique your interest, now could be the perfect chance to discover fast growing stocks with high insider ownership.

With shares trading below analyst targets and management signaling confidence through buybacks, is Yamaha now an undervalued opportunity? Or is the market already factoring in all the potential upside for the future?

Most Popular Narrative: 12% Undervalued

Yamaha’s most widely followed valuation perspective puts fair value at ¥1,132, comfortably above the last close of ¥993.5. This gap points to a market that may be missing the underlying growth story, according to consensus forecasts for future profits and margins.

Recent investments in digital transformation, including new product launches (digital pianos, electronic drums, and music tech from the Silicon Valley base), are set to capitalize on global growth in digital music creation and music education. These efforts support higher-margin revenue streams and future earnings growth.

Want to know what financial leaps power this forecast? The narrative hinges on a bold step-change in margins and profit, as well as a shift in how innovation drives value. Wondering what makes these projections so ambitious? Discover the forward-looking assumptions powering this impressive fair value for yourself.

Result: Fair Value of ¥1,132 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds or further declines in professional audio and piano sales could still derail Yamaha’s path to a valuation reset.

Find out about the key risks to this Yamaha narrative.

Another Perspective: Multiples Paint a Stricter Picture

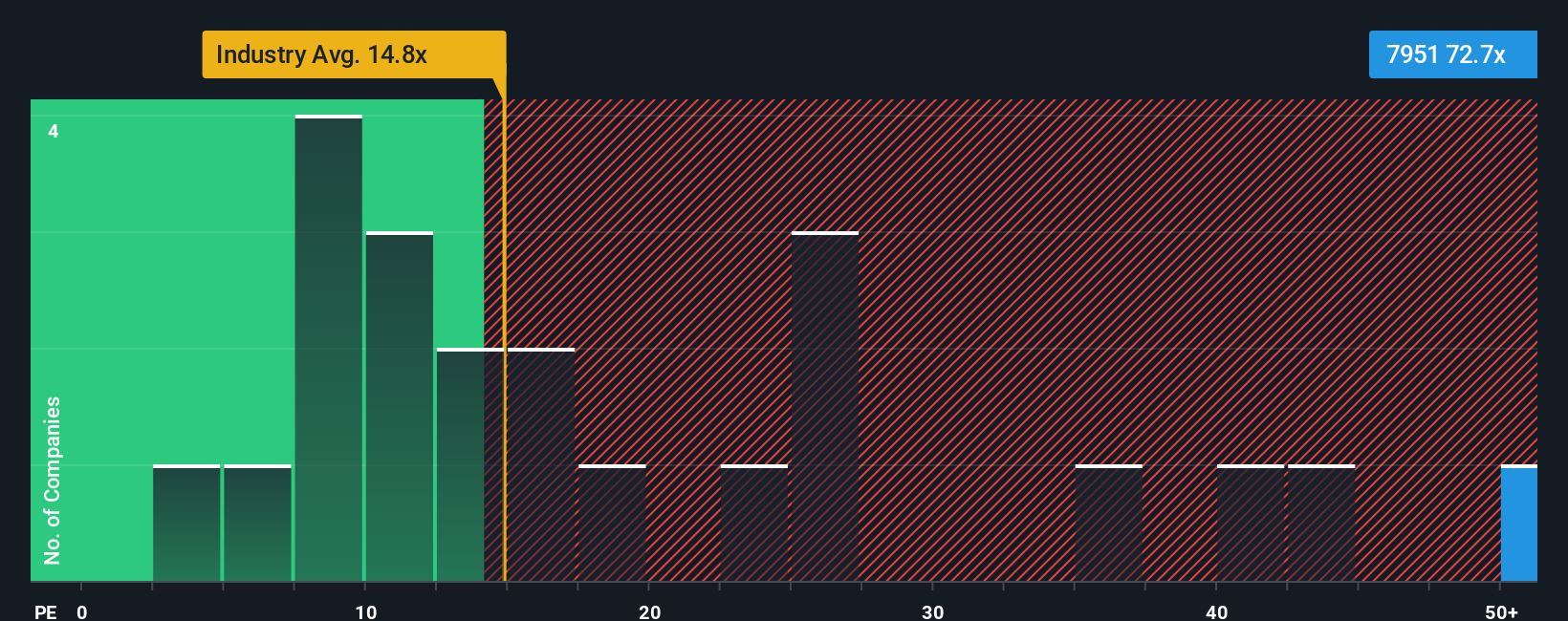

While consensus models point to undervaluation, the current valuation based on price-to-earnings tells a different story. Yamaha trades at a lofty 71.3x earnings, which is far above its peers at 22.2x and the industry average of 14.6x. This is also nearly triple its fair ratio of 24.6x. This could signal significant downside risk if expectations fall short. Which method do you trust the most for judging true value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Narrative

If you have your own take or want to crunch the numbers independently, you can shape your own perspective and insights in just a few minutes, so why not Do it your way.

A great starting point for your Yamaha research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay one step ahead by using the screener tools that simplify your search for the next winning stock. Smart investors keep their edge by acting early on new trends.

- Uncover strong income potential when you browse these 18 dividend stocks with yields > 3% offering yields above 3%, perfect for building stability into your portfolio.

- Accelerate your growth opportunities by filtering for these 26 AI penny stocks making real breakthroughs in artificial intelligence and automation.

- Capitalize on emerging tech with these 28 quantum computing stocks positioned at the forefront of quantum computing’s commercial surge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7951

Yamaha

Engages in the musical instruments, audio equipment, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives