Yamaha (TSE:7951) Records ¥16.2 Billion One-Off Loss, Testing Bullish Growth Narratives

Reviewed by Simply Wall St

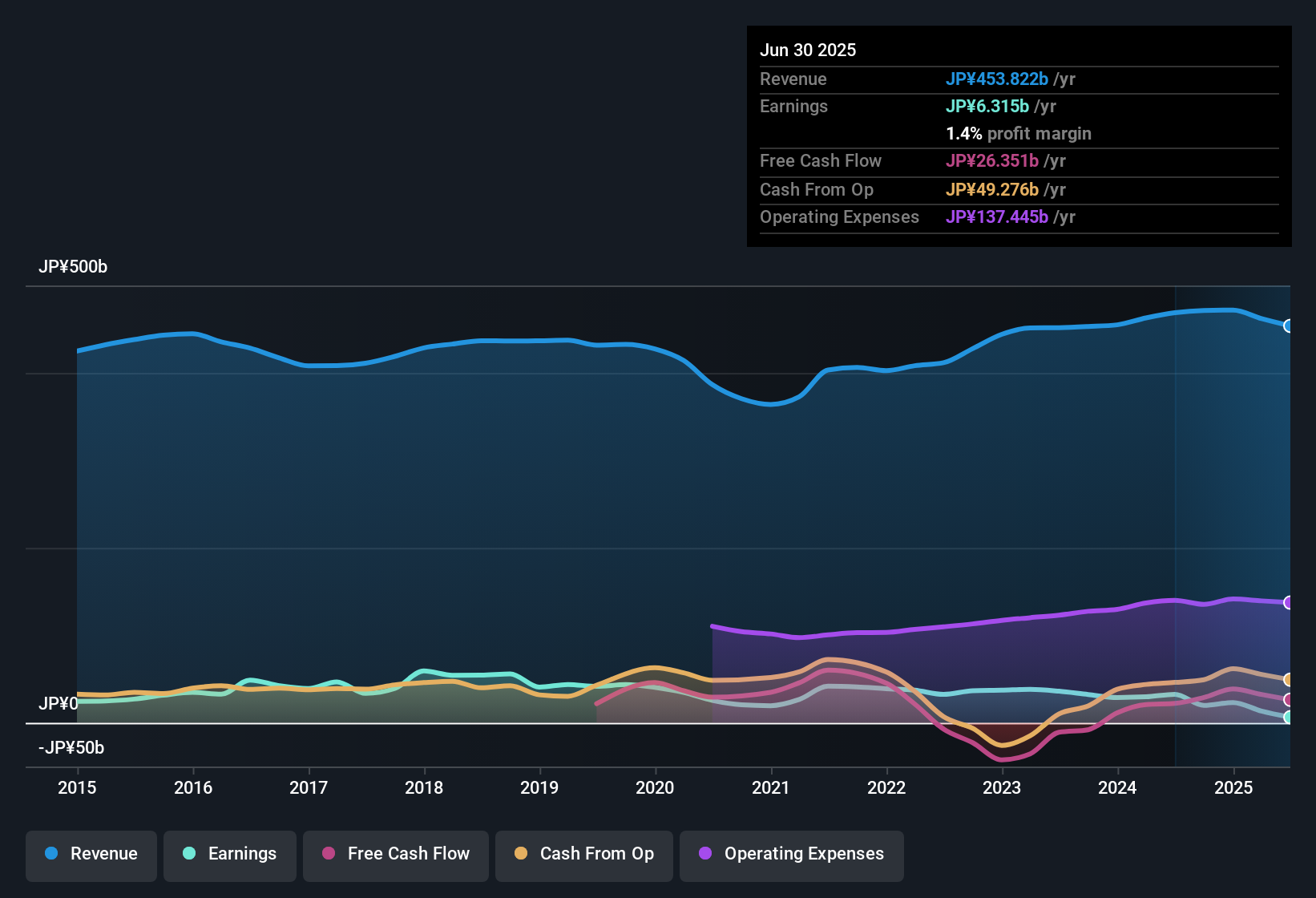

Yamaha (TSE:7951) posted revenue growth projections of 2.5% per year, coming in below the wider Japanese market’s 4.5% annual pace. Net profit margins softened to 4% from 4.2% last year, and earnings have declined by 10.6% per year over the past five years. Still, with earnings expected to surge 16.2% per year ahead, outpacing the market’s 7.8%, investors are weighing these improving forecasts against a notable one-off loss of ¥16.2 billion in the latest results.

See our full analysis for Yamaha.The next section digs into how these headline results compare with the key narratives investors are following. We’ll see which market stories hold up and where expectations are being recalibrated.

See what the community is saying about Yamaha

PE Ratio Premium Signals High Expectations

- Yamaha trades at a Price-to-Earnings Ratio of 25.9x, which is higher than both its peer average of 22.4x and the broader industry’s 14.6x. This indicates that investors are pricing in significant future growth relative to its current profitability.

- According to the analysts' consensus view, this valuation premium relies heavily on expectations that profit margins will rise from 1.4% today to 7.3% in three years, with:

- Future earnings forecasted to reach ¥34.8 billion by 2028, up substantially from ¥6.3 billion today.

- Analysts believe that for Yamaha’s shares to justify the PE multiple, profitability must expand meaningfully. This suggests little room for error if growth stalls or margins fail to improve as expected.

Non-Recurring Loss Clouds Current Profits

- The recent ¥16.2 billion one-off loss distorts core operating profit, making this year’s weaker margin profile less indicative of underlying business health and more the result of unusual charges.

- Bears argue that, despite management’s cost controls and digital expansion plans, persistent risks remain:

- Sustained currency headwinds and new tariffs could keep net margins under pressure even as some one-time losses fade.

- Profit and ROE forecasts have already been revised downward, with a new ROE target of 5.0%, not the original 6.3%. This is a sign that structural challenges remain unresolved.

DCF Fair Value Far Above Market Price

- The current share price of ¥1,021 sits well below the DCF fair value estimate of ¥2,367.71, potentially highlighting a disconnect between Yamaha’s long-term cash flow prospects and present market skepticism.

- The analysts' consensus view notes this valuation gap may look attractive on paper, but

- Investors remain cautious while revenue growth lags the 4.5% market pace and profitability improvements are not yet bankable.

- The divergence between a premium PE and a discounted share price signals both high future expectations and doubt around near-term delivery.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Yamaha on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? You can share your perspective and build your own narrative in just a few minutes. Do it your way

A great starting point for your Yamaha research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Yamaha’s future depends on profitability improving dramatically, but investors remain uneasy as earnings, margins, and return on equity continue to lag forecasts.

If you’re looking for steadier performance, use stable growth stocks screener (2080 results) to uncover companies consistently delivering reliable revenue and profit growth through different market climates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7951

Yamaha

Engages in the musical instruments, audio equipment, and other businesses in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives