Shimano (TSE:7309) Valuation in Focus After Buyback Completion and New Earnings Guidance

Reviewed by Simply Wall St

Shimano (TSE:7309) just wrapped up its multi-month share buyback and released fresh earnings guidance for 2025, giving investors a timely look at both capital management and expectations for the coming year. Both announcements arrived at nearly the same time.

See our latest analysis for Shimano.

Shimano’s completion of its sizable buyback and the release of new earnings guidance have helped set the tone for investor sentiment. However, the momentum has been tough to sustain, with the share price sliding 24.6% year-to-date and posting a -30.1% total shareholder return over the past year. Recent events have offered more clarity and suggest management remains proactive, but the stock’s long-term performance has struggled to keep pace with earlier peaks, reflecting cooling momentum even as growth signals remain in focus.

If you’re watching how major moves like buybacks influence the market, now’s the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the latest buyback and guidance now public, the big question is whether Shimano’s slide has gone too far, or if recent events are merely keeping pace with a challenging outlook. Could this be a real buying opportunity, or is the market already factoring in future growth?

Price-to-Earnings of 26.8x: Is it justified?

Shimano’s shares are currently trading at a price-to-earnings (P/E) ratio of 26.8x, putting its valuation above both industry peers and the broader market. This high multiple stands out, especially in light of earnings growth, prompting investors to consider whether expectations are being set too high.

The price-to-earnings ratio measures how much investors are willing to pay per yen of current earnings. It is widely used to assess whether a stock is expensive or cheap relative to its profit generation, with particular importance in consumer durables and leisure sectors known for cyclical swings.

In Shimano’s case, the P/E of 26.8x significantly exceeds the JP Leisure industry average of 14.5x and the peer group at 22.8x. Even relative to an estimated fair P/E of 25.6x, the current level appears stretched. These comparisons suggest that the market is pricing in optimistic earnings potential. Further upside may depend on future growth materializing in line with such high expectations.

Explore the SWS fair ratio for Shimano

Result: Price-to-Earnings of 26.8x (OVERVALUED)

However, continued share price declines and slowing long-term returns could challenge optimism if revenue growth or earnings momentum does not meet expectations.

Find out about the key risks to this Shimano narrative.

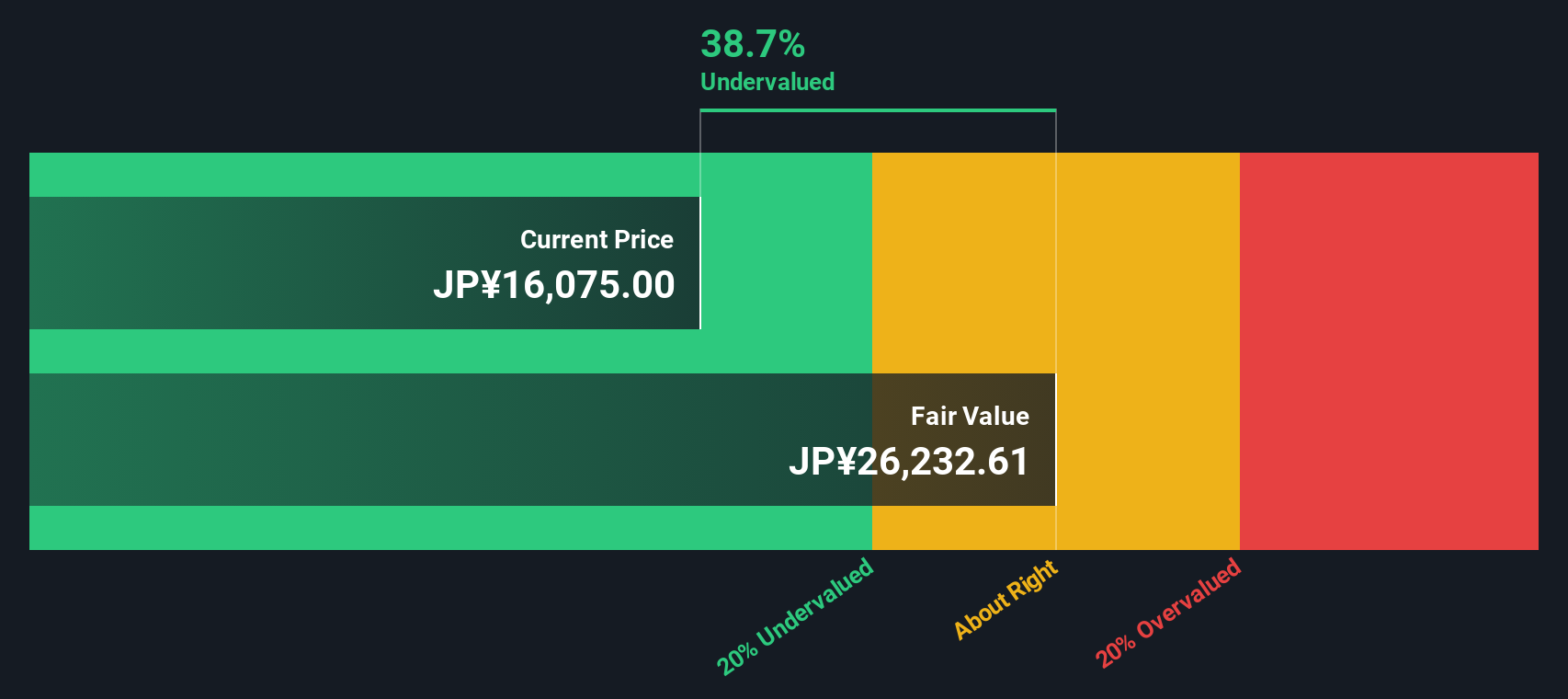

Another View: SWS DCF Model Shows Undervaluation

Taking a different approach, our DCF model suggests Shimano appears undervalued, with shares trading nearly 40% below what the model estimates as fair value. This result contrasts sharply with what the earnings multiple suggests. It raises questions about whether the market is overlooking the company’s true long-term earning power.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shimano for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 835 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shimano Narrative

If you have different perspectives or want to dive deeper on your own terms, you can build your own story in just a few minutes, and Do it your way.

A great starting point for your Shimano research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Find Your Next Winning Stock?

Smart investors never stop at just one opportunity. Expand your horizons now by targeting high-potential companies using these specialized stock ideas. Don’t let great opportunities slip by.

- Spot high yields and maximize your income potential by checking out these 20 dividend stocks with yields > 3% that consistently deliver over 3% returns.

- Seize the momentum in artificial intelligence and uncover emerging leaders within these 25 AI penny stocks for a portfolio built for the future.

- Strengthen your investment strategy with these 835 undervalued stocks based on cash flows showing attractive fundamentals based on real cash flows, before the rest of the market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7309

Shimano

Develops, produces, and distributes bicycle components, fishing tackles, and rowing equipment.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives