YONEX (TSE:7906): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

YONEX (TSE:7906) stock has caught investor attention recently after a stretch of underperformance over the past month. The company, known for its sporting goods, has seen its shares shift notably in the market.

See our latest analysis for YONEX.

After a sharp run-up earlier this year, YONEX shares have cooled off in recent weeks, with the stock experiencing a 17.9% drop over the past 90 days. The year-to-date share price return still stands at an impressive 52.8%. Despite this recent dip, long-term investors have seen outstanding results, as reflected in a 1-year total shareholder return of 62.4% and a 5-year total shareholder return of 475.3%. Momentum in the short term is fading, but the broader track record signals significant growth potential and shifts in risk perception.

If the latest swing in YONEX’s share price has you wondering what else could be next, this is a great time to broaden your view and discover fast growing stocks with high insider ownership

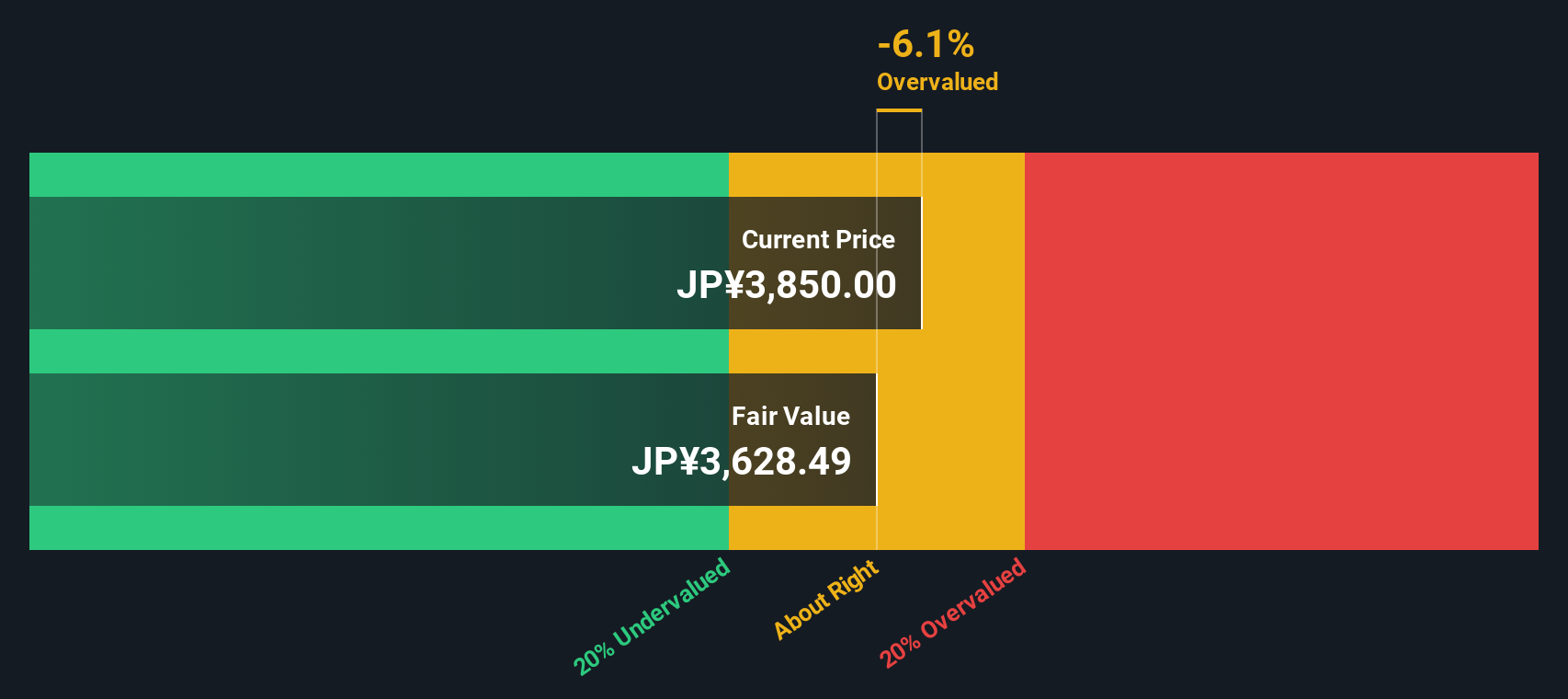

With the recent pullback following strong long-term gains, investors may be wondering if YONEX stock is undervalued now or if the market has already priced in all of its future growth potential. Is there still a buying opportunity?

Price-to-Earnings of 24.2x: Is it justified?

YONEX is currently trading at a price-to-earnings (P/E) ratio of 24.2x, which marks it as significantly more expensive than similar companies in its sector. With a last close price of ¥3,260, the market is assigning a premium multiple to its recent performance.

The P/E ratio shows how much investors are willing to pay for each yen of earnings. For a company like YONEX, known for strong momentum and growing profits, a higher P/E may reflect expectations of sustained future success. However, a premium multiple only holds up if earnings growth justifies it.

Examining the industry landscape, YONEX's P/E ratio is nearly double the JP Leisure industry average of 13.6x and is 11.7 points higher than the peer average of 12.5x. Compared to what our fair value analysis suggests is justified at a P/E ratio of 17.9x, shares are likely priced for robust growth and execution. The market could revise this premium if expectations shift.

Explore the SWS fair ratio for YONEX

Result: Price-to-Earnings of 24.2x (OVERVALUED)

However, slower earnings growth or an industry shift in consumer demand could challenge the premium valuation that investors currently assign to YONEX.

Find out about the key risks to this YONEX narrative.

Another View: Discounted Cash Flow

While the P/E ratio suggests YONEX is trading at a premium, our SWS DCF model provides a different perspective. Based on projected cash flows, YONEX’s current share price is about 12% below our estimate of its fair value, hinting at potential undervaluation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out YONEX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own YONEX Narrative

If you see the story differently or enjoy diving into the numbers yourself, you have the flexibility to build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding YONEX.

Looking for more investment ideas?

Don’t miss your chance to spot the next big winner. Simply Wall Street’s free tools make it easy to find opportunities that meet your goals right now.

- Uncover undervalued shares with strong fundamentals using these 930 undervalued stocks based on cash flows to boost your portfolio with high-potential picks.

- Upgrade your strategy by seeking stable income through these 14 dividend stocks with yields > 3%, featuring stocks that offer reliable yields above 3%.

- Stay ahead of the curve by tapping into innovation with these 25 AI penny stocks, highlighting companies leading real breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7906

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026