- Japan

- /

- Consumer Durables

- /

- TSE:7731

Does Nikon’s (TSE:7731) Lower Guidance Signal Deeper Challenges from Tariffs and Segment Slowdowns?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Nikon Corporation lowered its consolidated earnings guidance for the fiscal year ending March 31, 2026, expecting net sales of ¥680,000 million and operating profit of ¥14,000 million, attributing the revision to anticipated sales shortfalls in Precision Equipment and Digital Manufacturing as well as U.S. tariff impacts.

- This announcement follows a slightly improved first-half outlook, made possible by favorable currency movements and the earlier-than-expected recognition of gains from a technology transfer, highlighting the contrast between short-term gains and challenges to full-year forecasts.

- Let’s explore how concerns about lower sales in core business segments and U.S. tariffs may reshape Nikon's overall investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nikon Investment Narrative Recap

For me, being a Nikon shareholder means believing in the company's ability to drive growth through innovation across its Imaging, Precision Equipment, and Digital Manufacturing segments, while also managing external shocks. The recent downward revision to full-year earnings guidance points directly to sales headwinds and tariff pressures, which currently pose the biggest risk to the business and may curb any near-term rebound in the semiconductor division, making this news material for short-term expectations.

The launch of the ZR Cinema Camera in collaboration with RED is the most relevant recent announcement, as it underscores Nikon's efforts to diversify revenue through premium video products. This move addresses a key catalyst by expanding the Imaging Products segment, but the immediate impact could be muted if broader sales or economic headwinds persist.

Yet, despite past innovation, investors should be alert to the lingering risk that postponed customer investments in the semiconductor business could continue to pressure...

Read the full narrative on Nikon (it's free!)

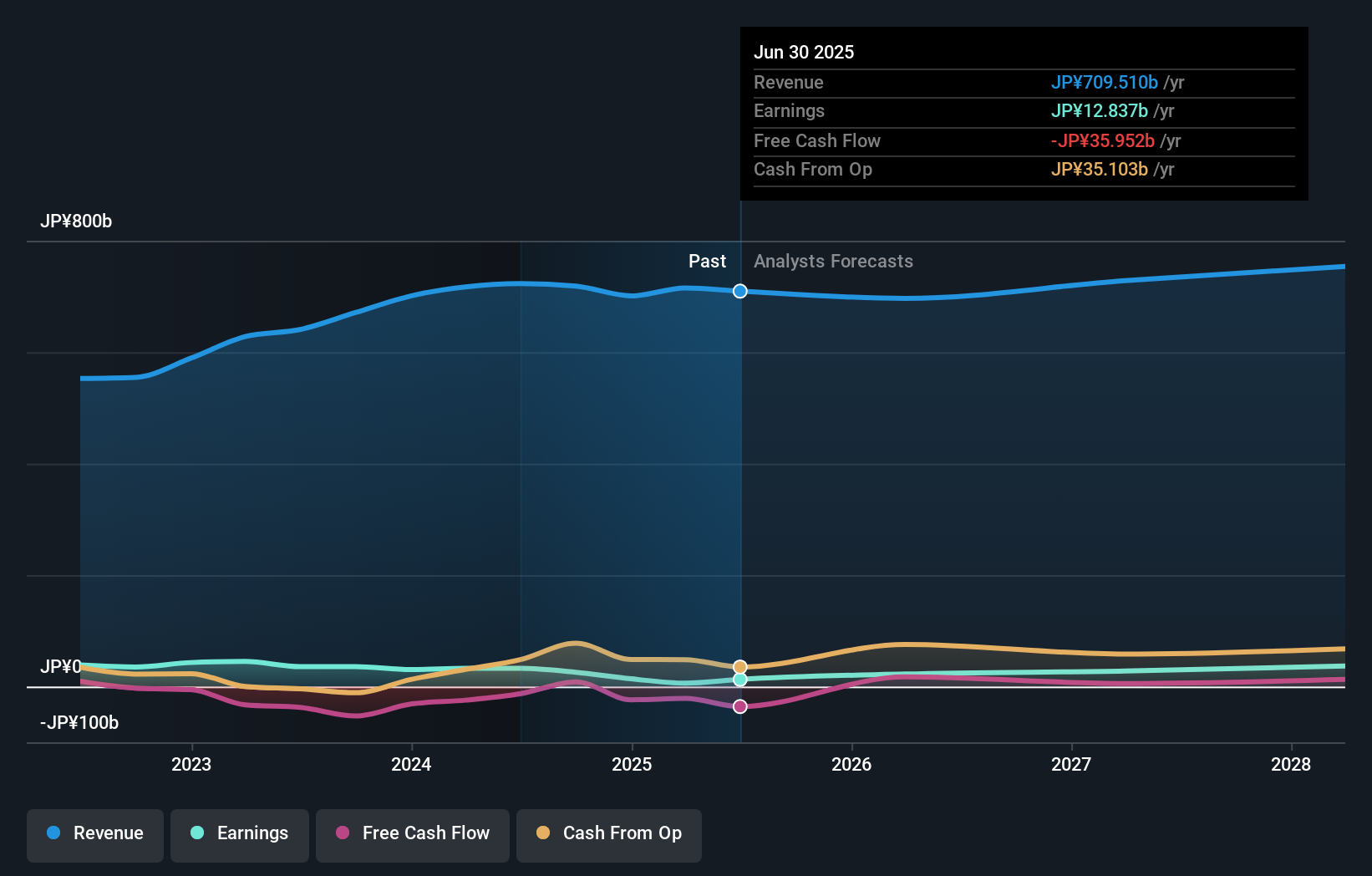

Nikon's outlook anticipates ¥753.2 billion in revenue and ¥41.0 billion in earnings by 2028. This is based on a 2.0% annual revenue growth rate and an increase in earnings of ¥28.2 billion from the current ¥12.8 billion.

Uncover how Nikon's forecasts yield a ¥1510 fair value, a 16% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided a single fair value estimate for Nikon at ¥1,509.55, reflecting one perspective before recent guidance revisions. As anticipated sales shortfalls cloud the semiconductor division, it is important to recognize how sharply opinions and expectations can diverge.

Explore another fair value estimate on Nikon - why the stock might be worth 16% less than the current price!

Build Your Own Nikon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nikon research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Nikon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nikon's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nikon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7731

Nikon

Manufactures and sells optical instruments in Japan, North America, Europe, China, Thailand, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives